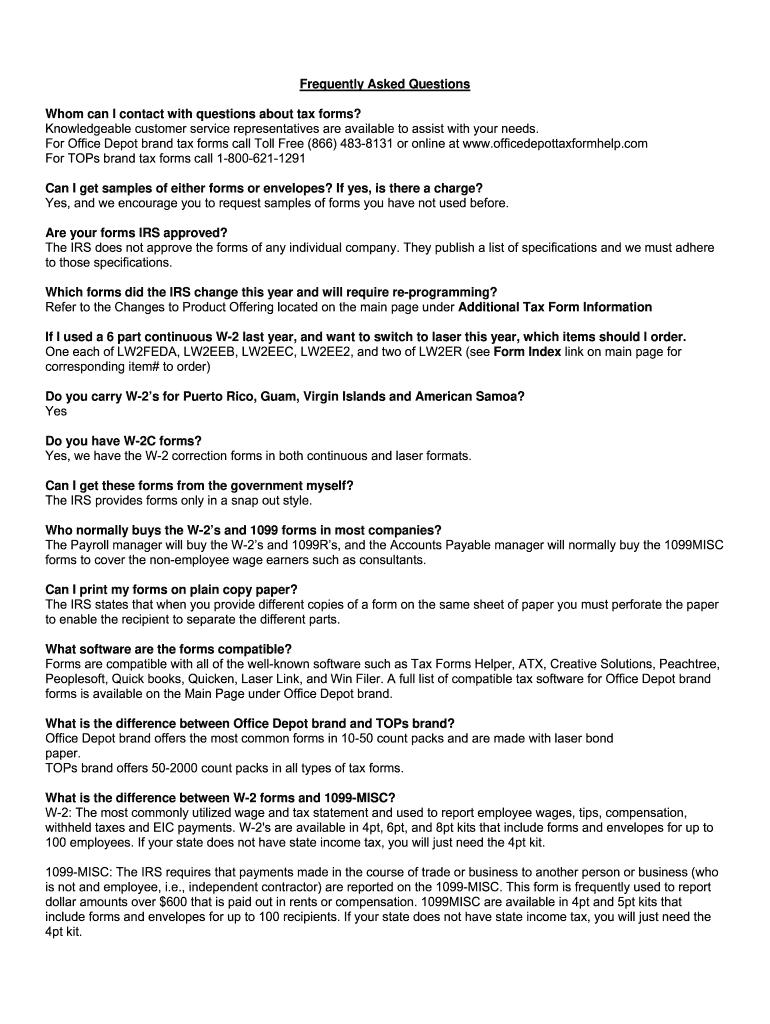

Frequently Asked Questions Whom Can I Contact with Office Depot Form

IRS Guidelines

The IRS provides specific guidelines for completing and submitting office depot 1099 forms. These forms are crucial for reporting various types of income other than wages, salaries, and tips. It is important to ensure that the information reported is accurate and timely. The IRS requires that businesses file these forms by January thirty-first of the year following the tax year in which the payments were made. This includes payments to independent contractors and other non-employee compensation. Understanding these guidelines helps in maintaining compliance and avoiding potential penalties.

Filing Deadlines / Important Dates

Filing deadlines for office depot 1099 forms are critical to avoid late penalties. Generally, the forms must be submitted to the IRS by January thirty-first for most types of 1099 forms. If the form is filed electronically, the deadline may extend to March second. It is advisable to keep track of these dates to ensure timely submission. Additionally, recipients should receive their copies by the same deadline to ensure they can report their income accurately on their tax returns.

Required Documents

To complete the office depot 1099 forms, several documents are necessary. First, you will need the recipient's Taxpayer Identification Number (TIN), which can be obtained using Form W-9. Additionally, you should have records of all payments made to the recipient during the tax year. This includes invoices, receipts, or any other documentation that can substantiate the amounts reported on the 1099 forms. Having these documents ready will streamline the process and help ensure accuracy in reporting.

Form Submission Methods (Online / Mail / In-Person)

Submitting office depot 1099 forms can be done through various methods. You can file the forms online using the IRS e-file system, which is often the quickest and most efficient method. Alternatively, you can mail the paper forms to the appropriate IRS address, depending on your location. For those who prefer in-person submission, some local IRS offices may accept forms directly, although this is less common. Each method has its own set of guidelines and deadlines, so it is important to choose the one that best fits your needs.

Penalties for Non-Compliance

Failure to comply with the IRS requirements for office depot 1099 forms can result in significant penalties. If forms are filed late, the penalties can range from fifty dollars to several hundred dollars per form, depending on how late the form is submitted. Additionally, incorrect information can lead to further penalties and complications with the IRS. It is crucial to ensure that all forms are completed accurately and submitted on time to avoid these financial repercussions.

Eligibility Criteria

Understanding the eligibility criteria for issuing office depot 1099 forms is essential for compliance. Generally, businesses must issue a 1099 form to any individual or entity to whom they have paid six hundred dollars or more in a tax year for services rendered. This includes independent contractors, freelancers, and other non-employees. However, certain types of payments, such as those made to corporations, may not require a 1099 form. Familiarizing yourself with these criteria can help ensure that you meet your reporting obligations.

Quick guide on how to complete frequently asked questions whom can i contact with office depot

Complete Frequently Asked Questions Whom Can I Contact With Office Depot easily on any device

Digital document management has gained traction among organizations and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can locate the appropriate form and safely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Handle Frequently Asked Questions Whom Can I Contact With Office Depot on any device with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and electronically sign Frequently Asked Questions Whom Can I Contact With Office Depot effortlessly

- Locate Frequently Asked Questions Whom Can I Contact With Office Depot and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your changes.

- Choose how you want to share your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate reprinting. airSlate SignNow meets all your document management requirements in just a few clicks from a device of your preference. Modify and electronically sign Frequently Asked Questions Whom Can I Contact With Office Depot to ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How can I ask my friend with whom I have no contact since years to talk with me?

There was this girl, once I liked very much. We haven't talked for almost 2 years. And it was getting harder and harder to initiate the conversation after a fight. Months converted into years and we were detached. I hated her because she never tried to contact me and may be she felt the same. On 13th April 2013, I don't know why, I wrote a poem for her, on her birthday. Telling, how much I adore her. I wonder even today, where did my ego go that day!!! The response was overwhelming. She cried in her college bus reading that E-mail, and again while talking to me in the night. I didn't contact her for another two months(changed city, changed number). It was just another morning, a "Hi" on Facebook from her changed almost everything. See, there are two ways. Or maybe infinite ways to break a silence. All you have to do is Think less, Do more. PS: Going anonymous because I haven't write a word for my current Gf and she's on quora. If she finds out this, she'll eat me alive.

-

How can I contact with the SSC regional office to make changes on my already registered form?

Go to the regional SSC Office and ask any official of which section deals with SSC CGL . Before visiting , go to the website, CPIOs numbers are given there. You can call them before going there. Go with the relevant documented proof to support your application and 1 photocopy of each. Exact process can only be suggested by concerned officials but meeting in person will help you.Regards//https://www.youtube.com/c/Exambay

-

Is it normal to have an interview with a manager asking you questions or sitting in an office by yourself filling out an application form and a 5 page questionnaire form? Is it normal to have an interview with a non-English speaking person?

1. it normal to have an interview with a manager asking you questions?Yes, this is what we call an interview.2. or sitting in an office by yourself filling out an application form and a 5 page questionnaire form?That probably depends on the job position you’re applying for.3. Is it normal to have an interview with a non-English speaking person?Yes, especially in non-English speaking countries.What the hell is your question about? Which Job position/industry and what country are you talking about and in what respect is this related to you? Your questions can not be thoroughly answered unless you give us more details.

-

How can I ask a girl to be my girlfriend when she has a best friend whom she always hangs out with?

Find a boyfriend to tame the best friend

-

How can I get in contact with an MRI specialist online or through WhatsApp? I have some questions to ask.

If you’re asking personal medical questions, I doubt I’ll be of help. But if they are about MRI in general, perhaps. See my Quora profile. Do not send me a Private Message unless I invite you to. Instead, fill out your Quora Profile, post one of your questions, and consider requesting me (along with a few others, as you wish,) to answer it.

-

I'm filling out the employment verification form online for KPMG and realized that it's not asking me for phone numbers to my previous employers. Just curious as to how they verify employment without me providing a contact number to call?

Many US employers today won’t allow individuals (coworkers, supervisors) at a company respond to any questions or write recommendations. Everything must go through HR and they will often only confirm dates of employment.I know this, so I’m not going to waste time contacting phone numbers/email lists of supposed former coworkers or managers. Fact is, if anyone answered and started responding to my questions, I’d be very suspicious. Instead, I just ask for the main number of the company — which I can look up on line and verify to be the actual number of the claimed company.Same deal with academic credentials. I’m not going to use your address for “Harvard” … the one with a PO Box in Laurel, KS. I’m going to look up the address for the registrar myself.Sorry to say, there’s far too much lying on resumes today, combined with the liability possible for a company to say anything about you. A common tactic is to lie about academic back ground while giving friends as your “former supervisor at XYZ.”

Create this form in 5 minutes!

How to create an eSignature for the frequently asked questions whom can i contact with office depot

How to create an electronic signature for the Frequently Asked Questions Whom Can I Contact With Office Depot online

How to generate an eSignature for the Frequently Asked Questions Whom Can I Contact With Office Depot in Chrome

How to make an eSignature for putting it on the Frequently Asked Questions Whom Can I Contact With Office Depot in Gmail

How to generate an eSignature for the Frequently Asked Questions Whom Can I Contact With Office Depot right from your mobile device

How to create an eSignature for the Frequently Asked Questions Whom Can I Contact With Office Depot on iOS devices

How to create an electronic signature for the Frequently Asked Questions Whom Can I Contact With Office Depot on Android

People also ask

-

What are office depot 1099 forms?

Office depot 1099 forms are tax documents used to report various types of income other than wages, salaries, and tips. They are essential for independent contractors and businesses to fulfill tax obligations. Utilizing airSlate SignNow makes filling and eSigning these forms quick and efficient.

-

How can airSlate SignNow help with office depot 1099 forms?

AirSlate SignNow offers a streamlined process for creating, sending, and eSigning office depot 1099 forms. Its user-friendly interface simplifies document management while ensuring compliance with tax regulations. This empowers businesses to handle their 1099 forms with ease and accuracy.

-

Is there a cost associated with using airSlate SignNow for office depot 1099 forms?

Yes, airSlate SignNow offers various pricing plans tailored to different needs, making it a cost-effective solution for businesses managing office depot 1099 forms. Plans may vary based on the number of users and features. Check our website for detailed pricing information.

-

Are there any integrations available for office depot 1099 forms on airSlate SignNow?

AirSlate SignNow integrates seamlessly with multiple applications, allowing you to efficiently manage office depot 1099 forms. You can connect with accounting software and other tools to automate the workflow and ensure all forms are processed correctly. This integration increases productivity while reducing errors.

-

What are the benefits of using airSlate SignNow for handling office depot 1099 forms?

Using airSlate SignNow for office depot 1099 forms provides numerous benefits, including time-saving automated workflows, enhanced security features, and a reliable eSigning process. Businesses can ensure compliance and simplify record-keeping, ultimately improving overall efficiency. It's an essential tool for compliance and ease of document management.

-

Can I customize office depot 1099 forms with airSlate SignNow?

Absolutely! AirSlate SignNow allows users to customize office depot 1099 forms according to their business needs. You can add company logos, adjust layout formats, and include necessary fields to make the forms align with your brand. This customization enhances professionalism in documentation.

-

How secure is airSlate SignNow for handling sensitive office depot 1099 forms?

AirSlate SignNow prioritizes security, utilizing encryption and advanced security measures to protect sensitive documents like office depot 1099 forms. Your data remains confidential and secure during the signing process. Compliance with major regulations adds to the trustworthiness of the platform.

Get more for Frequently Asked Questions Whom Can I Contact With Office Depot

- Peer evaluation form

- Mds scheduling tool form

- It 558 545450396 form

- Defensive driving certificate pdf form

- Use this form to establish income eligibility for discounts for the following sfmta programs

- Income eligibility formboot tow feescitatio

- Transportation consent form pathways inc

- Site specific hazard awareness trainingrecordcer form

Find out other Frequently Asked Questions Whom Can I Contact With Office Depot

- eSign Wisconsin Codicil to Will Online

- eSign Hawaii Guaranty Agreement Mobile

- eSign Hawaii Guaranty Agreement Now

- How Can I eSign Kentucky Collateral Agreement

- eSign Louisiana Demand for Payment Letter Simple

- eSign Missouri Gift Affidavit Myself

- eSign Missouri Gift Affidavit Safe

- eSign Nevada Gift Affidavit Easy

- eSign Arizona Mechanic's Lien Online

- eSign Connecticut IOU Online

- How To eSign Florida Mechanic's Lien

- eSign Hawaii Mechanic's Lien Online

- How To eSign Hawaii Mechanic's Lien

- eSign Hawaii IOU Simple

- eSign Maine Mechanic's Lien Computer

- eSign Maryland Mechanic's Lien Free

- How To eSign Illinois IOU

- Help Me With eSign Oregon Mechanic's Lien

- eSign South Carolina Mechanic's Lien Secure

- eSign Tennessee Mechanic's Lien Later