Form 203

What is the Form 203

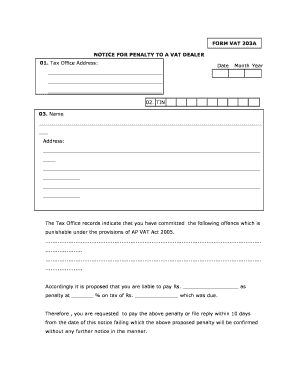

The Form 203 is a critical document used in various legal and administrative processes in the United States. It serves as a formal application or declaration, often required by government agencies or organizations to gather essential information from individuals or entities. Understanding the purpose and requirements of the Form 203 is vital for ensuring compliance and facilitating smooth processing.

How to use the Form 203

Using the Form 203 involves several steps to ensure accurate completion and submission. First, gather all necessary information, including personal details and any required documentation. Next, carefully fill out each section of the form, ensuring clarity and accuracy. After completing the form, review it for any errors or omissions before submitting it to the relevant authority. Depending on the requirements, you may submit the form online, by mail, or in person.

Steps to complete the Form 203

Completing the Form 203 requires careful attention to detail. Follow these steps:

- Read the instructions thoroughly to understand what information is required.

- Gather all necessary documents, such as identification and supporting materials.

- Complete the form section by section, ensuring all fields are filled out accurately.

- Double-check your entries for any mistakes or missing information.

- Sign and date the form where required.

- Submit the form according to the specified method, whether online, by mail, or in person.

Legal use of the Form 203

The legal use of the Form 203 is governed by specific regulations and requirements. To ensure that the form is legally binding, it must be completed accurately and submitted to the appropriate authority. Compliance with relevant laws, such as eSignature regulations, is essential. Utilizing a secure platform for electronic signatures can enhance the legal standing of the document, providing a reliable audit trail and ensuring that all parties' identities are verified.

Key elements of the Form 203

Understanding the key elements of the Form 203 is crucial for successful completion. These elements typically include:

- Personal Information: Name, address, and contact details of the applicant.

- Purpose of the Form: A clear statement of why the form is being submitted.

- Supporting Documentation: Any additional documents required to substantiate the application.

- Signature: The applicant's signature, confirming the accuracy of the information provided.

Form Submission Methods

There are several methods for submitting the Form 203, depending on the requirements set by the issuing authority. Common submission methods include:

- Online Submission: Many agencies allow electronic submission through their websites, which can expedite processing times.

- Mail: The form can be printed and mailed to the designated address, ensuring it is sent via a reliable postal service.

- In-Person Submission: Applicants may also have the option to submit the form directly at a designated office, allowing for immediate confirmation of receipt.

Quick guide on how to complete form 203 24592981

Complete Form 203 seamlessly on any device

Online document management has gained traction with businesses and individuals alike. It serves as an excellent eco-conscious alternative to traditional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage Form 203 on any platform using airSlate SignNow's Android or iOS applications and simplify your document-centric processes today.

The easiest way to modify and electronically sign Form 203 effortlessly

- Locate Form 203 and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize key sections of the documents or obscure sensitive information using tools specifically designed by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign Form 203 and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 203 24592981

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 203 and how can airSlate SignNow help with it?

Form 203 is a specific document used in various industries for important transactions. airSlate SignNow simplifies the process of completing and managing form 203 by allowing users to eSign and send documents seamlessly. With our platform, you can ensure quick turnaround times and maintain compliance with digital signatures.

-

What are the main features of airSlate SignNow for handling form 203?

airSlate SignNow offers features like customizable templates, automated workflows, and multi-party signing, making it easy to manage form 203. The platform also supports mobile access, which allows users to sign documents on-the-go. This ensures that your team can efficiently process form 203 regardless of their location.

-

Is there a cost associated with using airSlate SignNow for form 203?

Yes, airSlate SignNow offers various pricing plans suited to different business needs, starting with a free trial for new users. Depending on your requirements for form 203, you can choose between basic and advanced plans that provide additional features. This cost-effective solution ensures that you only pay for what you need.

-

Can I integrate airSlate SignNow with other applications when using form 203?

Absolutely, airSlate SignNow supports integrations with popular business applications, making it easy to manage form 203 alongside your existing tools. Integrations with platforms like Salesforce, Google Drive, and others ensure a seamless workflow. This connectivity helps streamline the management of your documents and enhances productivity.

-

What are the benefits of using airSlate SignNow for form 203?

Using airSlate SignNow for form 203 offers numerous benefits, including increased efficiency, improved document security, and faster turnaround times. The platform's user-friendly interface makes it accessible for all team members, enhancing collaboration and reducing errors. Moreover, the ability to track document status ensures that you stay informed throughout the signing process.

-

How secure is airSlate SignNow when managing form 203?

Security is a top priority for airSlate SignNow, especially when processing sensitive documents like form 203. The platform employs bank-level encryption and multi-factor authentication to protect your data. Additionally, our compliance with eIDAS and HIPAA regulations ensures that you can trust the security of your documents.

-

How can I get started with airSlate SignNow for form 203?

Getting started with airSlate SignNow for form 203 is simple. You can sign up for a free trial on our website, where you will receive step-by-step guidance. Once set up, you'll be able to create, send, and eSign form 203 documents in minutes, benefiting from our intuitive design.

Get more for Form 203

- Diabetes emergency action plan template form

- Vanbreda international claim form

- Human japanese pdf form

- Escreen specimen result certificate form

- Bb for baby paper craft family phonics craft worksheets form

- Registration form cvsu

- Form w 4mn minnesota withholding allowance

- Minnesota form ig260 nonadmitted insurance premium

Find out other Form 203

- eSign Minnesota Banking LLC Operating Agreement Online

- How Do I eSign Mississippi Banking Living Will

- eSign New Jersey Banking Claim Mobile

- eSign New York Banking Promissory Note Template Now

- eSign Ohio Banking LLC Operating Agreement Now

- Sign Maryland Courts Quitclaim Deed Free

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself