Illinois St 105 Form

What is the Illinois St 105 Form

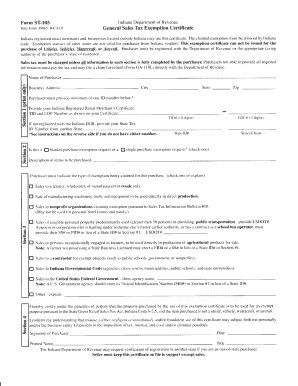

The Illinois St 105 form is a sales tax exemption certificate used by purchasers to claim exemption from sales tax on certain purchases. This form is particularly relevant for businesses and organizations that qualify for tax-exempt status under Illinois law. By completing and submitting the St 105 form, buyers can legally avoid paying sales tax on eligible items, which can significantly reduce overall costs for non-profit organizations, government entities, and certain types of businesses.

How to use the Illinois St 105 Form

To effectively use the Illinois St 105 form, the purchaser must fill it out accurately, providing essential information such as their name, address, and the reason for the exemption. The completed form should then be presented to the seller at the time of purchase. It is important for sellers to retain a copy of the St 105 form for their records, as it serves as proof that the sale was exempt from sales tax. Proper usage of this form ensures compliance with state tax regulations and helps avoid potential penalties.

Steps to complete the Illinois St 105 Form

Completing the Illinois St 105 form involves several straightforward steps:

- Begin by downloading the form from an official source or obtaining a physical copy.

- Fill in the purchaser's name and address accurately.

- Indicate the specific reason for the tax exemption, selecting from the provided options.

- Sign and date the form to validate the information provided.

- Present the completed form to the seller during the transaction.

Legal use of the Illinois St 105 Form

The legal use of the Illinois St 105 form is governed by state tax laws. To be valid, the form must be completed in full and signed by the purchaser. Misuse of the form, such as claiming exemptions for ineligible purchases, can lead to penalties, including fines and back taxes owed. It is essential for both buyers and sellers to understand the legal implications of using this form to ensure compliance with Illinois tax regulations.

Key elements of the Illinois St 105 Form

Key elements of the Illinois St 105 form include:

- Purchaser Information: Name and address of the buyer claiming the exemption.

- Reason for Exemption: Specific category under which the exemption is claimed.

- Signature: The form must be signed by an authorized representative of the purchasing entity.

- Date: The date when the form is completed and submitted.

Who Issues the Form

The Illinois St 105 form is issued by the Illinois Department of Revenue. This state agency is responsible for administering tax laws in Illinois, including the regulation of sales tax exemptions. The form is available for download on the Department of Revenue's official website, ensuring that all purchasers have access to the necessary documentation for claiming sales tax exemptions.

Quick guide on how to complete illinois st 105 form

Prepare Illinois St 105 Form effortlessly on any gadget

Digital document management has become increasingly popular among businesses and individuals alike. It offers an ideal environmentally friendly substitute to conventional printed and signed documents, allowing you to access the right form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents quickly and without delays. Manage Illinois St 105 Form on any gadget with airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to alter and eSign Illinois St 105 Form without hassle

- Find Illinois St 105 Form and click on Get Form to begin.

- Utilize the tools at your disposal to complete your document.

- Emphasize key sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Verify the information and click on the Done button to save your modifications.

- Select how you wish to share your form, via email, SMS, or an invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or mistakes that require new copies to be printed. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Illinois St 105 Form to ensure effective communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the illinois st 105 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ST 105 in airSlate SignNow?

The ST 105 refers to a specific feature within airSlate SignNow that simplifies the signing and management of documents. This feature allows users to send documents for eSignature easily, ensuring a streamlined process for businesses. By utilizing the ST 105, you can enhance your document workflow and increase overall efficiency.

-

How much does the airSlate SignNow ST 105 cost?

The pricing for airSlate SignNow varies based on the plan chosen, but the ST 105 feature is included in all plans. This cost-effective solution is designed to fit the budgets of businesses of any size, ensuring they can efficiently manage documents without breaking the bank. For specific pricing details, visit our website or contact our sales team.

-

What are the main benefits of using the ST 105 feature?

Using the ST 105 feature in airSlate SignNow offers numerous benefits, including enhanced document tracking, secure eSignatures, and improved turnaround times. This feature allows team members to collaborate seamlessly, reducing the time spent on paperwork. Businesses that implement the ST 105 can experience a signNow boost in productivity.

-

Can I integrate airSlate SignNow with other tools using the ST 105?

Yes, airSlate SignNow's ST 105 is designed to integrate with various third-party applications, making it a flexible tool for businesses. You can connect it with popular platforms such as Google Drive, Salesforce, and various CRM systems. This integration capability ensures that your document workflow is cohesive and streamlined across all tools used.

-

Is the ST 105 feature suitable for all types of businesses?

Absolutely! The ST 105 feature within airSlate SignNow is built to meet the needs of businesses in various industries, from small startups to large enterprises. Regardless of your business type, this feature can adapt to your document management requirements, providing customized solutions that align with your workflow.

-

How secure is the ST 105 feature for handling sensitive documents?

Security is a top priority for airSlate SignNow, and the ST 105 feature includes advanced encryption and compliance with legal standards. This ensures that all documents are securely signed and stored, protecting your sensitive information from unauthorized access. Businesses can trust that using the ST 105 will keep their data safe and compliant.

-

Does the ST 105 provide mobile compatibility?

Yes, the ST 105 feature in airSlate SignNow is fully mobile-compatible, allowing users to send and sign documents from any device. Whether in the office or on the go, you can manage your documents effortlessly. This mobile functionality enhances accessibility, making it easier for teams to operate efficiently.

Get more for Illinois St 105 Form

Find out other Illinois St 105 Form

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF

- How Can I Electronic signature New Mexico Finance & Tax Accounting Word