Form 3805q California Fillable

What is the Form 3805q California Fillable

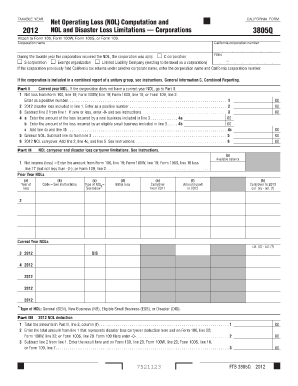

The Form 3805q, officially known as the California form 3805q, is a tax form used by taxpayers in California to report specific tax credits related to the state's income tax. This fillable form allows individuals and businesses to claim the California Compensating Use Tax and other applicable credits. It is essential for ensuring accurate reporting and compliance with California tax regulations. The form is designed to be user-friendly, making it easier for taxpayers to input their information and calculate their tax liabilities.

How to use the Form 3805q California Fillable

Using the Form 3805q is straightforward. Taxpayers can access the fillable PDF version online, allowing them to enter their information directly into the document. After filling out the required fields, individuals can save their progress and print the form for submission. It is important to follow the instructions provided on the form carefully to ensure all necessary information is included. This helps prevent delays in processing and ensures that taxpayers receive any applicable credits or refunds in a timely manner.

Steps to complete the Form 3805q California Fillable

Completing the Form 3805q involves several key steps:

- Download the fillable PDF version of the form from a reliable source.

- Enter personal information, including name, address, and Social Security number or taxpayer identification number.

- Fill in the relevant sections regarding income, deductions, and tax credits.

- Review the form for accuracy and completeness.

- Save the completed form and print it for submission.

Following these steps will help ensure that the form is filled out correctly and submitted on time.

Legal use of the Form 3805q California Fillable

The legal use of the Form 3805q is governed by California tax laws. This form must be completed accurately to comply with state regulations. eSignatures are accepted for electronic submissions, provided they meet the legal requirements outlined in the ESIGN Act and California's Uniform Electronic Transactions Act. When using digital tools to fill out and submit the form, it is crucial to ensure that the platform used complies with these legal standards to maintain the validity of the submission.

Filing Deadlines / Important Dates

Taxpayers should be aware of the filing deadlines associated with the Form 3805q. Typically, the form must be submitted by the annual tax filing deadline, which is usually April fifteenth for individual taxpayers. However, if the deadline falls on a weekend or holiday, it may be extended to the next business day. Staying informed about these dates is essential for avoiding penalties and ensuring timely processing of tax credits.

Required Documents

To complete the Form 3805q, taxpayers may need to gather several documents, including:

- Previous year’s tax return for reference.

- W-2 forms or 1099s to report income accurately.

- Documentation supporting any claimed deductions or credits.

Having these documents ready will streamline the process of filling out the form and help ensure accuracy in reporting.

Quick guide on how to complete form 3805q california fillable

Complete Form 3805q California Fillable effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed papers, as you can access the correct template and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and electronically sign your documents promptly without delays. Manage Form 3805q California Fillable on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The easiest way to modify and electronically sign Form 3805q California Fillable with ease

- Find Form 3805q California Fillable and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your files or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your edits.

- Select your method of sharing the form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form retrieval, or mistakes requiring you to print new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Form 3805q California Fillable while ensuring exceptional communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 3805q california fillable

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 3805Q, and why is it important?

Form 3805Q is a tax document used for reporting specific financial activities in real estate. Understanding and correctly filling out form 3805Q is crucial for compliance with tax regulations, ensuring that all relevant deductions are claimed.

-

How can airSlate SignNow assist with filling out Form 3805Q?

airSlate SignNow provides an intuitive platform that allows users to easily fill out and eSign Form 3805Q. Its user-friendly features streamline the document preparation process, ensuring accurate completion and timely submission.

-

What are the pricing options for using airSlate SignNow for Form 3805Q?

airSlate SignNow offers flexible pricing plans designed to accommodate various business needs when completing Form 3805Q. Whether you are a small business or a large enterprise, you can choose a plan that provides the right balance of features and cost-effectiveness.

-

Can I integrate airSlate SignNow with other software for managing Form 3805Q?

Yes, airSlate SignNow seamlessly integrates with various software applications, making it easy to manage Form 3805Q along with your other document workflows. This integration capability enhances productivity by connecting your eSigning processes with existing systems.

-

What features does airSlate SignNow offer for managing Form 3805Q?

airSlate SignNow includes features such as document templates, secure eSigning, and real-time tracking, specifically designed to simplify the management of Form 3805Q. These functionalities help ensure that your documents are handled efficiently and securely.

-

Is airSlate SignNow compliant with legal standards for Form 3805Q?

Absolutely! airSlate SignNow adheres to all legal standards required for electronic signatures and document management, ensuring that your Form 3805Q is compliant and valid for submission. This compliance is crucial for maintaining the integrity of your documentation.

-

What benefits does airSlate SignNow provide for businesses handling Form 3805Q?

Using airSlate SignNow to manage Form 3805Q helps businesses save time and reduce costs associated with printing, signing, and scanning documents. It enhances efficiency and speeds up the process of collecting signatures, which is vital during tax season.

Get more for Form 3805q California Fillable

Find out other Form 3805q California Fillable

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now