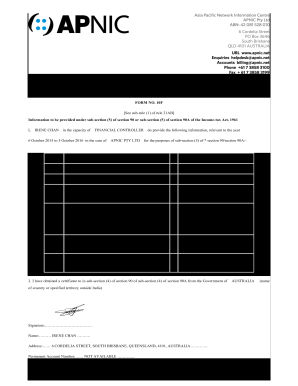

Form 10f

What is the Form 10f

The Form 10f is a document primarily used by foreign entities to claim tax treaty benefits in the United States. It serves as a declaration that the entity is a resident of a foreign country with which the U.S. has a tax treaty. This form helps in reducing or eliminating U.S. withholding tax on certain types of income, such as dividends, interest, and royalties. By submitting the Form 10f, the foreign entity can provide the necessary information to the withholding agent, ensuring compliance with U.S. tax laws while benefiting from applicable treaty provisions.

How to use the Form 10f

Using the Form 10f involves several key steps. First, the foreign entity must accurately complete the form, providing details such as its name, address, and the country of residence. It is essential to ensure that all information is correct to avoid delays or issues with tax treaty claims. Once completed, the form should be submitted to the U.S. withholding agent, who will use it to determine the appropriate tax treatment of payments made to the foreign entity. It is advisable to keep a copy of the submitted form for record-keeping purposes.

Steps to complete the Form 10f

Completing the Form 10f requires careful attention to detail. Here are the steps to follow:

- Gather necessary information, including the entity's name, address, and country of residence.

- Fill out the form, ensuring that all fields are completed accurately.

- Review the form for any errors or omissions.

- Sign and date the form, confirming the accuracy of the information provided.

- Submit the completed form to the appropriate U.S. withholding agent.

Legal use of the Form 10f

The legal use of the Form 10f is crucial for foreign entities seeking to benefit from U.S. tax treaties. By properly completing and submitting the form, entities can ensure compliance with U.S. tax regulations. The form acts as a declaration of residency and eligibility for treaty benefits, which can significantly reduce withholding tax rates. It is important to understand that any inaccuracies or fraudulent claims can lead to penalties or denial of treaty benefits.

Key elements of the Form 10f

Several key elements must be included when completing the Form 10f. These include:

- The name and address of the foreign entity.

- The country of residence of the entity.

- The specific tax treaty under which benefits are being claimed.

- A declaration of the entity's status and eligibility for treaty benefits.

Each of these elements plays a vital role in ensuring that the form is valid and that the entity can successfully claim the benefits available under U.S. tax treaties.

Filing Deadlines / Important Dates

Filing deadlines for the Form 10f can vary depending on the specific circumstances of the foreign entity and the type of income involved. Generally, it is advisable to submit the form before the payment is made to ensure that the correct withholding tax rate is applied. Entities should also be aware of any specific deadlines set forth in the relevant tax treaties, as these can impact the timing of submissions. Keeping track of these dates is essential for compliance and to avoid unnecessary withholding taxes.

Quick guide on how to complete form 10f 393223038

Effortlessly Prepare Form 10f on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed paperwork, as you can access the necessary form and securely save it online. airSlate SignNow equips you with all the resources required to create, edit, and electronically sign your documents promptly without any hold-ups. Manage Form 10f on any device using the airSlate SignNow Android or iOS applications and simplify your document-related tasks today.

How to Modify and Electronically Sign Form 10f with Ease

- Find Form 10f and click on Get Form to begin.

- Utilize our tools to complete your form.

- Underline important sections of your documents or conceal sensitive details with features that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or mistakes that necessitate reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign Form 10f while ensuring smooth communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 10f 393223038

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form 10f and how is it used?

The form 10f is a crucial document used for taxation purposes, particularly for non-residents claiming benefits under a tax treaty. This form allows individuals and businesses to reduce withholding tax on income earned in a foreign country. By using airSlate SignNow, you can effortlessly eSign and send your form 10f, ensuring compliance with local tax regulations.

-

How can airSlate SignNow help with managing form 10f?

With airSlate SignNow, you can easily create, eSign, and send the form 10f directly from your device. Our platform streamlines the process, making it simple to collect signatures and maintain records. This functionality not only saves time but also enhances the accuracy of your submissions to tax authorities.

-

Is there a cost associated with using airSlate SignNow for form 10f?

airSlate SignNow offers a cost-effective solution for managing documents like the form 10f. Pricing varies based on usage and the features you choose, ensuring that you get the best value for your needs. You can select from several plans that cater to both individuals and businesses.

-

What features does airSlate SignNow offer for form 10f submissions?

airSlate SignNow provides several features for form 10f submissions, including eSigning, document tracking, and template creation. These tools enhance efficiency, ensuring that your document is signed promptly and stored securely. Plus, you can customize workflows to fit your specific needs regarding the form 10f.

-

Can I integrate airSlate SignNow with other applications for form 10f management?

Yes, airSlate SignNow offers robust integrations with popular applications such as Google Drive and Salesforce. This allows you to manage your form 10f alongside other essential business tools seamlessly. Integrating these platforms can streamline your process and improve workflow efficiency.

-

What are the benefits of using airSlate SignNow for form 10f?

Using airSlate SignNow for the form 10f offers numerous benefits, such as convenience, speed, and enhanced security. The platform simplifies the signing process, reduces paper usage, and helps you stay compliant with legal requirements. Additionally, you gain access to real-time updates and document management features.

-

Is airSlate SignNow user-friendly for filing form 10f?

Absolutely! airSlate SignNow is designed with user experience in mind, making it straightforward for anyone to file their form 10f. Whether you're tech-savvy or not, you will find the interface intuitive, allowing you to navigate through the eSigning process with ease.

Get more for Form 10f

Find out other Form 10f

- Electronic signature North Carolina Car Dealer Purchase Order Template Safe

- Electronic signature Kentucky Business Operations Quitclaim Deed Mobile

- Electronic signature Pennsylvania Car Dealer POA Later

- Electronic signature Louisiana Business Operations Last Will And Testament Myself

- Electronic signature South Dakota Car Dealer Quitclaim Deed Myself

- Help Me With Electronic signature South Dakota Car Dealer Quitclaim Deed

- Electronic signature South Dakota Car Dealer Affidavit Of Heirship Free

- Electronic signature Texas Car Dealer Purchase Order Template Online

- Electronic signature Texas Car Dealer Purchase Order Template Fast

- Electronic signature Maryland Business Operations NDA Myself

- Electronic signature Washington Car Dealer Letter Of Intent Computer

- Electronic signature Virginia Car Dealer IOU Fast

- How To Electronic signature Virginia Car Dealer Medical History

- Electronic signature Virginia Car Dealer Separation Agreement Simple

- Electronic signature Wisconsin Car Dealer Contract Simple

- Electronic signature Wyoming Car Dealer Lease Agreement Template Computer

- How Do I Electronic signature Mississippi Business Operations Rental Application

- Electronic signature Missouri Business Operations Business Plan Template Easy

- Electronic signature Missouri Business Operations Stock Certificate Now

- Electronic signature Alabama Charity Promissory Note Template Computer