State from 44289 R22 04 Form

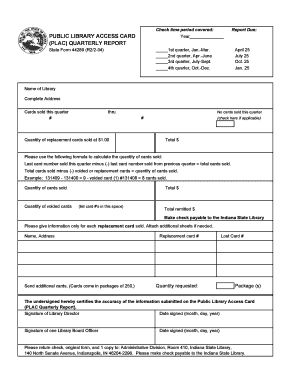

What is the State From 44289 R22 04 Form

The State From 44289 R22 04 Form is a specific document used for tax purposes within certain jurisdictions in the United States. It serves to report various financial information that may be required by state authorities. This form is essential for individuals and businesses to ensure compliance with state tax regulations. Understanding the purpose and requirements of this form is crucial for accurate filing and avoiding potential penalties.

How to use the State From 44289 R22 04 Form

Using the State From 44289 R22 04 Form involves several key steps. First, gather all necessary financial documents that pertain to the information you need to report. Next, carefully fill out the form, ensuring that all entries are accurate and complete. After completing the form, review it for any errors before submission. It is important to follow the specific instructions provided for your state to ensure proper use of the form.

Steps to complete the State From 44289 R22 04 Form

Completing the State From 44289 R22 04 Form requires attention to detail. Here are the steps to follow:

- Obtain the form from the appropriate state tax authority.

- Fill in your personal information, including your name, address, and taxpayer identification number.

- Report your income, deductions, and any other relevant financial information as required by the form.

- Double-check all entries for accuracy.

- Sign and date the form before submission.

Legal use of the State From 44289 R22 04 Form

The legal use of the State From 44289 R22 04 Form is governed by state tax laws. To be considered valid, the form must be completed accurately and submitted by the designated deadline. Failure to comply with these regulations can result in penalties or legal repercussions. It is essential to understand the legal implications of submitting this form to ensure that all requirements are met.

Key elements of the State From 44289 R22 04 Form

Several key elements must be included in the State From 44289 R22 04 Form to ensure its validity:

- Taxpayer identification information.

- Accurate reporting of income and deductions.

- Signature of the taxpayer or authorized representative.

- Date of submission.

Filing Deadlines / Important Dates

Filing deadlines for the State From 44289 R22 04 Form can vary by state. Generally, it is advisable to submit the form by the end of the tax year or as specified by state regulations. Missing these deadlines can lead to penalties or interest charges. It is important to stay informed about specific dates relevant to your state to ensure timely filing.

Quick guide on how to complete state from 44289 r22 04 form

Effortlessly Complete [SKS] on Any Device

Digital document management has gained traction among companies and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed paperwork, enabling you to access the necessary forms and securely store them online. airSlate SignNow provides all the tools required to create, modify, and electronically sign your documents quickly and efficiently. Handle [SKS] on any platform using the airSlate SignNow Android or iOS applications and enhance any document-focused process today.

The easiest way to modify and eSign [SKS] without hassle

- Locate [SKS] and click on Get Form to begin.

- Utilize the tools available to fill out your form.

- Mark important sections of your documents or redact sensitive data using the features that airSlate SignNow provides specifically for this purpose.

- Generate your eSignature with the Sign tool, which takes only moments and holds the same legal validity as a conventional ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose your preferred method for sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign [SKS] to ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to State From 44289 R22 04 Form

Create this form in 5 minutes!

How to create an eSignature for the state from 44289 r22 04 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the State From 44289 R22 04 Form?

The State From 44289 R22 04 Form is a specific document often used for various administrative purposes. With airSlate SignNow, you can easily create, send, and eSign this form, streamlining your workflow. Our platform ensures that all your documents, including the State From 44289 R22 04 Form, are securely signed and stored.

-

How does airSlate SignNow ensure the security of the State From 44289 R22 04 Form?

airSlate SignNow utilizes advanced security protocols to protect your documents, including the State From 44289 R22 04 Form. Our platform is compliant with industry standards for data protection, ensuring every transaction is secure. You can confidently eSign and manage your documents, knowing they are safe and secure.

-

Can I customize the State From 44289 R22 04 Form with airSlate SignNow?

Yes, airSlate SignNow allows you to customize the State From 44289 R22 04 Form according to your specific needs. You can add your company logo, modify fields, and more to make it align with your brand identity. This customization capability enhances the professionalism of your documents.

-

What are the pricing options for using airSlate SignNow for the State From 44289 R22 04 Form?

airSlate SignNow offers flexible pricing plans that cater to different business sizes and needs for managing the State From 44289 R22 04 Form. Our plans are cost-effective and scalable, allowing you to choose the one that best fits your usage. You can explore our website to find detailed pricing information.

-

What features does airSlate SignNow provide for the State From 44289 R22 04 Form?

airSlate SignNow provides a range of features for managing the State From 44289 R22 04 Form, including template creation, eSignature capabilities, and real-time tracking. You can easily integrate these features into your existing workflow to enhance efficiency. Our platform is designed to simplify document management tasks for businesses.

-

How can I integrate the State From 44289 R22 04 Form into my existing systems?

Integrating the State From 44289 R22 04 Form with your existing systems is simple with airSlate SignNow. Our platform offers various API options and integrations with popular software, making it easy to sync your documents seamlessly. This means you can maintain your current processes while enhancing functionality.

-

What benefits can I expect from using airSlate SignNow for the State From 44289 R22 04 Form?

Using airSlate SignNow for the State From 44289 R22 04 Form offers numerous benefits, including time savings and improved collaboration. You can quickly send documents for eSigning and track their status in real-time. Additionally, the cost-effectiveness of our solution means you can manage paperwork efficiently without breaking the bank.

Get more for State From 44289 R22 04 Form

- Eff jan2019424 west obrien drive julale center su form

- Exhibit 1 242 fw 12 bloodborne pathogens exposure control plan fws form

- Labcorp facsimile verification form sdishelp com

- Chattanooga tn 37403 phone 423 778 8067 health system form

- Takeda pharmaceuticals u s a help at hand form

- 294125 form

- Insurance group form

- Group customer number form

Find out other State From 44289 R22 04 Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors