Ar Ifta Form

What is the Arkansas IFTA?

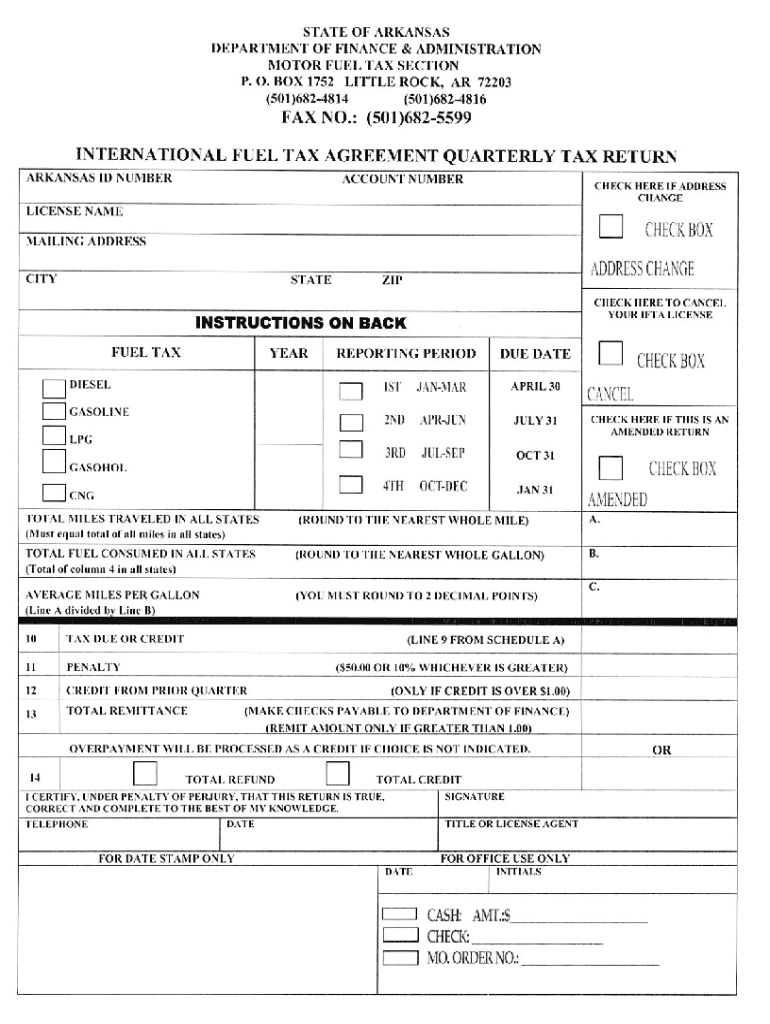

The Arkansas International Fuel Tax Agreement (IFTA) is a tax collection agreement among the contiguous United States and Canadian provinces. It simplifies the reporting of fuel use by motor carriers operating in multiple jurisdictions. Under this agreement, carriers can report and pay their fuel taxes in one state, which then distributes the revenue to the appropriate jurisdictions based on mileage and fuel consumption.

How to Obtain the Arkansas IFTA

To obtain the Arkansas IFTA, businesses must first register with the Arkansas Department of Finance and Administration. The registration process typically involves completing an application form, providing necessary documentation such as proof of vehicle ownership, and paying any applicable fees. Once registered, the carrier will receive an IFTA license and decals for their vehicles, allowing them to operate legally across participating jurisdictions.

Steps to Complete the Arkansas IFTA

Completing the Arkansas IFTA involves several key steps:

- Gather all necessary records, including fuel purchase receipts and mileage logs.

- Calculate total miles traveled in each jurisdiction and total gallons of fuel purchased.

- Complete the IFTA tax return form, detailing the fuel usage and mileage for each state.

- Submit the completed form along with any payment due by the specified deadline.

Legal Use of the Arkansas IFTA

The legal use of the Arkansas IFTA ensures compliance with state and federal regulations regarding fuel taxation. Carriers must maintain accurate records of their fuel purchases and mileage to substantiate their IFTA filings. Failure to comply with these regulations can result in penalties, including fines and potential audits by state authorities.

Filing Deadlines / Important Dates

Filing deadlines for the Arkansas IFTA are typically quarterly. Carriers must submit their tax returns by the last day of the month following the end of each quarter. Important dates include:

- First Quarter: January 1 - March 31, due April 30

- Second Quarter: April 1 - June 30, due July 31

- Third Quarter: July 1 - September 30, due October 31

- Fourth Quarter: October 1 - December 31, due January 31

Required Documents

When applying for or filing the Arkansas IFTA, several documents are required to ensure compliance:

- Proof of vehicle ownership or lease agreements

- Fuel purchase receipts

- Mileage logs detailing travel in each jurisdiction

- Completed IFTA application form

Penalties for Non-Compliance

Non-compliance with Arkansas IFTA regulations can lead to significant penalties. These may include fines, interest on unpaid taxes, and potential suspension of the IFTA license. It is essential for carriers to remain diligent in their record-keeping and timely filings to avoid these consequences.

Quick guide on how to complete arkansas ifta online form

Effortlessly Prepare Ar Ifta on Any Device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed papers, enabling you to locate the correct form and securely store it online. airSlate SignNow provides all the tools necessary to swiftly create, modify, and electronically sign your documents without any delays. Handle Ar Ifta on any device with airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

The easiest way to modify and electronically sign Ar Ifta with ease

- Obtain Ar Ifta and click on Get Form to initiate the process.

- Utilize the tools available to fill out your form.

- Emphasize pertinent sections of your documents or conceal sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes only seconds and has the same legal validity as a traditional handwritten signature.

- Review all information carefully and click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, SMS, or shareable link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form navigation, or errors that necessitate printing new copies of documents. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Ar Ifta and ensure seamless communication at any stage of the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How do I fill out an Indian passport form online?

You need to be careful while filling up the Passport form online. If is better if you download the Passport form and fill it up offline. You can upload the form again after you completely fill it up. You can check the complete procedure to know : How to Apply for Indian Passport Online ?

-

What is the procedure for filling out the CPT registration form online?

CHECK-LIST FOR FILLING-UP CPT JUNE - 2017 EXAMINATION APPLICATION FORM1 - BEFORE FILLING UP THE FORM, PLEASE DETERMINE YOUR ELIGIBILITY AS PER DETAILS GIVEN AT PARA 1.3 (IGNORE FILLING UP THE FORM IN CASE YOU DO NOT COMPLY WITH THE ELIGIBILITY REQUIREMENTS).2 - ENSURE THAT ALL COLUMNS OF THE FORM ARE FILLED UP/SELECTED CORRECTLY AND ARE CORRECTLY APPEARING IN THE PDF.3 - CENTRE IS SELECTED CORRECTLY AND IS CORRECTLY APPEARING IN THE PDF. (FOR REFERENCE SEE APPENDIX-A).4 - MEDIUM OF THE EXAMINATION IS SELECTED CORRECTLY AND IS CORRECTLY APPEARING IN THE PDF.5 - THE SCANNED COPY OF THE DECLARATION UPLOADED PERTAINS TO THE CURRENT EXAM CYCLE.6 - ENSURE THAT PHOTOGRAPHS AND SIGNATURES HAVE BEEN AFFIXED (If the same are not appearing in the pdf) AT APPROPRIATE COLUMNS OF THE PRINTOUT OF THE EXAM FORM.7 - ADDRESS HAS BEEN RECORDED CORRECTLY AND IS CORRECTLY APPEARING IN THE PDF.8 - IN CASE THE PDF IS NOT CONTAINING THE PHOTO/SIGNATURE THEN CANDIDATE HAS TO GET THE DECLARATION SIGNED AND PDF IS GOT ATTESTED.9 - RETAIN A COPY OF THE PDF/FILLED-IN FORM FOR YOUR FUTURE REFERENCE.10 - IN CASE THE PHOTO/SIGN IS NOT APPEARING IN THE PDF, PLEASE TAKE ATTESTATIONS AND SEND THE PDF (PRINT OUT) OF THE ONLINE SUMBITTED EXAMINATION APPLICATION BY SPEED POST/REGISTERED POST ONLY.11 - KEEP IN SAFE CUSTODY THE SPEED POST/REGISTERED POST RECEIPT ISSUED BY POSTAL AUTHORITY FOR SENDING THE PDF (PRINT OUT) OF THE ONLINE SUMBITTED EXAMINATION APPLICATION FORM TO THE INSTITUTE/ RECEIPT ISSUED BY ICAI IN CASE THE APPLICATION IS DEPOSITED BY HAND.Regards,Scholar For CA089773 13131Like us on facebookScholar for ca,cma,cs https://m.facebook.com/scholarca...Sambamurthy Nagar, 5th Street, Kakinada, Andhra Pradesh 533003https://g.co/kgs/VaK6g0

-

How do I fill out the online form on Mymoneysage?

Hi…If you are referring to eCAN form, then please find the below details for your reference.The CAN is a new mutual fund investment identification number using which investor can hold schemes from different AMCs. To utilise the services of Mymoneysage (Client)for investing in direct plans of mutual funds, you require a CAN. If you want to invest as a single holder in some schemes and as joint holders in others, then you will need two CANs to do so.For eCAN, you need to provide some basic details in the form like1) CAN holder type2) Demographic Details3) Bank details (in which you want to transact with)4) And Nominee details.Applying eCAN is completely Free.To apply one please visit Log In

-

How can we fill out an online ATM form?

Have you asked your bank? I am unsure of what you want to accomplish. If you have an acount you can transfer funds online; from savings to checking via bill pay. Otherwise I can not tell you how to solve your problem. Sorry that I am unable to help, perhaps someone else can.

-

How can you make online form filling fun?

Personally, I feel filling forms are never fun, We can just make it less boring with some techniques. As far as,the fun element is concerned, they can always be added through visual aids. Our mind fundamentally is more of a visual tool than that of a Textual tool. Even the fun elements can be added as part of design, here are some suggestions:Lets reduce the Cognitive load with adding simple interaction elements like Buttons, sliders, drop down menu. The idea is to include the natural human tendency to act in a certain way. A lot of animations and Jquery can actually make the form unusable.The Visual Load can be reduced with keeping the basic eye movements under consideration while designing the fields. In below image we can see how designing form in certain way can lower visual load. The Motor load can be diminished with the use of larger intuitive buttons.I am writing down some of the ideas that I know with which we can make Form Filling Less cumbersome if not playful or fun, You may add in comments too.The idea is create Engagement/Interactions not forms. E.g. Take for example Tripit. This application for managing your travel plans by using your travel confirmation emails could easily have asked all new members to sign up through a registration form. Instead, to the join the service new members simply have to send Tripit a travel confirmation email. From this email, Tripit creates an account and extracts the information it needs to create a rich travel plan for new members. No form required. People sign up for Tripit by using it and learning what the application can do for them.A different type of Sign Up form Minimize the Key Inputs, try to make it point and click for web and Touch oriented for Mobiles.Using Web Services for Login : Web services allow people to log-in to a new service using their profile and contact information from other Web sites. The idea here is to make use of information people have already provided elsewhere instead of having them fill it all in again on your sign-up form.Other Communication Tools like Email. Tripit already uses it, Posterous, which is a blogging service, let you write a blog post in your email, attach a photo, send it over to Posterous, and they'll essentially publish that whole thing for you, no need to ever get out of your email client. The idea is that input can come from anywhere. You can use your email client to provide input. You can use your IM client to provide input. You can use Twitter, or you can use your calendar. You can use book marklets or browser extensions. Mad Libs forms ask people the same questions found in typical sign-up forms in a narrative format. They present input fields to people as blanks within sentences. Create Data Extractions points at various points of user interaction. Asking people for information once they are already using an application is often more successful than asking them before they start using the application. These days linkedin.com is trying to do the same.

Create this form in 5 minutes!

How to create an eSignature for the arkansas ifta online form

How to make an electronic signature for your Arkansas Ifta Online Form online

How to create an electronic signature for your Arkansas Ifta Online Form in Chrome

How to create an electronic signature for putting it on the Arkansas Ifta Online Form in Gmail

How to generate an electronic signature for the Arkansas Ifta Online Form from your smart phone

How to make an electronic signature for the Arkansas Ifta Online Form on iOS devices

How to create an eSignature for the Arkansas Ifta Online Form on Android OS

People also ask

-

What is the Arkansas IFTA program?

The Arkansas IFTA program, or International Fuel Tax Agreement, simplifies fuel tax reporting for commercial vehicle operators. Businesses that travel across state lines can report their fuel usage and miles driven in one state, making compliance easier. This unified approach helps ensure transparency in reporting and taxation.

-

How can airSlate SignNow help with Arkansas IFTA documentation?

AirSlate SignNow streamlines the process of sending and eSigning documents necessary for Arkansas IFTA compliance. With its easy-to-use platform, you can quickly share tax-related paperwork and gather signatures. This efficiency not only saves time but also enhances accuracy in your Arkansas IFTA filings.

-

What are the pricing options for airSlate SignNow related to Arkansas IFTA?

AirSlate SignNow offers various pricing plans that cater to businesses of all sizes, allowing easy management of Arkansas IFTA documentation. Each plan provides essential features for eSigning and document management. Review the pricing tiers to find the best fit for your business needs regarding Arkansas IFTA compliance.

-

Does airSlate SignNow integrate with other software for Arkansas IFTA management?

Yes, airSlate SignNow seamlessly integrates with various accounting and transportation management software, enhancing your Arkansas IFTA operations. These integrations allow for a centralized platform where all documents and data can be managed efficiently. Streamlining your workflow this way ensures that you stay compliant with Arkansas IFTA requirements.

-

What are the benefits of using airSlate SignNow for Arkansas IFTA forms?

Using airSlate SignNow for Arkansas IFTA forms increases efficiency by automating the signing process. This not only speeds up your workflow but also reduces the chances of errors associated with manual signatures. By leveraging this technology, businesses can focus on their core operations while ensuring compliance with Arkansas IFTA.

-

Is airSlate SignNow secure for handling Arkansas IFTA documents?

Yes, airSlate SignNow employs state-of-the-art encryption and security protocols to protect all Arkansas IFTA documents. Your sensitive information is safeguarded at every step, ensuring compliance and data integrity. Trusting airSlate SignNow means your Arkansas IFTA filing process remains secure and confidential.

-

How can I get started with airSlate SignNow for Arkansas IFTA?

Getting started with airSlate SignNow for Arkansas IFTA is simple. You can sign up for a free trial on our website to explore all the features. Once registered, you can start sending and signing Arkansas IFTA documents immediately with ease and efficiency.

Get more for Ar Ifta

- Capf 60 80 form

- Commercial personal property rendition form arkansas

- Cigna biometric screening form

- Comp time form template

- Hernando county online permitting form

- Home rules contract pdf form

- Sample form nebraska state fire marshal sfm ne

- January wl 368 instant ticket safe inventory wl 368 wl368 wl 368 wl368 form

Find out other Ar Ifta

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document