1149 Form

What is the 1149 Form

The 1149 form is a specific document used primarily for tax-related purposes in the United States. It serves as a declaration or request for certain tax benefits, credits, or adjustments. Understanding the nature and function of this form is essential for taxpayers who wish to ensure compliance with IRS regulations. The 1149 form is integral for individuals and businesses looking to clarify their tax obligations and entitlements.

How to use the 1149 Form

Using the 1149 form involves a straightforward process that ensures accurate reporting and compliance with tax laws. Taxpayers should first obtain the form, which can typically be downloaded from the IRS website or other official sources. Once in possession of the form, individuals must fill it out with the required information, including personal identification details and specifics related to the tax issue at hand. After completing the form, it should be submitted according to the guidelines provided by the IRS, ensuring that all necessary supporting documents are included.

Steps to complete the 1149 Form

Completing the 1149 form requires careful attention to detail. Here are the essential steps:

- Download the 1149 form from an official source.

- Read the instructions carefully to understand the requirements.

- Fill in your personal information accurately, including your name, address, and taxpayer identification number.

- Provide the necessary details related to the tax benefits or adjustments you are requesting.

- Review the completed form for any errors or omissions.

- Attach any required supporting documents that validate your claims.

- Submit the form through the appropriate channels, whether online, by mail, or in person.

Legal use of the 1149 Form

The legal use of the 1149 form is crucial for ensuring that all claims made are valid and recognized by the IRS. This form must be completed in accordance with IRS guidelines to be considered legally binding. Failure to adhere to these guidelines can result in penalties or rejection of the claims made. It is important for users to familiarize themselves with the legal implications of the information they provide on the form, as inaccuracies can lead to serious consequences.

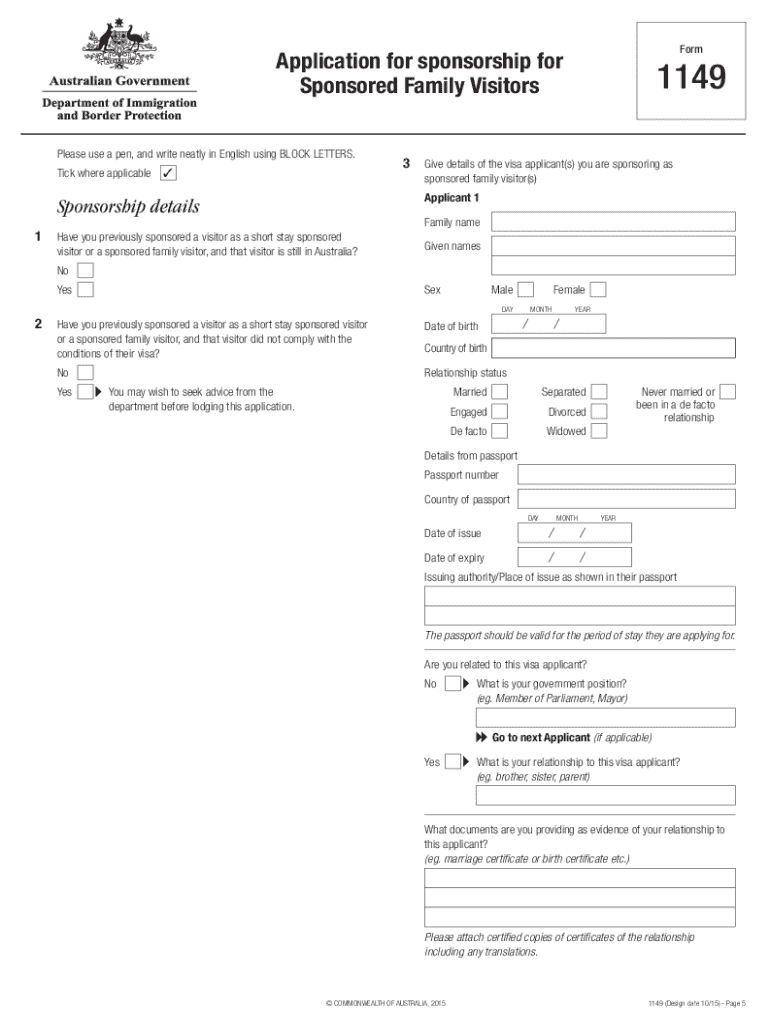

Key elements of the 1149 Form

The 1149 form contains several key elements that are essential for its completion and submission. These include:

- Personal Information: This section requires the taxpayer's name, address, and identification number.

- Tax Year: Indicating the specific tax year for which the claims are being made is crucial.

- Claim Details: This part outlines the specific benefits or adjustments being requested.

- Signature: The form must be signed by the taxpayer or an authorized representative to validate the submission.

Form Submission Methods

The 1149 form can be submitted through various methods, providing flexibility for taxpayers. The primary submission methods include:

- Online Submission: Many taxpayers prefer to submit forms electronically through the IRS e-filing system, which is often quicker and more efficient.

- Mail: The form can be printed and mailed to the appropriate IRS address, as specified in the form instructions.

- In-Person: Some taxpayers may choose to deliver the form in person at local IRS offices, ensuring immediate confirmation of receipt.

Quick guide on how to complete 1149 form

Complete 1149 Form effortlessly on any device

Digital document management has become increasingly popular among companies and individuals. It serves as an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and electronically sign your documents quickly without delays. Handle 1149 Form on any platform using airSlate SignNow Android or iOS applications and streamline any document-related process today.

Steps to edit and eSign 1149 Form without difficulty

- Find 1149 Form and click on Get Form to commence.

- Use the tools we offer to fill out your document.

- Mark important sections of the documents or redact sensitive details with the tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature with the Sign feature, which takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the worries of lost or misplaced documents, time-consuming form searches, or errors that necessitate creating new copies. airSlate SignNow fulfills all your requirements in document management in just a few clicks from any device you choose. Edit and eSign 1149 Form to ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 1149 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow 1149?

airSlate SignNow 1149 is a comprehensive eSignature solution designed to help businesses streamline their document signing process. With its intuitive interface and robust features, it allows users to send, sign, and manage documents efficiently, ensuring a seamless experience.

-

How much does airSlate SignNow 1149 cost?

The pricing for airSlate SignNow 1149 is competitive and varies based on the number of users and selected features. Businesses can choose from various plans tailored to their needs, ensuring they only pay for what’s essential for their document workflows.

-

What features are included in airSlate SignNow 1149?

airSlate SignNow 1149 comes packed with features like document templates, team collaboration tools, and customizable branding options. These features are designed to enhance productivity and ensure that all signing processes are secure and trackable.

-

Can I integrate airSlate SignNow 1149 with my existing software?

Yes, airSlate SignNow 1149 offers seamless integration options with popular software applications such as Google Drive, Salesforce, and many others. This allows businesses to work within their preferred environments without disrupting established workflows.

-

What are the benefits of using airSlate SignNow 1149?

Using airSlate SignNow 1149 provides numerous benefits, including faster turnaround times for document signing and enhanced security features. Businesses can save time and reduce costs related to printing, scanning, and mailing documents.

-

Is airSlate SignNow 1149 suitable for small businesses?

Absolutely! airSlate SignNow 1149 is designed to be cost-effective and easy to use, making it an ideal solution for small businesses looking to enhance their document management processes. Its scalability means it can grow with your business needs.

-

How secure is airSlate SignNow 1149 for document signing?

airSlate SignNow 1149 employs top-notch security measures, including encryption and compliance with global standards like GDPR and HIPAA. This ensures that all sensitive documents are protected when sent and signed, giving users peace of mind.

Get more for 1149 Form

Find out other 1149 Form

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT

- How Do I eSign Alaska Car Dealer Form

- How To eSign California Car Dealer Form

- Can I eSign Colorado Car Dealer Document

- How Can I eSign Colorado Car Dealer Document

- Can I eSign Hawaii Car Dealer Word

- How To eSign Hawaii Car Dealer PPT

- How To eSign Hawaii Car Dealer PPT