ACOM2205a Motor Trade Loan Vehicle Indemnity Allianz EBroker Form

What is the ACOM2205a Motor Trade Loan Vehicle Indemnity Allianz EBroker

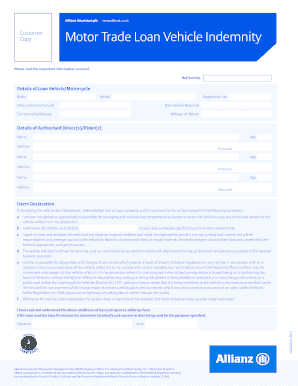

The ACOM2205a Motor Trade Loan Vehicle Indemnity Allianz EBroker form is a crucial document designed for businesses in the automotive sector. It serves as a vehicle indemnity agreement that protects motor trade businesses against potential liabilities arising from vehicle usage. This form is particularly relevant for those who engage in buying, selling, or leasing vehicles. It outlines the terms of coverage and responsibilities of all parties involved, ensuring that businesses are safeguarded against unforeseen incidents that may occur during the course of their operations.

Steps to complete the ACOM2205a Motor Trade Loan Vehicle Indemnity Allianz EBroker

Completing the ACOM2205a Motor Trade Loan Vehicle Indemnity Allianz EBroker form involves several key steps to ensure accuracy and compliance. First, gather all necessary information related to your business and the vehicles involved. This includes details such as vehicle identification numbers, ownership information, and any relevant financial data. Next, fill out the form carefully, ensuring that all sections are completed accurately. It is important to review the form for any errors or omissions before submission. Finally, electronically sign the document using a secure eSignature solution to validate the form and ensure it meets legal requirements.

Legal use of the ACOM2205a Motor Trade Loan Vehicle Indemnity Allianz EBroker

The legal use of the ACOM2205a Motor Trade Loan Vehicle Indemnity Allianz EBroker form hinges on compliance with applicable laws and regulations governing electronic signatures and document execution. In the United States, the ESIGN Act and UETA provide the legal framework for recognizing electronic signatures as valid. To ensure the form is legally binding, it must be signed using a secure platform that provides an electronic certificate of completion. This certificate serves as proof of the signing process and can be critical in case of disputes or legal inquiries.

Key elements of the ACOM2205a Motor Trade Loan Vehicle Indemnity Allianz EBroker

Several key elements define the ACOM2205a Motor Trade Loan Vehicle Indemnity Allianz EBroker form. These include the identification of the parties involved, a detailed description of the vehicles covered, and the specific terms of indemnity. Additionally, the form outlines the responsibilities of each party, including any conditions that may affect coverage. Understanding these elements is essential for businesses to ensure they are adequately protected and compliant with industry standards.

How to obtain the ACOM2205a Motor Trade Loan Vehicle Indemnity Allianz EBroker

Obtaining the ACOM2205a Motor Trade Loan Vehicle Indemnity Allianz EBroker form can be done through various channels. Typically, businesses can request the form directly from Allianz or authorized eBroker platforms. It may also be available through industry associations or regulatory bodies that oversee motor trade operations. Ensure that you are accessing the most current version of the form to meet all legal and operational requirements.

Examples of using the ACOM2205a Motor Trade Loan Vehicle Indemnity Allianz EBroker

Examples of using the ACOM2205a Motor Trade Loan Vehicle Indemnity Allianz EBroker form include scenarios where a motor trade business needs to secure financing for vehicle purchases. For instance, a dealership may use this form to indemnify itself against potential damages while vehicles are in transit or during test drives. Another example is when a leasing company requires the form to ensure that it is protected from liabilities associated with the vehicles leased to clients. These practical applications highlight the form's importance in the motor trade industry.

Quick guide on how to complete acom2205a motor trade loan vehicle indemnity allianz ebroker

Complete ACOM2205a Motor Trade Loan Vehicle Indemnity Allianz EBroker seamlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, as you can easily locate the appropriate form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and eSign your documents swiftly without interruptions. Handle ACOM2205a Motor Trade Loan Vehicle Indemnity Allianz EBroker on any device with the airSlate SignNow Android or iOS applications and enhance any document-centric workflow today.

The easiest way to modify and eSign ACOM2205a Motor Trade Loan Vehicle Indemnity Allianz EBroker effortlessly

- Locate ACOM2205a Motor Trade Loan Vehicle Indemnity Allianz EBroker and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of your documents or obscure sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Select how you would like to share your form, either by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or mislaid files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device you choose. Edit and eSign ACOM2205a Motor Trade Loan Vehicle Indemnity Allianz EBroker and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the acom2205a motor trade loan vehicle indemnity allianz ebroker

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ACOM2205a Motor Trade Loan Vehicle Indemnity Allianz EBroker?

The ACOM2205a Motor Trade Loan Vehicle Indemnity Allianz EBroker is a specialized insurance product designed to cover vehicles used in the motor trade. It helps protect businesses from potential financial losses when lending or renting vehicles. This indemnity ensures that both you and your clients are safeguarded during transactions involving motor trade loans.

-

How does the ACOM2205a Motor Trade Loan Vehicle Indemnity Allianz EBroker work?

The ACOM2205a Motor Trade Loan Vehicle Indemnity Allianz EBroker works by providing coverage for vehicles that are loaned or hired out by motor trade businesses. When a vehicle is in possession of a customer, this indemnity covers damages or losses that may occur during the loan period. It's a comprehensive solution that helps businesses manage risk effectively.

-

What are the pricing options for the ACOM2205a Motor Trade Loan Vehicle Indemnity Allianz EBroker?

Pricing for the ACOM2205a Motor Trade Loan Vehicle Indemnity Allianz EBroker varies based on factors such as the number of vehicles and the specific coverage needed. To get an accurate quote, it’s best to contact insurers directly or use a specialist broker. Typically, businesses find that this indemnity offers competitive rates compared to similar products.

-

What benefits does the ACOM2205a Motor Trade Loan Vehicle Indemnity Allianz EBroker provide?

The ACOM2205a Motor Trade Loan Vehicle Indemnity Allianz EBroker provides several key benefits, including financial protection against damages, enhanced customer trust, and peace of mind during vehicle lending. By securing this indemnity, businesses can operate more confidently, knowing they are protected from signNow liabilities related to vehicle usage.

-

Can I integrate the ACOM2205a Motor Trade Loan Vehicle Indemnity Allianz EBroker with other business tools?

Yes, the ACOM2205a Motor Trade Loan Vehicle Indemnity Allianz EBroker can often be integrated with other business management tools. This integration helps streamline operations and ensures that document management and insurance compliance are handled efficiently. Check with your provider to explore specific integrations available.

-

Is the ACOM2205a Motor Trade Loan Vehicle Indemnity Allianz EBroker suitable for all motor trade businesses?

The ACOM2205a Motor Trade Loan Vehicle Indemnity Allianz EBroker is generally suitable for various types of motor trade businesses, including dealerships, garages, and rental companies. However, it's important to assess your specific business needs and consult with an insurance expert to ensure this indemnity fits your operational requirements.

-

How can I obtain the ACOM2205a Motor Trade Loan Vehicle Indemnity Allianz EBroker?

You can obtain the ACOM2205a Motor Trade Loan Vehicle Indemnity Allianz EBroker by contacting an Allianz EBroker agent or visiting their website for more information. The process typically involves filling out an application, providing relevant business details, and reviewing your coverage options with an advisor.

Get more for ACOM2205a Motor Trade Loan Vehicle Indemnity Allianz EBroker

Find out other ACOM2205a Motor Trade Loan Vehicle Indemnity Allianz EBroker

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself

- Help Me With Electronic signature Missouri Government Rental Application

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement

- Electronic signature New Jersey Government Promissory Note Template Online

- Electronic signature Michigan Education LLC Operating Agreement Myself

- How To Electronic signature Massachusetts Finance & Tax Accounting Quitclaim Deed

- Electronic signature Michigan Finance & Tax Accounting RFP Now

- Electronic signature Oklahoma Government RFP Later