Rsa Retail Bonds Application Form

What is the rsa retail bonds application form

The rsa retail bonds application form is a crucial document for individuals looking to invest in retail bonds offered by the RSA. This form serves as a formal request to purchase bonds, allowing investors to benefit from interest rates that are typically more attractive than traditional savings accounts. By completing this application, individuals can secure their investment in retail bonds, which are designed to provide a stable return over a specified period.

Steps to complete the rsa retail bonds application form

Completing the rsa retail bonds application form involves several straightforward steps:

- Gather necessary personal information, including your name, address, and Social Security number.

- Provide details about your investment preferences, such as the amount you wish to invest and the term of the bonds.

- Review the terms and conditions associated with the retail bonds, ensuring you understand the interest rates and withdrawal penalties.

- Sign and date the application form to validate your request.

- Submit the completed form through the designated method, whether online, by mail, or in person.

Legal use of the rsa retail bonds application form

The rsa retail bonds application form must be used in accordance with applicable laws and regulations. It is essential that the form is filled out accurately and honestly, as any discrepancies may lead to legal complications or denial of the application. The form is designed to comply with the Electronic Signatures in Global and National Commerce (ESIGN) Act, ensuring that electronically signed documents are legally binding.

Required documents

When completing the rsa retail bonds application form, certain documents may be required to verify your identity and investment eligibility. These documents typically include:

- A government-issued identification, such as a driver's license or passport.

- Proof of address, which can be a utility bill or bank statement.

- Any financial documents that demonstrate your ability to invest, such as income statements or tax returns.

Form submission methods

The rsa retail bonds application form can be submitted through various methods, providing flexibility for investors. Common submission methods include:

- Online submission through a secure portal, which is often the fastest option.

- Mailing the completed form to the designated address, ensuring it is sent via a reliable service.

- In-person submission at a local office or designated financial institution, allowing for immediate confirmation of receipt.

Eligibility criteria

To successfully complete the rsa retail bonds application form, applicants must meet specific eligibility criteria. Generally, these criteria include:

- Being a legal resident of the United States.

- Meeting the minimum investment amount, which varies by bond type.

- Having a valid Social Security number or taxpayer identification number.

Quick guide on how to complete rsa retail bonds application form

Handle Rsa Retail Bonds Application Form seamlessly on any gadget

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, edit, and eSign your documents quickly without interruptions. Manage Rsa Retail Bonds Application Form on any gadget with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and eSign Rsa Retail Bonds Application Form with ease

- Locate Rsa Retail Bonds Application Form and click Get Form to begin.

- Use the tools we offer to complete your document.

- Highlight necessary portions of your documents or obscure confidential information with tools specifically provided by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Choose how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Rsa Retail Bonds Application Form and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the rsa retail bonds application form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

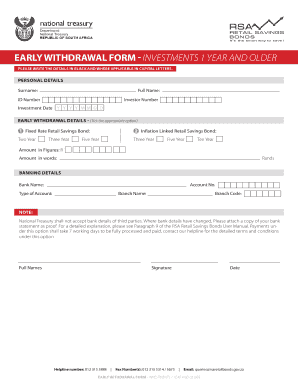

What is the rsa retail bonds early withdrawal form?

The rsa retail bonds early withdrawal form is a document that allows bondholders to request an early redemption of their retail bonds. By completing this form, investors can facilitate the process of accessing their funds before the maturity date, ensuring ease and efficiency.

-

How can I access the rsa retail bonds early withdrawal form?

You can access the rsa retail bonds early withdrawal form directly through your financial institution's website or customer service portal. Many institutions provide downloadable forms, or you may request a copy via email or phone to ensure convenience.

-

What are the fees associated with the rsa retail bonds early withdrawal form?

Fees for processing the rsa retail bonds early withdrawal form can vary by institution. It is essential to review your specific bond terms or contact customer support to understand any potential charges for early withdrawal.

-

What information do I need to complete the rsa retail bonds early withdrawal form?

To complete the rsa retail bonds early withdrawal form, you typically need to provide your personal identification details, bond serial numbers, and the amount you wish to withdraw. Double-checking your information will help to avoid delays in processing.

-

What are the benefits of using the rsa retail bonds early withdrawal form?

The rsa retail bonds early withdrawal form offers several benefits, including quick access to your invested funds and the ability to manage your financial liquidity more effectively. This form is designed to streamline the withdrawal process, making it user-friendly and efficient.

-

How long does it take to process the rsa retail bonds early withdrawal form?

Processing times for the rsa retail bonds early withdrawal form can vary, generally taking anywhere from a few business days to several weeks. It’s advisable to check with your financial institution for their specific timelines to ensure you have an accurate expectation.

-

Are there any restrictions when using the rsa retail bonds early withdrawal form?

Yes, there may be certain restrictions when using the rsa retail bonds early withdrawal form. These can include penalties for early withdrawal or limits on the amount that can be accessed before maturity, so it's crucial to review your bond's terms carefully.

Get more for Rsa Retail Bonds Application Form

Find out other Rsa Retail Bonds Application Form

- eSignature New Mexico Doctors Lease Termination Letter Fast

- eSignature New Mexico Doctors Business Associate Agreement Later

- eSignature North Carolina Doctors Executive Summary Template Free

- eSignature North Dakota Doctors Bill Of Lading Online

- eSignature Delaware Finance & Tax Accounting Job Description Template Fast

- How To eSignature Kentucky Government Warranty Deed

- eSignature Mississippi Government Limited Power Of Attorney Myself

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself