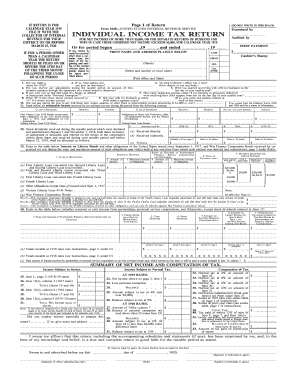

1919 Form 1040

What is the 1919 Form 1040

The 1919 Form 1040 is a federal income tax form used by individuals in the United States to report their annual income to the Internal Revenue Service (IRS). This form is essential for taxpayers to calculate their tax obligations and determine whether they owe taxes or are eligible for a refund. The 1919 Form 1040 includes various sections where taxpayers can report income from wages, dividends, and other sources, as well as claim deductions and credits that may reduce their taxable income.

Steps to complete the 1919 Form 1040

Completing the 1919 Form 1040 involves several key steps that ensure accurate reporting of income and deductions:

- Gather necessary documents: Collect all relevant financial documents, including W-2 forms, 1099 forms, and records of other income.

- Fill out personal information: Enter your name, address, and Social Security number at the top of the form.

- Report income: Use the appropriate sections to list all sources of income, including wages, interest, and dividends.

- Claim deductions and credits: Review available deductions and tax credits to reduce your taxable income.

- Calculate tax liability: Follow the instructions to compute your total tax owed based on your taxable income.

- Sign and date the form: Ensure that you sign and date the form before submission, as this validates your return.

Legal use of the 1919 Form 1040

The legal use of the 1919 Form 1040 is governed by federal tax laws, which require accurate reporting of income and compliance with all applicable regulations. When filing this form, it is crucial to provide truthful information, as discrepancies can lead to penalties or audits by the IRS. Additionally, e-signatures are legally recognized under the ESIGN Act, allowing taxpayers to submit the form electronically while maintaining compliance with legal standards.

How to obtain the 1919 Form 1040

Taxpayers can obtain the 1919 Form 1040 through several methods. The form is available for download directly from the IRS website, where users can access the latest version in PDF format. Additionally, taxpayers may request a physical copy by contacting the IRS or visiting local IRS offices. Many tax preparation services also provide access to the form as part of their filing software, streamlining the process for users.

Form Submission Methods (Online / Mail / In-Person)

Submitting the 1919 Form 1040 can be done through various methods, providing flexibility for taxpayers:

- Online submission: Taxpayers can file electronically using IRS-approved e-filing software, which often simplifies the process and speeds up refunds.

- Mail submission: The completed form can be printed and mailed to the appropriate IRS address based on the taxpayer's location and whether they are enclosing a payment.

- In-person submission: Taxpayers may also choose to file in person at designated IRS offices, where assistance is available for completing the form.

Filing Deadlines / Important Dates

Filing deadlines for the 1919 Form 1040 are typically set by the IRS and can vary each year. Generally, the deadline for submitting the form is April 15, unless it falls on a weekend or holiday. Taxpayers should also be aware of extensions that may be available, allowing additional time to file, though any taxes owed are still due by the original deadline to avoid penalties.

Quick guide on how to complete 1919 form 1040

Handle 1919 Form 1040 seamlessly on any gadget

Internet-based document administration has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can locate the appropriate form and securely save it online. airSlate SignNow provides you with all the resources necessary to create, modify, and electronically sign your documents swiftly without delays. Handle 1919 Form 1040 on any device with airSlate SignNow Android or iOS applications and enhance any document-focused activity today.

The easiest method to modify and electronically sign 1919 Form 1040 with ease

- Obtain 1919 Form 1040 and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow supplies specifically for that purpose.

- Generate your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Verify all the details and then click on the Done button to save your modifications.

- Choose how you want to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tiring form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Alter and electronically sign 1919 Form 1040 and ensure outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 1919 form 1040

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 1919 form 1040 and how is it used?

The 1919 form 1040 is a specific tax form used for reporting income and calculating taxes owed. In the context of airSlate SignNow, this form can be eSigned and sent electronically, streamlining the filing process for individuals and businesses alike.

-

How does airSlate SignNow simplify the completion of the 1919 form 1040?

airSlate SignNow provides an intuitive platform that allows you to fill out the 1919 form 1040 digitally. You can easily navigate through the form, ensuring that all necessary fields are completed accurately, which minimizes errors and saves time.

-

What are the pricing options for using airSlate SignNow with the 1919 form 1040?

airSlate SignNow offers various pricing plans to cater to different user needs. These plans include features specifically designed for handling forms like the 1919 form 1040, allowing you to choose a solution that fits your budget and requirements.

-

Can I integrate airSlate SignNow with other applications while processing the 1919 form 1040?

Yes, airSlate SignNow supports seamless integrations with numerous applications, making it easy to manage your documents alongside your existing workflow. You can integrate tools like CRM systems or document management software to enhance the efficiency of processing the 1919 form 1040.

-

What features does airSlate SignNow offer for eSigning the 1919 form 1040?

airSlate SignNow includes features such as secure eSigning, real-time tracking, and customizable templates for the 1919 form 1040. These tools ensure that your documents are signed quickly and safely, giving you peace of mind during tax season.

-

How does using airSlate SignNow benefit my business when handling the 1919 form 1040?

Using airSlate SignNow to manage the 1919 form 1040 can enhance your business's efficiency by reducing paper usage and speeding up the document workflow. This not only saves time but also promotes a greener approach to business operations.

-

Is support available if I encounter issues with the 1919 form 1040 on airSlate SignNow?

Absolutely! airSlate SignNow provides customer support to assist users with any challenges they may face while using the platform, including issues related to the 1919 form 1040. You can access help through live chat, email, or a comprehensive knowledge base.

Get more for 1919 Form 1040

Find out other 1919 Form 1040

- How To Sign Nevada Life Sciences LLC Operating Agreement

- Sign Montana Non-Profit Warranty Deed Mobile

- Sign Nebraska Non-Profit Residential Lease Agreement Easy

- Sign Nevada Non-Profit LLC Operating Agreement Free

- Sign Non-Profit Document New Mexico Mobile

- Sign Alaska Orthodontists Business Plan Template Free

- Sign North Carolina Life Sciences Purchase Order Template Computer

- Sign Ohio Non-Profit LLC Operating Agreement Secure

- Can I Sign Ohio Non-Profit LLC Operating Agreement

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer

- Sign South Carolina Non-Profit Promissory Note Template Mobile

- Sign South Carolina Non-Profit Lease Agreement Template Online

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast

- How To Sign Virginia Non-Profit Lease Agreement Template