Form W 4MN, Minnesota Withholding Allowance 2024

What is the Form W-4MN, Minnesota Withholding Allowance

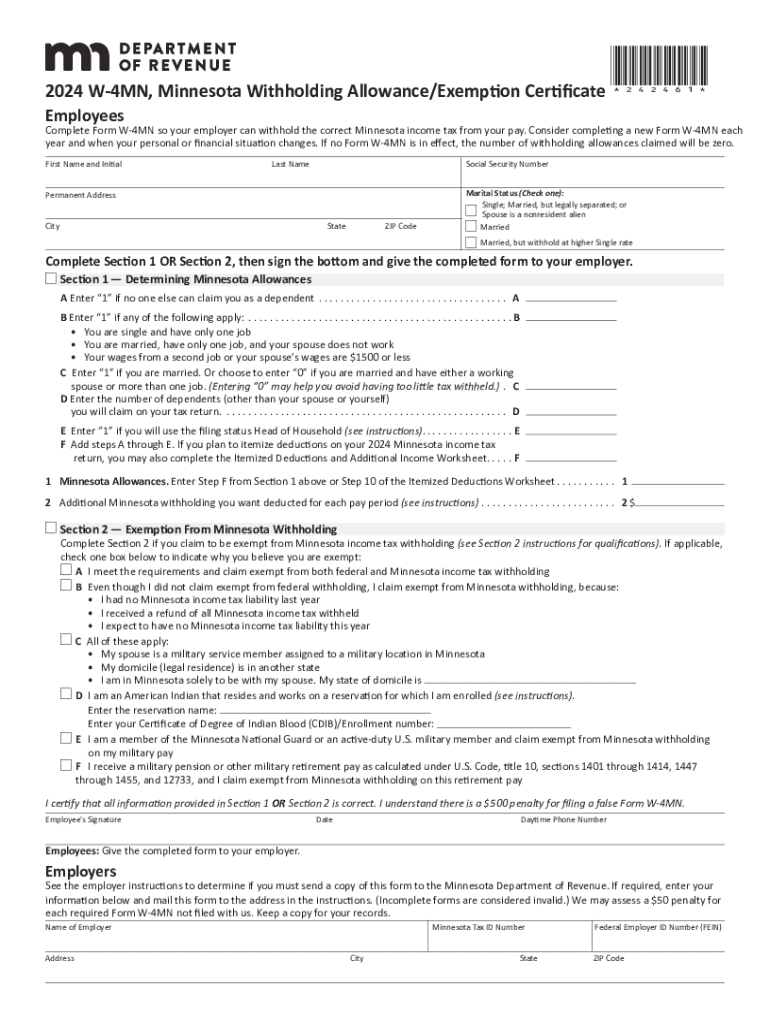

The Form W-4MN is a state-specific withholding allowance certificate used in Minnesota. It allows employees to inform their employers of the number of allowances they are claiming for state income tax withholding. This form is essential for ensuring that the correct amount of state tax is withheld from an employee's paycheck, helping to avoid underpayment or overpayment of taxes throughout the year. The W-4MN is particularly relevant for individuals who have unique tax situations, such as multiple jobs or dependents, which may affect their withholding amounts.

How to obtain the Form W-4MN, Minnesota Withholding Allowance

Obtaining the Form W-4MN is straightforward. The form can be downloaded directly from the Minnesota Department of Revenue's website as a PDF. Additionally, employers may provide copies of the form to their employees upon request. It is important to ensure that you are using the most current version of the W-4MN, as tax laws and regulations can change annually. For the 2024 tax year, you should specifically look for the 2024 W-4MN form to ensure compliance with the latest withholding requirements.

Steps to complete the Form W-4MN, Minnesota Withholding Allowance

Completing the Form W-4MN involves several key steps:

- Begin by entering your personal information, including your name, address, and Social Security number.

- Indicate your filing status, which can be single, married, or head of household.

- Claim the number of allowances you are entitled to based on your personal and financial situation. This includes considering dependents and other factors that may affect your tax liability.

- If applicable, you can also specify any additional amount you want withheld from your paycheck.

- Finally, sign and date the form before submitting it to your employer.

Key elements of the Form W-4MN, Minnesota Withholding Allowance

The Form W-4MN includes several important elements that employees must understand:

- Personal Information: This section requires basic details about the employee, including name, address, and Social Security number.

- Filing Status: Employees must select their filing status, which impacts the tax rate applied to their income.

- Allowances: The form allows individuals to claim allowances based on their tax situation, which directly affects the amount withheld from their paychecks.

- Additional Withholding: Employees have the option to request additional withholding if they anticipate owing more taxes at the end of the year.

State-specific rules for the Form W-4MN, Minnesota Withholding Allowance

In Minnesota, there are specific rules regarding the use of the W-4MN. Employees must ensure that the number of allowances claimed accurately reflects their tax situation to avoid penalties for under-withholding. Additionally, Minnesota allows for certain exemptions that can be claimed on the form, which may include individuals with low income or those who qualify for specific tax credits. It is important to review the Minnesota Department of Revenue's guidelines to ensure compliance with state tax laws.

Filing Deadlines / Important Dates

Filing deadlines for the Form W-4MN coincide with the start of the tax year. Employees should submit their completed W-4MN to their employer as soon as they begin employment or when their tax situation changes. It is advisable to review and update the form at least annually or whenever significant life changes occur, such as marriage, divorce, or the birth of a child. Keeping the form current helps ensure that the correct amount of state tax is withheld throughout the year.

Create this form in 5 minutes or less

Find and fill out the correct form w 4mn minnesota withholding allowance

Create this form in 5 minutes!

How to create an eSignature for the form w 4mn minnesota withholding allowance

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the w 4mn form and how can airSlate SignNow help?

The w 4mn form is a tax document used for withholding allowances. airSlate SignNow simplifies the process of filling out and signing the w 4mn form electronically, ensuring that your documents are securely stored and easily accessible.

-

How much does airSlate SignNow cost for managing w 4mn forms?

airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes. With our cost-effective solution, you can manage your w 4mn forms efficiently without breaking the bank, ensuring you get the best value for your investment.

-

What features does airSlate SignNow offer for w 4mn document management?

airSlate SignNow provides a range of features for managing w 4mn documents, including customizable templates, secure eSigning, and real-time tracking. These features streamline the process, making it easier for businesses to handle their tax documents.

-

Can I integrate airSlate SignNow with other software for w 4mn processing?

Yes, airSlate SignNow seamlessly integrates with various software applications, enhancing your workflow for w 4mn processing. This integration allows you to connect with tools you already use, making document management even more efficient.

-

What are the benefits of using airSlate SignNow for w 4mn forms?

Using airSlate SignNow for your w 4mn forms offers numerous benefits, including increased efficiency, reduced paper usage, and enhanced security. Our platform ensures that your documents are processed quickly and securely, allowing you to focus on your business.

-

Is airSlate SignNow user-friendly for completing w 4mn forms?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for anyone to complete w 4mn forms. Our intuitive interface guides users through the process, ensuring that even those with minimal tech skills can navigate it effortlessly.

-

How does airSlate SignNow ensure the security of my w 4mn documents?

airSlate SignNow prioritizes the security of your w 4mn documents by employing advanced encryption and secure storage solutions. We adhere to industry standards to protect your sensitive information, giving you peace of mind while managing your documents.

Get more for Form W 4MN, Minnesota Withholding Allowance

- New hampshire note form

- New hampshire note 497318845 form

- Notice of option for recording new hampshire form

- Life documents planning package including will power of attorney and living will new hampshire form

- General durable power of attorney for property and finances or financial effective upon disability new hampshire form

- Essential legal life documents for baby boomers new hampshire form

- New hampshire general form

- Revocation of general durable power of attorney new hampshire form

Find out other Form W 4MN, Minnesota Withholding Allowance

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement