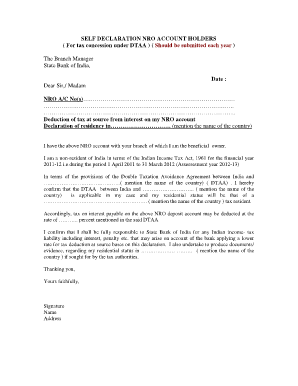

Dtaa Form

What is the DTAA Form

The DTAA form, or Double Taxation Avoidance Agreement form, is a document used to claim benefits under tax treaties between the United States and other countries. This form is essential for individuals or businesses that earn income in foreign jurisdictions while being residents of the U.S. It helps prevent double taxation on the same income, ensuring that taxpayers do not pay tax on the same earnings in both countries.

How to Use the DTAA Form

Using the DTAA form involves several steps to ensure compliance with tax regulations. First, determine if you qualify for benefits under a specific tax treaty. Next, accurately fill out the form, providing necessary details such as your personal information, the nature of the income, and the relevant tax treaty provisions. Finally, submit the completed form to the appropriate tax authority, which may vary depending on the income source and treaty specifics.

Steps to Complete the DTAA Form

Completing the DTAA form requires careful attention to detail. Here are the steps to follow:

- Gather necessary documentation, including identification and tax information.

- Identify the specific tax treaty that applies to your situation.

- Fill out the DTAA form, ensuring all personal and income details are accurate.

- Review the form for completeness and correctness.

- Submit the form to the relevant tax authority or attach it to your tax return.

Legal Use of the DTAA Form

The legal use of the DTAA form hinges on compliance with both U.S. tax laws and the specific provisions of the applicable tax treaty. Properly completing and submitting the form can provide significant tax benefits, such as reduced withholding rates on income earned abroad. It is essential to understand the legal implications and ensure that all information provided is truthful and accurate to avoid penalties.

Required Documents

To complete the DTAA form, you will need several documents, including:

- A valid identification document, such as a passport or driver's license.

- Proof of residency in the United States, like a utility bill or bank statement.

- Documentation of income earned in the foreign country, such as pay stubs or tax statements.

- Any additional forms or schedules required by the specific tax treaty.

Filing Deadlines / Important Dates

Filing deadlines for the DTAA form can vary based on the type of income and the tax treaty in question. Generally, it is advisable to submit the form along with your tax return to ensure you claim the appropriate benefits. Be aware of specific deadlines related to foreign income reporting, as failing to meet these deadlines can result in penalties or the loss of treaty benefits.

Quick guide on how to complete dtaa form

Effortlessly prepare Dtaa Form on any device

Digital document management has gained signNow traction among organizations and individuals. It serves as an ideal environmentally-friendly alternative to conventional printed and signed paperwork, allowing you to obtain the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Dtaa Form on any platform with airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The easiest way to alter and electronically sign Dtaa Form without hassle

- Find Dtaa Form and click on Get Form to begin.

- Make use of the tools we offer to complete your document.

- Emphasize relevant sections of your documents or obscure sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Dtaa Form to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the dtaa form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a DTAA form and why is it important?

A DTAA form refers to the Double Taxation Avoidance Agreement form, which helps prevent the same income from being taxed in two different countries. Its importance lies in ensuring that individuals and businesses can efficiently manage their tax liabilities while conducting cross-border transactions.

-

How does airSlate SignNow facilitate the signing of a DTAA form?

airSlate SignNow makes it easy to electronically sign a DTAA form with just a few clicks. Our platform allows users to upload, share, and sign documents securely, ensuring that all parties can quickly finalize their agreements without any hassle.

-

What are the pricing options for using airSlate SignNow to manage a DTAA form?

airSlate SignNow offers flexible pricing plans that cater to various business needs, including the management of DTAA forms. Pricing starts at a competitive rate, and users can choose from monthly or annual subscriptions, with additional features available for higher-tier plans.

-

Can I integrate airSlate SignNow with other applications for handling DTAA forms?

Yes, airSlate SignNow easily integrates with numerous applications, allowing you to streamline your workflow for handling DTAA forms. This includes popular platforms such as CRM systems, cloud storage services, and productivity tools, enhancing your overall document management experience.

-

What features does airSlate SignNow offer for completing a DTAA form?

airSlate SignNow provides several features to simplify the completion of a DTAA form, including templates, custom branding, and automated reminders. These capabilities ensure that you can complete your documents quickly and efficiently, reducing the time spent on paperwork.

-

Is airSlate SignNow secure for signing and storing DTAA forms?

Absolutely! airSlate SignNow employs top-tier security measures, including encryption and secure cloud storage, to protect your DTAA forms and sensitive information. You can trust our platform to keep your documents safe and ensure compliance with legal standards.

-

How can airSlate SignNow benefit businesses needing to manage multiple DTAA forms?

For businesses dealing with multiple DTAA forms, airSlate SignNow offers streamlined document management and collaboration tools. This enables teams to track the status of each form, send reminders, and collaborate in real-time, enhancing efficiency and productivity.

Get more for Dtaa Form

Find out other Dtaa Form

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document

- Can I Electronic signature Minnesota Insurance PDF

- How Do I Electronic signature Minnesota Insurance Document

- How To Electronic signature Missouri Insurance Form

- How Can I Electronic signature New Jersey Insurance Document

- How To Electronic signature Indiana High Tech Document

- How Do I Electronic signature Indiana High Tech Document

- How Can I Electronic signature Ohio Insurance Document

- Can I Electronic signature South Dakota Insurance PPT

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document