Fannie Mae Form 1088

What is the Fannie Mae Form 1088

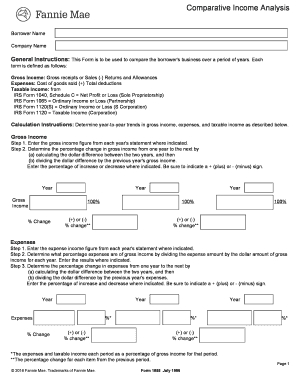

The Fannie Mae Form 1088 is a critical document used in the mortgage industry, specifically designed for reporting income from rental properties. This form is essential for lenders to assess the income potential of a property when evaluating a borrower's financial profile. It provides a standardized method for documenting rental income, ensuring that all necessary information is captured for underwriting purposes.

How to use the Fannie Mae Form 1088

Using the Fannie Mae Form 1088 involves several key steps. First, gather all relevant financial information related to your rental properties, including lease agreements and income statements. Next, accurately fill out the form, ensuring that all sections are completed to reflect your rental income and expenses. Once completed, the form can be submitted to your lender as part of your mortgage application package. It is vital to ensure that the information provided is accurate, as discrepancies may lead to delays in the approval process.

Steps to complete the Fannie Mae Form 1088

Completing the Fannie Mae Form 1088 requires careful attention to detail. Follow these steps for successful completion:

- Begin by entering your personal information, including your name, address, and contact details.

- List each rental property you own, providing details such as the property address and type.

- Document the rental income for each property, including the monthly rent and any other income sources related to the property.

- Include any relevant expenses associated with the properties, such as maintenance costs and property management fees.

- Review the entire form for accuracy before submitting it to ensure all information is correct.

Legal use of the Fannie Mae Form 1088

The Fannie Mae Form 1088 is legally binding when completed accurately and submitted in accordance with lender requirements. It is important to comply with all applicable laws and regulations regarding income reporting. This ensures that the information provided is not only accurate but also adheres to the legal standards set forth by governing bodies. Failure to comply with these regulations can result in penalties or delays in the mortgage approval process.

Key elements of the Fannie Mae Form 1088

Several key elements are essential to the Fannie Mae Form 1088. These include:

- Personal Information: Details about the borrower, including name and contact information.

- Property Details: Information on each rental property, such as address and type.

- Income Reporting: A comprehensive account of rental income and any additional income sources.

- Expense Reporting: Documentation of expenses related to property management and maintenance.

Form Submission Methods

The Fannie Mae Form 1088 can be submitted through various methods depending on lender preferences. Common submission methods include:

- Online Submission: Many lenders allow for electronic submission through their platforms.

- Mail: The form can be printed and mailed directly to the lender.

- In-Person: Some borrowers may choose to deliver the form in person at their lender's office.

Quick guide on how to complete fannie mae form 1088

Effortlessly Prepare Fannie Mae Form 1088 on Any Device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly substitute to conventional printed and signed papers, as you can easily find the right template and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and electronically sign your documents promptly without any holdups. Manage Fannie Mae Form 1088 across any platform with airSlate SignNow Android or iOS applications and enhance any document-driven process today.

The Easiest Way to Modify and eSign Fannie Mae Form 1088 with Ease

- Find Fannie Mae Form 1088 and then select Get Form to initiate.

- Utilize the features we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive data with tools specifically designed for that purpose by airSlate SignNow.

- Design your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then hit the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, text message (SMS), or invite link, or download it onto your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and electronically sign Fannie Mae Form 1088 while ensuring effective communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fannie mae form 1088

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the fannie mae form 1088 fillable, and why is it important?

The fannie mae form 1088 fillable is a crucial document used in the mortgage process for reporting financial information. This digital version allows users to easily fill out, save, and share the form, ensuring accuracy and compliance. By using the fillable version, businesses can streamline their processes, save time, and reduce errors.

-

How can airSlate SignNow help with the fannie mae form 1088 fillable?

airSlate SignNow provides a user-friendly platform for filling out and eSigning the fannie mae form 1088 fillable. This solution simplifies document management by allowing users to complete forms electronically, ensuring they can efficiently gather necessary signatures. With added features like tracking and reminders, you can stay organized throughout the process.

-

Is there a cost associated with using the fannie mae form 1088 fillable in airSlate SignNow?

Yes, there is a subscription cost for using airSlate SignNow, which provides access to features including the fannie mae form 1088 fillable. Pricing plans are designed to be affordable and cater to different business sizes and needs. You can choose a plan that best fits your usage and budget.

-

What key features does airSlate SignNow offer for the fannie mae form 1088 fillable?

airSlate SignNow offers several features for the fannie mae form 1088 fillable, including customizable templates, electronic signatures, and secure storage. These features help ensure that your documents are handled efficiently and securely, transforming the way you manage important paperwork. Additionally, automated workflows simplify the process of collecting necessary approvals.

-

Can I integrate airSlate SignNow with other applications for the fannie mae form 1088 fillable?

Yes, airSlate SignNow integrates seamlessly with multiple applications, making it easy to work with the fannie mae form 1088 fillable. You can connect it to CRM systems, cloud storage, and many other tools to streamline your document workflow. This interoperability enhances productivity and ensures a smoother experience when managing your documents.

-

How does eSigning the fannie mae form 1088 fillable with airSlate SignNow work?

eSigning the fannie mae form 1088 fillable with airSlate SignNow is straightforward. Users can fill out the form digitally, add their signature, and send it securely to others for signing. This process eliminates the need for printing and scanning, saving time and resources while ensuring compliance with legal eSignature standards.

-

What are the benefits of using the fannie mae form 1088 fillable with airSlate SignNow?

Using the fannie mae form 1088 fillable with airSlate SignNow provides numerous benefits, including increased efficiency, reduced paperwork, and improved organization. Electric signatures allow for quicker processing times, which can expedite mortgage applications. Additionally, the platform's security features ensure that sensitive information is well-protected.

Get more for Fannie Mae Form 1088

Find out other Fannie Mae Form 1088

- How To Sign Nevada Retainer for Attorney

- How To Sign Georgia Assignment of License

- Sign Arizona Assignment of Lien Simple

- How To Sign Kentucky Assignment of Lien

- How To Sign Arkansas Lease Renewal

- Sign Georgia Forbearance Agreement Now

- Sign Arkansas Lease Termination Letter Mobile

- Sign Oregon Lease Termination Letter Easy

- How To Sign Missouri Lease Renewal

- Sign Colorado Notice of Intent to Vacate Online

- How Can I Sign Florida Notice of Intent to Vacate

- How Do I Sign Michigan Notice of Intent to Vacate

- Sign Arizona Pet Addendum to Lease Agreement Later

- How To Sign Pennsylvania Notice to Quit

- Sign Connecticut Pet Addendum to Lease Agreement Now

- Sign Florida Pet Addendum to Lease Agreement Simple

- Can I Sign Hawaii Pet Addendum to Lease Agreement

- Sign Louisiana Pet Addendum to Lease Agreement Free

- Sign Pennsylvania Pet Addendum to Lease Agreement Computer

- Sign Rhode Island Vacation Rental Short Term Lease Agreement Safe