Ifta Quarterly Report Form

What is the IFTA Quarterly Report Form

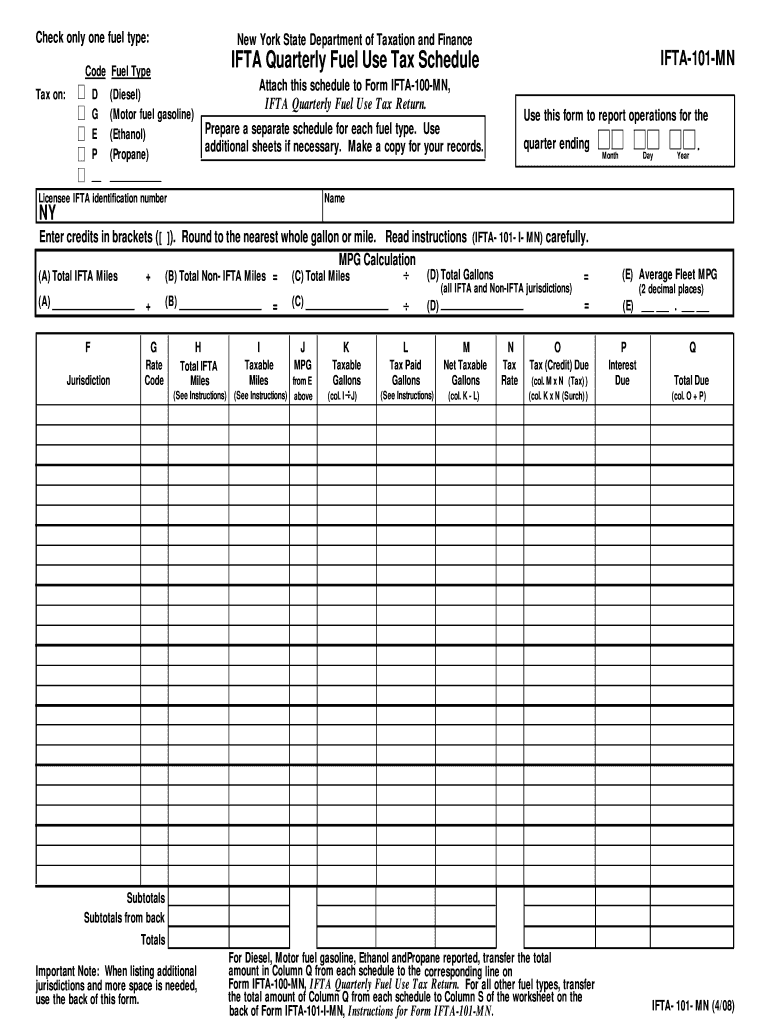

The International Fuel Tax Agreement (IFTA) Quarterly Report Form is a crucial document for commercial motor carriers operating in multiple jurisdictions. This form helps track fuel use and calculate the fuel taxes owed to each state or province where the vehicle operates. The IFTA report example typically includes details such as the total miles driven, fuel purchased, and the jurisdictions in which the vehicle traveled. Accurate completion of this form ensures compliance with state regulations and helps avoid penalties.

Steps to Complete the IFTA Quarterly Report Form

Completing the IFTA Quarterly Report Form involves several key steps:

- Gather all necessary data, including total miles driven in each jurisdiction and the amount of fuel purchased.

- Fill out the form accurately, ensuring all figures are correct and reflect the data collected.

- Calculate the total tax owed based on the fuel consumption and mileage in each jurisdiction.

- Review the completed form for any errors or omissions before submission.

- Submit the form by the specified deadline to avoid late fees.

Key Elements of the IFTA Quarterly Report Form

The IFTA Quarterly Report Form consists of several key elements that must be accurately reported:

- Jurisdiction: The states or provinces where the vehicle operated.

- Total miles: The total distance traveled in each jurisdiction.

- Fuel purchased: The amount of fuel bought in each jurisdiction.

- Tax calculation: The formula used to determine the tax owed based on fuel consumption.

Filing Deadlines / Important Dates

Filing deadlines for the IFTA Quarterly Report Form are typically set on a quarterly basis. It is essential to be aware of these dates to ensure timely submission. Generally, the deadlines are as follows:

- First quarter: April 30

- Second quarter: July 31

- Third quarter: October 31

- Fourth quarter: January 31

Form Submission Methods (Online / Mail / In-Person)

The IFTA Quarterly Report Form can be submitted through various methods, providing flexibility for carriers:

- Online: Many jurisdictions offer online submission through their official websites, allowing for quick and efficient filing.

- Mail: The form can be printed and mailed to the appropriate state agency.

- In-Person: Some jurisdictions may allow for in-person submissions at designated locations.

Penalties for Non-Compliance

Failing to file the IFTA Quarterly Report Form on time or submitting inaccurate information can result in penalties. Common penalties include:

- Late filing fees, which vary by jurisdiction.

- Interest on unpaid taxes, which accumulates over time.

- Potential audits or increased scrutiny from state agencies.

Quick guide on how to complete ifta quarterly report form

Complete Ifta Quarterly Report Form effortlessly on any device

Web-based document management has become widely embraced by businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to access the necessary form and securely archive it online. airSlate SignNow provides all the tools needed to create, modify, and eSign your documents swiftly without interruptions. Manage Ifta Quarterly Report Form on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric task today.

The easiest way to modify and eSign Ifta Quarterly Report Form with minimal effort

- Find Ifta Quarterly Report Form and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of the documents or conceal sensitive information with tools provided by airSlate SignNow specifically for this purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose your preferred delivery method for your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you select. Edit and eSign Ifta Quarterly Report Form and ensure outstanding communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ifta quarterly report form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an IFTA report example?

An IFTA report example illustrates how fuel tax reporting works under the International Fuel Tax Agreement. It includes details such as miles traveled, fuel purchased, and taxes due for each participating state. Understanding this example can help ensure compliance and accurate reporting.

-

How can airSlate SignNow assist with IFTA reports?

airSlate SignNow simplifies the submission of your IFTA report by allowing you to eSign and send documents efficiently. With customizable templates, you can create and store IFTA report examples that fit your business's needs. This streamlines the entire reporting process.

-

Are there templates available for IFTA reports in airSlate SignNow?

Yes, airSlate SignNow offers customizable templates for IFTA reports which can serve as your IFTA report examples. These templates are designed to simplify the process, ensuring you include all necessary information while saving time. You can easily edit and manage them within the platform.

-

What pricing plans does airSlate SignNow offer for IFTA report management?

airSlate SignNow offers various pricing plans tailored to different business needs, including options for those focused on IFTA report management. Each plan provides a range of features, including templates and integrations for efficient reporting. You can choose a plan that best suits your volume of documents.

-

Can airSlate SignNow integrate with other accounting software for IFTA reporting?

Absolutely! airSlate SignNow seamlessly integrates with many popular accounting software platforms. This allows users to automatically populate their IFTA report examples with data from their existing systems, enhancing accuracy and reducing manual input.

-

What are the benefits of using airSlate SignNow for IFTA reports?

Using airSlate SignNow for IFTA reports offers numerous benefits, including increased efficiency, reduced errors, and improved compliance. It provides an easy-to-use interface for managing your IFTA report examples, enabling quick document turnaround. This helps businesses stay organized and compliant with tax regulations.

-

How secure is the information in my IFTA report example on airSlate SignNow?

airSlate SignNow prioritizes the security of your documents, including IFTA report examples. The platform uses robust encryption and secure storage solutions to protect sensitive data. With industry-standard security measures in place, you can trust your information remains confidential.

Get more for Ifta Quarterly Report Form

Find out other Ifta Quarterly Report Form

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF