Illinois Ptax 230 Form

What is the Illinois Ptax 230 Form

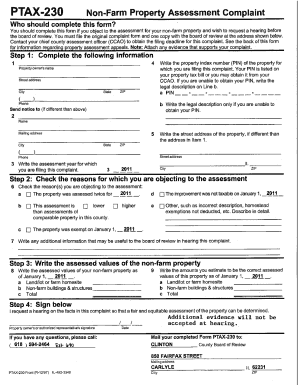

The Illinois Ptax 230 form, officially known as the Property Tax Assessment Complaint Form, is utilized by property owners in Illinois to contest their property tax assessments. This form allows individuals to formally challenge the assessed value of their property, which can significantly affect their property tax liability. By filing this form, taxpayers seek a review of their property’s valuation by the local Board of Review or the Illinois Property Tax Appeal Board.

How to use the Illinois Ptax 230 Form

Using the Illinois Ptax 230 form involves several key steps. First, property owners must accurately fill out the form, providing essential information such as their property address, the current assessed value, and the reasons for contesting the assessment. It is crucial to include supporting documentation, such as recent property appraisals or comparable property assessments, to strengthen the case. Once completed, the form must be submitted to the appropriate local authority within the designated filing period.

Steps to complete the Illinois Ptax 230 Form

Completing the Illinois Ptax 230 form requires careful attention to detail. Begin by gathering all necessary information regarding your property and its assessment. Follow these steps:

- Obtain the form from the local assessor’s office or download it from the official state website.

- Fill in your personal information, including your name, address, and contact details.

- Provide the property identification number and the assessed value as stated on your tax bill.

- Clearly state the grounds for your complaint, such as overvaluation or unequal assessment.

- Attach any supporting documents that substantiate your claims.

- Review the completed form for accuracy before submission.

Legal use of the Illinois Ptax 230 Form

The Illinois Ptax 230 form is legally recognized as a formal mechanism for property owners to appeal their property tax assessments. To ensure its legal validity, it must be filled out correctly and submitted within the specified deadlines set by local authorities. The form adheres to state laws governing property tax assessments and appeals, making it an essential tool for taxpayers seeking to protect their financial interests.

Form Submission Methods

Property owners have several options for submitting the Illinois Ptax 230 form. The form can be submitted online through the local Board of Review's website, mailed directly to the appropriate office, or delivered in person. Each method has its own benefits, such as immediate confirmation of receipt for online submissions or the ability to discuss your case directly with officials when submitting in person. It is important to choose the method that best suits your needs and to keep a copy of the submitted form for your records.

Eligibility Criteria

To file the Illinois Ptax 230 form, property owners must meet specific eligibility criteria. Primarily, the individual must be the owner of the property in question and must be contesting the assessed value as stated on their property tax bill. Additionally, the property must be located in an area where the local Board of Review or the Illinois Property Tax Appeal Board has jurisdiction. Understanding these criteria is essential to ensure that your appeal is valid and can be processed effectively.

Quick guide on how to complete illinois ptax 230 form

Effortlessly Prepare Illinois Ptax 230 Form on Any Device

Managing documents online has gained tremendous popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, as you can easily locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly and without delays. Handle Illinois Ptax 230 Form on any gadget with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to Adjust and Electronically Sign Illinois Ptax 230 Form with Ease

- Locate Illinois Ptax 230 Form and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Mark important sections of the documents or conceal sensitive details with tools that airSlate SignNow provides specifically for that intention.

- Generate your signature using the Sign tool, which only takes a few seconds and carries the same legal validity as a standard wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Choose how you wish to send your form, either via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your chosen device. Edit and electronically sign Illinois Ptax 230 Form to maintain optimal communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the illinois ptax 230 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Illinois PTAX 230 Form?

The Illinois PTAX 230 Form is used for property tax assessment in the state of Illinois. It allows property owners to report changes in property use or ownership, facilitating accurate tax assessments. Understanding this form is crucial for ensuring compliance with Illinois tax regulations.

-

How can airSlate SignNow help with the Illinois PTAX 230 Form?

airSlate SignNow provides a streamlined platform for electronically signing and sending the Illinois PTAX 230 Form. By using our solution, you can easily manage and store your tax documents securely. This not only saves time but also minimizes the chances of errors in the process.

-

Is there a cost associated with using airSlate SignNow for the Illinois PTAX 230 Form?

Yes, airSlate SignNow offers various pricing plans tailored to meet different business needs. Whether you are a small business or a large enterprise, you can find a cost-effective solution that includes features for managing the Illinois PTAX 230 Form. We aim to provide great value for our users.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow provides a comprehensive set of features for document management, including eSignature capabilities, templates, and collaboration tools. You can easily customize your Illinois PTAX 230 Form and track its status in real-time. These features enhance workflow efficiency and accuracy.

-

Can airSlate SignNow integrate with other software for easier management of the Illinois PTAX 230 Form?

Yes, airSlate SignNow seamlessly integrates with various software applications to streamline your workflow. This includes CRM systems, document storage solutions, and more. These integrations allow you to manage the Illinois PTAX 230 Form more effectively, ensuring all your data is in one place.

-

How secure is the airSlate SignNow platform for handling sensitive documents like the Illinois PTAX 230 Form?

airSlate SignNow prioritizes security, incorporating encryption and other advanced measures to protect your sensitive documents, including the Illinois PTAX 230 Form. Our platform complies with industry standards and regulations, ensuring that your data remains confidential and secure during the signing process.

-

What are the benefits of using airSlate SignNow for the Illinois PTAX 230 Form?

Using airSlate SignNow for the Illinois PTAX 230 Form offers numerous benefits, including increased efficiency, reduced paper usage, and the ability to expedite the submission process. Our platform simplifies document management, allowing you to focus on your core business activities while ensuring compliance with tax laws.

Get more for Illinois Ptax 230 Form

- Professional tax certificate download ahmedabad form

- City bank authorization form

- State bar of california osaac certificate application for out form

- Pldpi001 pdf pld pi 001 attorney or party form

- Wv 120 info how can i respond to a petition for form

- Volunteer waiver montgomery county food bank form

- Attorneys for applicant clarks manor llc form

- Form rc l 201g arizona registrar of contractors az gov

Find out other Illinois Ptax 230 Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors