Form RP 6704 C1 Joint Statement of School Tax Levy for the

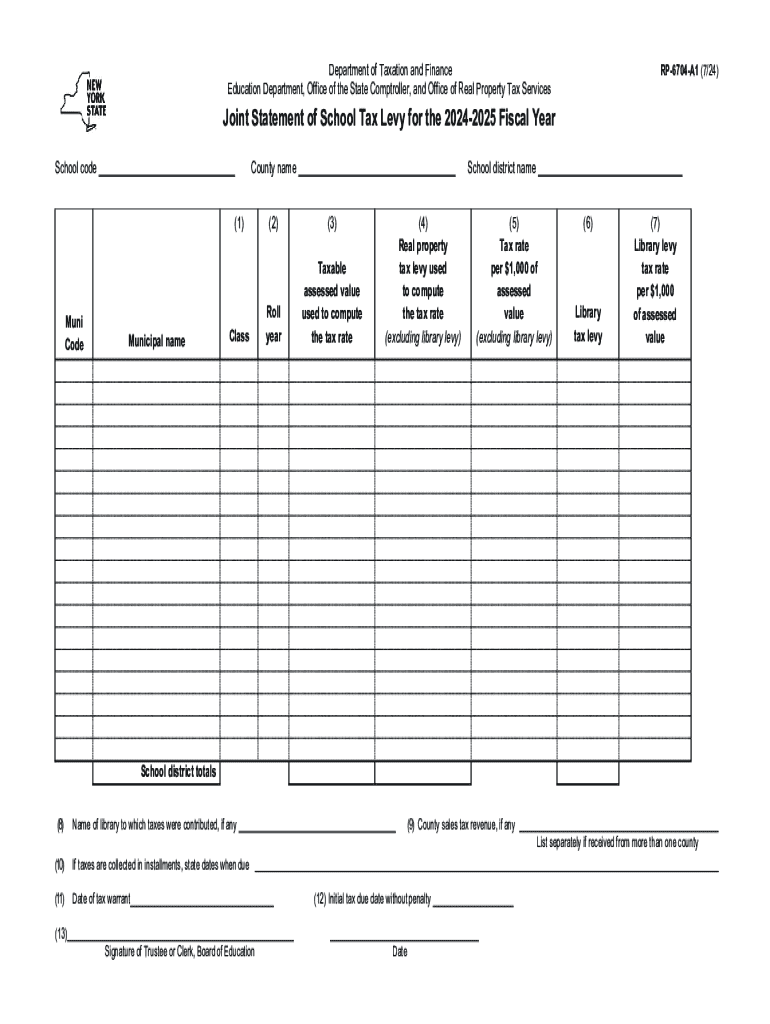

What is the RP 6704 A1 Form?

The RP 6704 A1 form, also known as the Joint Statement of School Tax Levy, is a document used in New York State to report the school tax levy for a property. This form is essential for property owners who need to provide accurate information regarding their school tax obligations. It helps ensure that the correct amount of school taxes is assessed and collected, reflecting any changes in ownership or property status.

How to Use the RP 6704 A1 Form

To use the RP 6704 A1 form, property owners must complete it with accurate details about their property and the applicable school tax levy. The form requires information such as the property address, owner details, and the specific school district. Once filled out, the form should be submitted to the appropriate local tax authority to ensure proper processing.

Steps to Complete the RP 6704 A1 Form

Completing the RP 6704 A1 form involves several key steps:

- Gather necessary information, including property details and owner information.

- Fill in the required fields on the form, ensuring accuracy.

- Review the completed form for any errors or omissions.

- Submit the form to the local tax authority by the specified deadline.

Key Elements of the RP 6704 A1 Form

The RP 6704 A1 form includes several important elements that must be accurately reported:

- Property identification details, including tax map number.

- Owner's name and contact information.

- School district information.

- Details regarding any exemptions or special assessments.

Legal Use of the RP 6704 A1 Form

The legal use of the RP 6704 A1 form is crucial for compliance with New York State tax laws. Submitting this form accurately ensures that property owners meet their tax obligations and helps avoid penalties associated with incorrect reporting. It is important to follow the guidelines set forth by the local tax authority when using this form.

Filing Deadlines for the RP 6704 A1 Form

Filing deadlines for the RP 6704 A1 form can vary depending on the local jurisdiction. Typically, property owners should submit the form by the deadline established by the local tax authority, often aligned with the annual tax assessment cycle. Staying informed about these deadlines is essential to avoid any potential penalties or issues with tax assessments.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form rp 6704 c1 joint statement of school tax levy for the

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the rp 6704 a1 form?

The rp 6704 a1 form is a specific document used for various administrative purposes. It is essential for businesses that need to comply with regulatory requirements. Understanding how to properly fill out and submit the rp 6704 a1 form can streamline your operations.

-

How can airSlate SignNow help with the rp 6704 a1 form?

airSlate SignNow provides an easy-to-use platform for sending and eSigning the rp 6704 a1 form. With our solution, you can quickly prepare, send, and track the document, ensuring that all parties can sign it efficiently. This saves time and reduces the risk of errors.

-

Is there a cost associated with using airSlate SignNow for the rp 6704 a1 form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Our plans are designed to be cost-effective, allowing you to manage the rp 6704 a1 form and other documents without breaking the bank. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for the rp 6704 a1 form?

airSlate SignNow includes features such as customizable templates, real-time tracking, and secure cloud storage for the rp 6704 a1 form. These features enhance the signing experience and ensure that your documents are handled securely and efficiently. You can also integrate with other tools to streamline your workflow.

-

Can I integrate airSlate SignNow with other applications for the rp 6704 a1 form?

Absolutely! airSlate SignNow supports integrations with various applications, making it easy to manage the rp 6704 a1 form alongside your existing tools. Whether you use CRM systems, project management software, or other platforms, our integrations help you maintain a seamless workflow.

-

What are the benefits of using airSlate SignNow for the rp 6704 a1 form?

Using airSlate SignNow for the rp 6704 a1 form offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform allows you to manage documents digitally, which can signNowly speed up the signing process and improve overall productivity.

-

Is airSlate SignNow secure for handling the rp 6704 a1 form?

Yes, airSlate SignNow prioritizes security and compliance when handling the rp 6704 a1 form. We use advanced encryption and secure storage solutions to protect your documents. You can trust that your sensitive information is safe with us.

Get more for Form RP 6704 C1 Joint Statement Of School Tax Levy For The

- Release supervision form

- Order court form

- Order for reconfinement after revocation of extended supervision wisconsin form

- Bifurcated sentence form

- Referral by department of corrections to sentencing court section 3021139g geriatric terminal wisconsin form

- Sentence modification form

- Wisconsin sentence adjustment form

- Wisconsin district attorney form

Find out other Form RP 6704 C1 Joint Statement Of School Tax Levy For The

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer