Gst Reg 06 Form

What is the Gst Reg 06

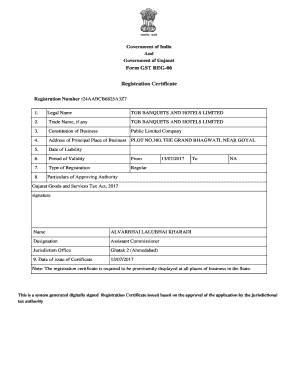

The Gst Reg 06 is a specific form used for registering for Goods and Services Tax (GST) in the United States. This form is essential for businesses that meet certain revenue thresholds or engage in taxable activities. By completing the Gst Reg 06, businesses can ensure compliance with state tax regulations and facilitate the collection of GST on their sales. The form captures vital information about the business, including its legal structure, ownership details, and nature of taxable activities.

How to use the Gst Reg 06

Using the Gst Reg 06 involves several steps to ensure accurate completion and submission. First, gather all necessary information, including your business's legal name, address, and tax identification number. Next, fill out the form carefully, ensuring that all sections are completed accurately. Once the form is filled out, review it for any errors before submission. Depending on your state, you may have the option to submit the form online, by mail, or in person at your local tax office.

Steps to complete the Gst Reg 06

Completing the Gst Reg 06 requires a systematic approach to ensure all information is accurately provided. Follow these steps:

- Gather required documents, including your business license and tax identification number.

- Fill out the form, ensuring all sections are complete and accurate.

- Review the form for any mistakes or missing information.

- Submit the completed form according to your state’s guidelines, either online, by mail, or in person.

Legal use of the Gst Reg 06

The Gst Reg 06 is legally binding once submitted and accepted by the appropriate tax authority. It is crucial for businesses to ensure that the information provided is truthful and accurate, as discrepancies can lead to penalties or legal issues. Compliance with state tax laws is essential for maintaining good standing and avoiding audits. Additionally, keeping a copy of the submitted form is recommended for your records.

Required Documents

When preparing to complete the Gst Reg 06, several documents are typically required. These may include:

- Your business's legal name and address.

- Tax identification number (EIN or SSN).

- Business formation documents (e.g., Articles of Incorporation).

- Proof of business location (e.g., utility bill or lease agreement).

Form Submission Methods

The Gst Reg 06 can be submitted through various methods, depending on state regulations. Common submission methods include:

- Online submission through the state’s tax website.

- Mailing the completed form to the designated tax office.

- In-person submission at local tax offices or designated locations.

Penalties for Non-Compliance

Failure to properly complete and submit the Gst Reg 06 can result in significant penalties. Businesses may face fines, interest on unpaid taxes, or even legal action if they do not comply with state tax regulations. It is essential to understand the implications of non-compliance and to ensure timely and accurate submission of the form to avoid these consequences.

Quick guide on how to complete gst reg 06 467139581

Effortlessly prepare Gst Reg 06 on any device

The management of online documents has gained traction among both organizations and individuals. It offers an excellent environmentally friendly option to traditional printed and signed forms, as you can access the necessary documents and securely store them online. airSlate SignNow provides you with all the functionalities required to create, edit, and electronically sign your documents quickly without delays. Handle Gst Reg 06 on any device with the airSlate SignNow applications for Android or iOS and streamline any document-related process today.

The simplest way to modify and electronically sign Gst Reg 06 without hassle

- Find Gst Reg 06 and click on Get Form to initiate the process.

- Utilize our available tools to fill out your form.

- Emphasize essential sections of your documents or conceal sensitive information with the tools specifically provided by airSlate SignNow for this purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all the details and then click on the Done button to save your updates.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious searches for forms, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Gst Reg 06 and ensure outstanding communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the gst reg 06 467139581

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is gst reg 06 and how can it benefit my business?

GST reg 06 is a form used for GST registration, essential for businesses dealing with goods and services. Using airSlate SignNow, you can effortlessly eSign your gst reg 06 documentation, streamlining compliance and enhancing operational efficiency.

-

Is there a cost associated with using airSlate SignNow for gst reg 06?

AirSlate SignNow offers competitive pricing plans that cater to various business needs. You can sign your gst reg 06 documents without incurring hefty expenses, as our solutions are designed to be cost-effective.

-

How does airSlate SignNow streamline the process of signing gst reg 06 forms?

With airSlate SignNow, you can electronically sign your gst reg 06 forms anytime and anywhere. Our user-friendly interface ensures a seamless signing experience, allowing businesses to focus on their core activities instead of paperwork.

-

Can I integrate airSlate SignNow with other software for handling gst reg 06?

Yes, airSlate SignNow offers integration with various popular software applications, making it easier to manage your gst reg 06 documents. This interoperability ensures that your business processes remain interconnected and efficient.

-

What features does airSlate SignNow provide for managing gst reg 06?

AirSlate SignNow offers a range of features including document templates, real-time tracking, and secure storage for gst reg 06 forms. These tools allow businesses to manage their documentation efficiently while ensuring compliance with GST regulations.

-

How secure is airSlate SignNow for handling my gst reg 06 documentation?

Security is a top priority at airSlate SignNow. Our platform utilizes advanced encryption measures to protect your gst reg 06 documents, ensuring that sensitive information remains confidential and secure against unauthorized access.

-

Can multiple users collaborate on a gst reg 06 form using airSlate SignNow?

Absolutely! AirSlate SignNow allows multiple users to collaborate on the same gst reg 06 document simultaneously. This feature enhances teamwork and accelerates the signing process, making it easier to get necessary approvals.

Get more for Gst Reg 06

Find out other Gst Reg 06

- Sign Hawaii Orthodontists Claim Free

- Sign Nevada Plumbing Job Offer Easy

- Sign Nevada Plumbing Job Offer Safe

- Sign New Jersey Plumbing Resignation Letter Online

- Sign New York Plumbing Cease And Desist Letter Free

- Sign Alabama Real Estate Quitclaim Deed Free

- How Can I Sign Alabama Real Estate Affidavit Of Heirship

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding

- Sign South Dakota Plumbing Job Offer Later

- Sign Tennessee Plumbing Business Letter Template Secure

- Sign South Dakota Plumbing Emergency Contact Form Later

- Sign South Dakota Plumbing Emergency Contact Form Myself

- Help Me With Sign South Dakota Plumbing Emergency Contact Form

- How To Sign Arkansas Real Estate Confidentiality Agreement

- Sign Arkansas Real Estate Promissory Note Template Free

- How Can I Sign Arkansas Real Estate Operating Agreement

- Sign Arkansas Real Estate Stock Certificate Myself

- Sign California Real Estate IOU Safe

- Sign Connecticut Real Estate Business Plan Template Simple