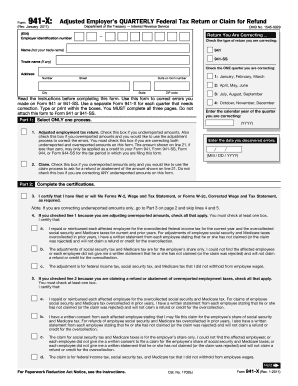

Omb No 1545 0029 Form

What is the OMB No ?

The OMB No is a form issued by the Internal Revenue Service (IRS) that is primarily used for tax-related purposes. This form is commonly associated with the IRS's requirements for various tax filings and documentation. It plays a crucial role in ensuring compliance with federal tax laws and regulations. Understanding the purpose and requirements of the OMB No is essential for individuals and businesses to avoid penalties and ensure accurate reporting.

How to Use the OMB No

Using the OMB No involves several steps to ensure proper completion and submission. First, gather all necessary information, such as personal identification details and financial records relevant to the tax year. Next, carefully fill out the form, ensuring that all entries are accurate and complete. Once the form is filled out, review it for any errors before submission. It is important to follow the specific instructions provided by the IRS for this form to ensure compliance and avoid delays in processing.

Steps to Complete the OMB No

Completing the OMB No requires a systematic approach. Here are the key steps:

- Obtain the form from the IRS website or through authorized tax preparation software.

- Read the instructions carefully to understand the requirements for each section.

- Fill out the form with accurate information, ensuring you include all necessary details.

- Double-check for any mistakes or omissions.

- Sign and date the form where required.

- Submit the completed form according to the IRS guidelines, either electronically or via mail.

Legal Use of the OMB No

The legal use of the OMB No is governed by federal tax laws. It is essential to ensure that the form is completed accurately to maintain its legal validity. Any discrepancies or inaccuracies can lead to complications, including audits or penalties. The form must be submitted within the designated time frames established by the IRS to ensure compliance. Understanding the legal implications of using this form is crucial for both individuals and businesses.

Filing Deadlines / Important Dates

Filing deadlines for the OMB No vary depending on the specific tax year and the type of taxpayer. Generally, individual taxpayers must submit their forms by April 15 of the following year. However, extensions may be available under certain circumstances. It is important to stay informed about any changes in deadlines or additional requirements that may arise each tax year. Keeping a calendar of important dates can help ensure timely filing.

Required Documents

To complete the OMB No accurately, several documents may be required. These typically include:

- Personal identification information, such as Social Security numbers.

- Income statements, such as W-2 forms or 1099 forms.

- Records of deductions and credits that apply to your tax situation.

- Any previous tax returns that may provide relevant information.

Having all necessary documents on hand will facilitate a smoother completion process and help ensure accuracy.

Quick guide on how to complete omb no 1545 0029

Complete Omb No 1545 0029 effortlessly on any device

Managing documents online has gained traction among companies and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, enabling you to access the necessary form and securely store it in the cloud. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly and without delays. Handle Omb No 1545 0029 on any device using airSlate SignNow's Android or iOS applications and streamline any document-centric workflow today.

Effortlessly edit and electronically sign Omb No 1545 0029

- Find Omb No 1545 0029 and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Mark important sections of your documents or redact sensitive information using tools specifically offered by airSlate SignNow for this purpose.

- Generate your signature with the Sign feature, which takes just moments and carries the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Choose how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misfiled documents, tedious form searches, or errors that necessitate the printing of new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Omb No 1545 0029, ensuring clear communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the omb no 1545 0029

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 1545 form?

The 1545 form is a crucial document used for reporting specific tax information to the IRS. It provides businesses with essential details necessary for ensuring compliance with tax regulations. Understanding how to utilize the 1545 form is vital for effective tax management.

-

How can airSlate SignNow simplify the 1545 form process?

airSlate SignNow streamlines the process of completing and submitting the 1545 form by allowing users to eSign documents easily. With its intuitive interface, you can fill out the form, add signatures, and send it directly to the necessary parties without hassle. This saves time and reduces the likelihood of errors.

-

Is there a cost associated with eSigning the 1545 form using airSlate SignNow?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Users can opt for affordable solutions that provide them with the tools necessary for eSigning the 1545 form and other documents. You can explore the pricing details on our website to find the best fit for your organization.

-

Can I integrate airSlate SignNow with other applications to manage the 1545 form?

Absolutely! airSlate SignNow supports integrations with various business applications, enhancing your ability to manage the 1545 form. This integration allows for a seamless workflow, enabling document tracking and storage alongside your existing tools.

-

What benefits does airSlate SignNow provide for businesses using the 1545 form?

Using airSlate SignNow for your 1545 form enhances efficiency, reduces paperwork, and speeds up the signing process. It also ensures that documents are stored securely while providing ease of access for future needs. Moreover, the solution enables better collaboration among team members.

-

Is airSlate SignNow compliant with eSignature laws for the 1545 form?

Yes, airSlate SignNow is fully compliant with eSignature laws, ensuring that your eSigned 1545 form is valid and legally binding. This compliance is crucial for businesses that need to maintain legal integrity while handling important documents digitally.

-

What types of documents can I eSign besides the 1545 form?

In addition to the 1545 form, airSlate SignNow allows users to eSign a wide range of documents, including contracts, agreements, and forms. This versatility makes it a valuable tool for any business looking to streamline their document management process.

Get more for Omb No 1545 0029

- Dc clean hands certificate printable form

- When is a baby like a basketball player form

- Semak no ic melalui nama form

- Human impact and dependence on oceans color by number answer key form

- Gem claim form 471908311

- Printable hvac proposal forms

- Cs elevators escalators tdlr texas form

- Application for non domestic rates payment under the form

Find out other Omb No 1545 0029

- Electronic signature Texas Car Dealer Purchase Order Template Online

- Electronic signature Texas Car Dealer Purchase Order Template Fast

- Electronic signature Maryland Business Operations NDA Myself

- Electronic signature Washington Car Dealer Letter Of Intent Computer

- Electronic signature Virginia Car Dealer IOU Fast

- How To Electronic signature Virginia Car Dealer Medical History

- Electronic signature Virginia Car Dealer Separation Agreement Simple

- Electronic signature Wisconsin Car Dealer Contract Simple

- Electronic signature Wyoming Car Dealer Lease Agreement Template Computer

- How Do I Electronic signature Mississippi Business Operations Rental Application

- Electronic signature Missouri Business Operations Business Plan Template Easy

- Electronic signature Missouri Business Operations Stock Certificate Now

- Electronic signature Alabama Charity Promissory Note Template Computer

- Electronic signature Colorado Charity Promissory Note Template Simple

- Electronic signature Alabama Construction Quitclaim Deed Free

- Electronic signature Alaska Construction Lease Agreement Template Simple

- Electronic signature Construction Form Arizona Safe

- Electronic signature Kentucky Charity Living Will Safe

- Electronic signature Construction Form California Fast

- Help Me With Electronic signature Colorado Construction Rental Application