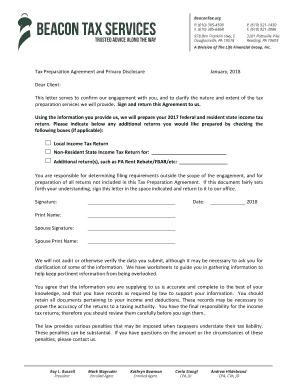

Tax Preparation Agreement and Privacy Disclosure January, Form

Understanding the Tax Preparer Agreement Form

The tax preparer agreement form is a crucial document that outlines the relationship between a taxpayer and their tax preparer. This form typically includes details about the services to be provided, the fees involved, and the responsibilities of both parties. It serves as a contract that ensures transparency and sets expectations for the tax preparation process. By having a clear agreement, both the taxpayer and the preparer can avoid misunderstandings and establish a professional working relationship.

Key Elements of the Tax Preparer Agreement Form

Several essential components must be included in a tax preparer agreement form to ensure its effectiveness and legality. These elements typically encompass:

- Contact Information: Names, addresses, and phone numbers of both the taxpayer and the tax preparer.

- Scope of Services: A detailed description of the services the tax preparer will provide, including tax return preparation and consultation.

- Fees and Payment Terms: Clear information about how fees will be calculated, payment methods, and due dates.

- Confidentiality Clause: Assurance that the taxpayer's information will be kept confidential and secure.

- Signatures: A section for both parties to sign, indicating their agreement to the terms outlined in the document.

Steps to Complete the Tax Preparer Agreement Form

Filling out the tax preparer agreement form involves several straightforward steps to ensure accuracy and completeness:

- Gather Necessary Information: Collect personal details, including your Social Security number and financial information.

- Review the Services Offered: Understand what services the tax preparer will provide and ensure they meet your needs.

- Fill Out the Form: Complete the form with accurate information, ensuring all sections are filled out.

- Review the Agreement: Carefully read through the entire agreement to ensure you understand the terms.

- Sign and Date: Both parties should sign and date the form to make it legally binding.

Legal Use of the Tax Preparer Agreement Form

To be considered legally binding, the tax preparer agreement form must comply with relevant laws and regulations. In the United States, electronic signatures are recognized under the ESIGN Act and UETA, making it possible to sign documents digitally. It is essential to ensure that the form is executed correctly, with both parties providing their consent through signatures. This legal framework helps protect both the taxpayer and the preparer in case of disputes.

Obtaining the Tax Preparer Agreement Form

The tax preparer agreement form can typically be obtained from various sources, including:

- Tax Preparation Firms: Many tax preparers provide their own version of the agreement as part of their onboarding process.

- Online Resources: Various websites offer templates that can be customized to fit individual needs.

- Professional Associations: Organizations related to tax preparation may provide standardized forms for their members.

Disclosure Requirements in the Tax Preparer Agreement Form

Disclosure requirements are vital in the tax preparer agreement form to ensure that taxpayers are informed about how their information will be used. The form should clearly state:

- How the preparer will handle and protect sensitive taxpayer information.

- Any third parties that may have access to the taxpayer's data.

- The purpose of collecting specific information and how it will be used in the tax preparation process.

Quick guide on how to complete tax preparation agreement and privacy disclosure january

Manage Tax Preparation Agreement And Privacy Disclosure January, effortlessly on any device

Digital document handling has gained signNow traction among businesses and individuals. It offers an excellent eco-friendly substitute to traditional printed and signed materials, as you can easily access the necessary form and safely keep it online. airSlate SignNow provides all the tools required to create, modify, and electronically sign your documents promptly without delays. Handle Tax Preparation Agreement And Privacy Disclosure January, on any device using airSlate SignNow’s Android or iOS applications and simplify any document-related task today.

Steps to modify and electronically sign Tax Preparation Agreement And Privacy Disclosure January, with ease

- Obtain Tax Preparation Agreement And Privacy Disclosure January, and click on Get Form to begin.

- Make use of the tools we offer to complete your form.

- Emphasize important sections of your documents or conceal sensitive data with tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign feature, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, or invite link, or download it to your computer.

Leave behind worries of lost or misplaced documents, frustrating form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in a few clicks from any device you prefer. Modify and electronically sign Tax Preparation Agreement And Privacy Disclosure January, to ensure exceptional communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax preparation agreement and privacy disclosure january

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a tax preparer agreement form?

A tax preparer agreement form is a legal document that outlines the relationship between a tax preparer and their client. It sets forth the responsibilities, rights, and obligations of both parties, ensuring clarity in the service provided. airSlate SignNow offers features that make filling out and signing this form straightforward and secure.

-

Why should I use airSlate SignNow for my tax preparer agreement form?

Using airSlate SignNow for your tax preparer agreement form simplifies the signing process with its user-friendly interface and robust eSignature capabilities. It provides a secure way to send documents, track their status, and manage everything from one platform. This enhances efficiency and ensures compliance with legal standards.

-

Is there a cost associated with using airSlate SignNow for a tax preparer agreement form?

Yes, airSlate SignNow offers several pricing plans, allowing you to choose one that fits your needs, whether you are a solo tax preparer or part of a larger firm. Each plan includes features designed to streamline the signing process for documents like the tax preparer agreement form. Sign up today to discover which plan suits your business best.

-

What features does airSlate SignNow offer for creating tax preparer agreement forms?

airSlate SignNow includes several features for creating tax preparer agreement forms, such as customizable templates, drawing and typing signatures, and collaboration tools. These features ensure that you can easily tailor the agreement to meet your specific legal requirements and quickly gather signatures. The platform also allows for easy document sharing and tracking.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Absolutely! airSlate SignNow supports integrations with various software applications commonly used in tax preparation. This allows you to seamlessly combine functions, enabling you to manage your tax preparer agreement forms alongside your accounting and client management systems. Check our integration options to see what works best for your workflow.

-

How secure is the signing process for the tax preparer agreement form on airSlate SignNow?

Security is a top priority at airSlate SignNow. The platform uses advanced encryption and compliance protocols, ensuring that your tax preparer agreement form is safe during transmission and storage. Additionally, detailed audit trails provide transparency and help verify the authenticity of signed documents.

-

What is the turnaround time for getting a tax preparer agreement form signed?

The turnaround time for getting a tax preparer agreement form signed on airSlate SignNow is typically very quick, often within minutes or hours. The platform's real-time notifications keep all parties informed about document status, enabling faster processing. This means you can focus on your tax preparation tasks rather than waiting for signatures.

Get more for Tax Preparation Agreement And Privacy Disclosure January,

- Klaviernoten una mattina pdf form

- Temple housing authority confluct of interest form

- East renfrewshire housing register medical priority application form barrh bcserver8

- Timeshare resale contract closemytimeshare com form

- Dhs 38 form

- Assistant coach evaluation form fill online printable

- End of rental notice agreement template form

- Editablerental agreement template form

Find out other Tax Preparation Agreement And Privacy Disclosure January,

- How Do I Sign Minnesota Government Quitclaim Deed

- Sign Minnesota Government Affidavit Of Heirship Simple

- Sign Missouri Government Promissory Note Template Fast

- Can I Sign Missouri Government Promissory Note Template

- Sign Nevada Government Promissory Note Template Simple

- How To Sign New Mexico Government Warranty Deed

- Help Me With Sign North Dakota Government Quitclaim Deed

- Sign Oregon Government Last Will And Testament Mobile

- Sign South Carolina Government Purchase Order Template Simple

- Help Me With Sign Pennsylvania Government Notice To Quit

- Sign Tennessee Government Residential Lease Agreement Fast

- Sign Texas Government Job Offer Free

- Sign Alabama Healthcare / Medical LLC Operating Agreement Online

- Sign Alabama Healthcare / Medical Quitclaim Deed Mobile

- Can I Sign Alabama Healthcare / Medical Quitclaim Deed

- Sign Utah Government Month To Month Lease Myself

- Can I Sign Texas Government Limited Power Of Attorney

- Sign Arkansas Healthcare / Medical Living Will Free

- Sign Arkansas Healthcare / Medical Bill Of Lading Later

- Sign California Healthcare / Medical Arbitration Agreement Free