UC 020 UI Tax Wage Listing Continuation Tax Wage Listing Continuation 2019-2026

What is the UC 020 UI Tax Wage Listing Continuation?

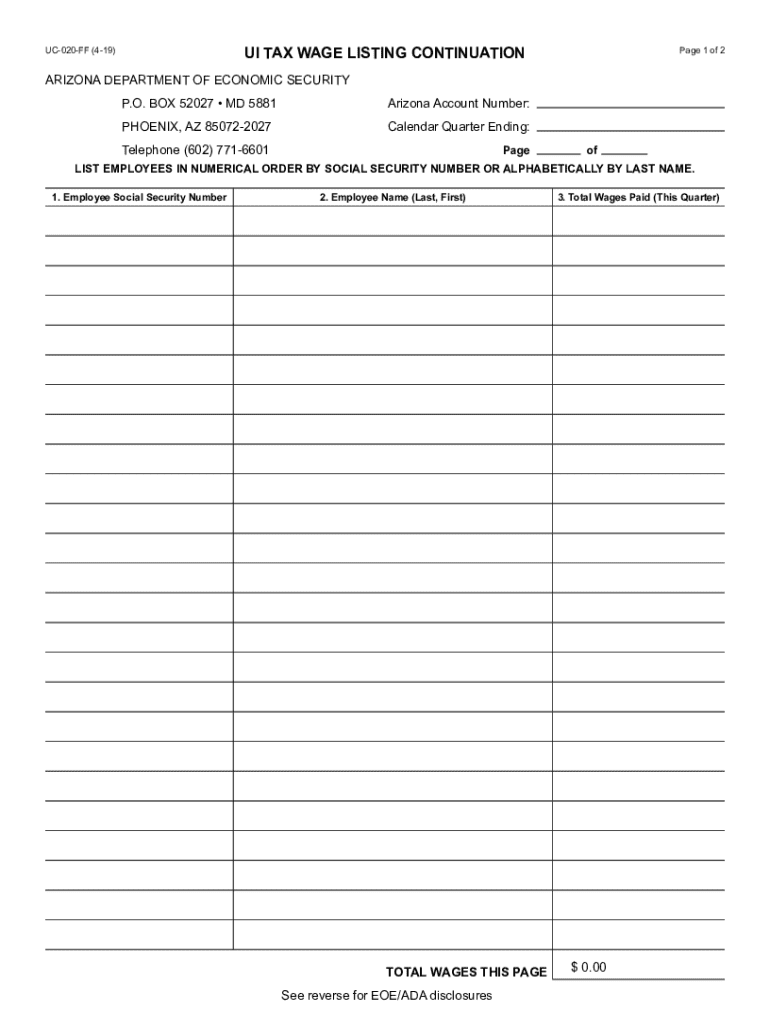

The UC 020 UI Tax Wage Listing Continuation is a specific form used in the United States for reporting wages subject to unemployment insurance taxes. This form is essential for employers to accurately report employee wages to state unemployment agencies. By providing detailed wage information, employers ensure compliance with state regulations and contribute to the funding of unemployment benefits for eligible workers.

Steps to Complete the UC 020 UI Tax Wage Listing Continuation

Completing the UC 020 UI Tax Wage Listing Continuation involves several key steps:

- Gather necessary employee wage data, including total earnings and hours worked.

- Fill out the form with accurate information for each employee, ensuring that all required fields are completed.

- Review the form for accuracy to avoid potential penalties or delays in processing.

- Submit the form according to your state’s guidelines, either electronically or via mail.

Legal Use of the UC 020 UI Tax Wage Listing Continuation

The UC 020 UI Tax Wage Listing Continuation must be used in accordance with state laws governing unemployment insurance. Employers are legally required to submit this form to report wages accurately. Failure to comply with these regulations can result in penalties, including fines or increased tax rates. It is important for businesses to understand their obligations under state law to maintain compliance.

Required Documents for the UC 020 UI Tax Wage Listing Continuation

To complete the UC 020 UI Tax Wage Listing Continuation, employers typically need the following documents:

- Employee payroll records, detailing wages, hours worked, and any deductions.

- Previous tax filings related to unemployment insurance.

- Any correspondence from the state unemployment agency regarding wage reporting.

Filing Deadlines for the UC 020 UI Tax Wage Listing Continuation

Filing deadlines for the UC 020 UI Tax Wage Listing Continuation vary by state but are generally aligned with quarterly tax reporting periods. Employers should be aware of their specific state deadlines to avoid late submissions, which can incur penalties. It is advisable to check with the state unemployment agency for the most accurate and current deadlines.

Examples of Using the UC 020 UI Tax Wage Listing Continuation

Employers may encounter various scenarios when using the UC 020 UI Tax Wage Listing Continuation. For instance:

- A small business with seasonal employees must report wages accurately to ensure that unemployment benefits are available during off-peak seasons.

- A company that has recently expanded its workforce needs to update its wage listings to reflect new hires and changes in employee status.

Quick guide on how to complete uc 020 ui tax wage listing continuation tax wage listing continuation

Easily Prepare UC 020 UI Tax Wage Listing Continuation Tax Wage Listing Continuation on Any Device

Digital document management has gained signNow traction among companies and individuals. It serves as an ideal environmentally-friendly alternative to traditional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents promptly and without delays. Handle UC 020 UI Tax Wage Listing Continuation Tax Wage Listing Continuation on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to Adjust and eSign UC 020 UI Tax Wage Listing Continuation Tax Wage Listing Continuation Effortlessly

- Find UC 020 UI Tax Wage Listing Continuation Tax Wage Listing Continuation and select Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of your documents or conceal sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your eSignature with the Sign tool, which takes just seconds and carries the same legal validity as a conventional handwritten signature.

- Review the details and click the Done button to save your modifications.

- Decide how you want to send your form—via email, SMS, invitation link, or download it to your computer.

Eliminate the hassles of lost or misfiled documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Alter and eSign UC 020 UI Tax Wage Listing Continuation Tax Wage Listing Continuation to ensure excellent communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct uc 020 ui tax wage listing continuation tax wage listing continuation

Create this form in 5 minutes!

How to create an eSignature for the uc 020 ui tax wage listing continuation tax wage listing continuation

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the UC 020 UI Tax Wage Listing Continuation?

The UC 020 UI Tax Wage Listing Continuation is a crucial document used for reporting wages for unemployment insurance purposes. It helps businesses ensure compliance with state regulations regarding unemployment tax. Understanding this document is essential for accurate payroll management.

-

How can airSlate SignNow assist with the UC 020 UI Tax Wage Listing Continuation?

airSlate SignNow provides an efficient platform for businesses to eSign and send the UC 020 UI Tax Wage Listing Continuation securely. Our solution simplifies the document management process, ensuring that your tax wage listings are submitted on time and in compliance with regulations.

-

What are the pricing options for using airSlate SignNow for UC 020 UI Tax Wage Listing Continuation?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses of all sizes. Our cost-effective solution ensures that you can manage your UC 020 UI Tax Wage Listing Continuation without breaking the bank. Explore our plans to find the best fit for your organization.

-

What features does airSlate SignNow offer for managing the UC 020 UI Tax Wage Listing Continuation?

Our platform includes features such as customizable templates, secure eSigning, and automated workflows specifically designed for documents like the UC 020 UI Tax Wage Listing Continuation. These tools enhance efficiency and accuracy, making it easier for businesses to handle their tax wage listings.

-

Are there any integrations available with airSlate SignNow for the UC 020 UI Tax Wage Listing Continuation?

Yes, airSlate SignNow integrates seamlessly with various accounting and payroll software, allowing for streamlined management of the UC 020 UI Tax Wage Listing Continuation. This integration ensures that your data is synchronized and reduces the risk of errors during the submission process.

-

What benefits does airSlate SignNow provide for businesses handling the UC 020 UI Tax Wage Listing Continuation?

Using airSlate SignNow for your UC 020 UI Tax Wage Listing Continuation offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform empowers businesses to focus on their core operations while ensuring compliance with tax regulations.

-

Is airSlate SignNow user-friendly for submitting the UC 020 UI Tax Wage Listing Continuation?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for anyone to navigate and submit the UC 020 UI Tax Wage Listing Continuation. Our intuitive interface ensures that you can complete your tasks quickly and efficiently, regardless of your technical expertise.

Get more for UC 020 UI Tax Wage Listing Continuation Tax Wage Listing Continuation

Find out other UC 020 UI Tax Wage Listing Continuation Tax Wage Listing Continuation

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors