Irs Complaint Form Online

What is the IRS Complaint Form Online

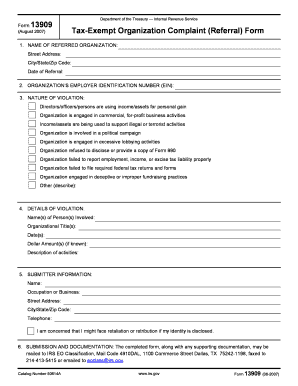

The IRS complaint form is a crucial document used by individuals to report issues related to tax matters, including fraud, misconduct, or unfair treatment by the IRS. This form allows taxpayers to express their concerns directly to the IRS, ensuring that their grievances are formally recorded and addressed. The online version of the IRS complaint form streamlines the submission process, making it easier for users to fill out and submit their complaints electronically. By utilizing the online format, taxpayers can save time and ensure their complaints are submitted promptly.

How to Use the IRS Complaint Form Online

Using the IRS complaint form online involves a straightforward process. First, access the form through the IRS website or a trusted digital platform. Once you have the form, carefully read the instructions provided. Fill in the required fields, including personal information and details about your complaint. It is essential to provide clear and concise information to facilitate the review process. After completing the form, review your entries for accuracy before submitting it electronically. This method ensures that your complaint reaches the appropriate IRS department efficiently.

Steps to Complete the IRS Complaint Form Online

Completing the IRS complaint form online can be broken down into several key steps:

- Access the IRS complaint form through a secure online platform.

- Read the instructions thoroughly to understand the requirements.

- Fill in your personal information, including your name, address, and contact details.

- Provide a detailed description of your complaint, including relevant dates and circumstances.

- Review your entries for accuracy and completeness.

- Submit the form electronically and save a copy for your records.

Legal Use of the IRS Complaint Form Online

The IRS complaint form online is legally recognized as a valid means of reporting tax-related issues. To ensure its legal standing, users must adhere to specific guidelines, including providing truthful and accurate information. The form must be signed electronically, which confirms the authenticity of the complaint. By following the legal requirements set forth by the IRS, taxpayers can ensure that their complaints are taken seriously and addressed appropriately.

Key Elements of the IRS Complaint Form Online

Several key elements are essential when filling out the IRS complaint form online:

- Personal Information: Accurate details about the complainant, including name, address, and contact information.

- Complaint Details: A thorough description of the issue, including specific incidents and relevant dates.

- Supporting Documentation: Any additional documents that may support the complaint should be referenced or attached.

- Signature: An electronic signature is required to validate the submission.

Form Submission Methods

The IRS complaint form can be submitted through various methods, including online, by mail, or in person. The online submission is the most efficient way, allowing for immediate processing. If submitting by mail, ensure that the form is sent to the correct IRS address and is postmarked by the deadline. In-person submissions can be made at designated IRS offices, where assistance may be available if needed.

Quick guide on how to complete irs complaint form online

Complete Irs Complaint Form Online effortlessly on any device

Managing documents online has gained popularity among businesses and individuals. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, alter, and eSign your documents quickly without delays. Handle Irs Complaint Form Online on any platform with airSlate SignNow Android or iOS applications and enhance any document-focused operation today.

The easiest way to modify and eSign Irs Complaint Form Online without any hassle

- Obtain Irs Complaint Form Online and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your revisions.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about misplaced files, tedious form searching, or mistakes that require printing new copies of documents. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Irs Complaint Form Online and ensure excellent communication at any point in your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the irs complaint form online

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an IRS complaint form?

An IRS complaint form is a document that taxpayers can use to report issues or concerns related to tax professionals or tax-related services. It's essential for ensuring accountability and addressing any misconduct within the tax preparation community.

-

How can airSlate SignNow help with the IRS complaint form process?

With airSlate SignNow, you can easily create, send, and eSign IRS complaint forms efficiently. Our user-friendly platform ensures that your documents are processed quickly and securely, allowing you to focus on resolving your concerns without unnecessary delays.

-

Is there a cost associated with using airSlate SignNow for IRS complaint forms?

airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes. By choosing our service, you gain access to a cost-effective solution for managing IRS complaint forms and other essential documents, all backed by robust features.

-

What features does airSlate SignNow offer for IRS complaint forms?

airSlate SignNow includes features such as customizable templates, electronic signatures, and real-time document tracking for IRS complaint forms. These tools allow you to streamline your complaint process and ensure your documents are handled promptly and accurately.

-

Can I integrate airSlate SignNow with other applications for IRS complaint forms?

Yes, airSlate SignNow offers seamless integrations with various applications and tools, enhancing your workflow for IRS complaint forms. Whether you're using CRM systems, document storage services, or collaboration tools, our platform can easily connect to keep your processes efficient.

-

What are the benefits of using airSlate SignNow for IRS complaint forms?

Using airSlate SignNow for IRS complaint forms provides numerous benefits, including increased efficiency, reduced turnaround times, and enhanced security. Our platform ensures your sensitive information is protected while simplifying the submission process for your complaint.

-

How secure is airSlate SignNow when handling IRS complaint forms?

Security is a top priority at airSlate SignNow. We employ advanced encryption technologies and strict compliance measures to ensure your IRS complaint forms are handled securely, protecting your sensitive data throughout the document management lifecycle.

Get more for Irs Complaint Form Online

Find out other Irs Complaint Form Online

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form