Multiple Counter Offer Wisconsin 2010-2026

Understanding the Multiple Counter Offer in Wisconsin

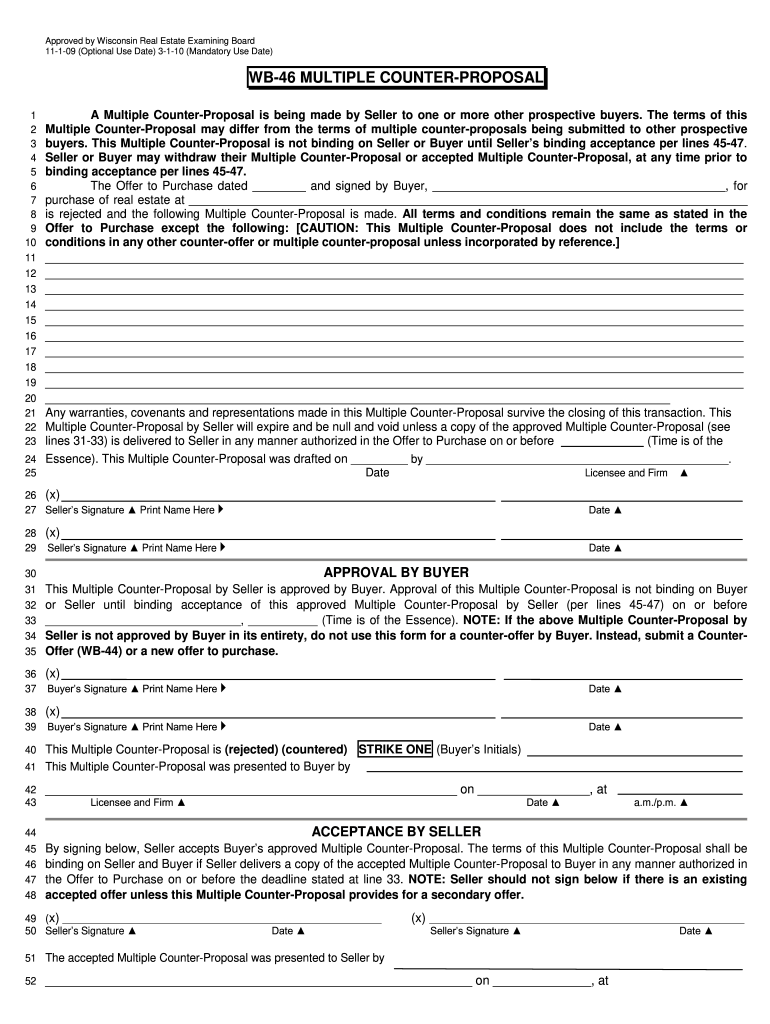

The Multiple Counter Offer in Wisconsin is a crucial document used in real estate transactions when a seller receives multiple offers on a property. This form allows the seller to respond to each offer with a counter proposal, enabling negotiations to continue with more than one buyer simultaneously. It is essential for sellers to clearly outline their terms and conditions in the counter offer, ensuring that all potential buyers understand their position and the specifics of the negotiation process.

Key Elements of the Multiple Counter Offer in Wisconsin

When drafting a Multiple Counter Offer, several key elements must be included to ensure clarity and legal validity:

- Identification of Parties: Clearly state the names of the seller and each potential buyer.

- Property Description: Include a detailed description of the property being sold, including its address.

- Offer Details: Specify the terms of each offer being countered, including price and any contingencies.

- Response Deadline: Indicate a deadline for buyers to respond to the counter offer.

- Signature Lines: Provide space for signatures from the seller and each buyer to confirm agreement.

Steps to Complete the Multiple Counter Offer in Wisconsin

Completing a Multiple Counter Offer involves several straightforward steps:

- Gather all received offers on the property.

- Review each offer carefully, noting terms that are acceptable or require negotiation.

- Draft the Multiple Counter Offer, incorporating the necessary elements outlined above.

- Distribute the counter offer to all potential buyers, ensuring they understand the terms.

- Set a clear deadline for responses to facilitate timely negotiations.

Legal Use of the Multiple Counter Offer in Wisconsin

The Multiple Counter Offer must comply with Wisconsin real estate laws to be legally binding. It is vital that all parties involved understand their rights and obligations under the terms of the counter offer. Sellers should ensure that the document is clear and unambiguous to avoid potential disputes. Consulting with a real estate professional or attorney can provide additional assurance that the document meets all legal requirements.

Examples of Using the Multiple Counter Offer in Wisconsin

Consider a scenario where a seller receives three offers for their property. The seller may choose to issue a Multiple Counter Offer to all three buyers, indicating that they are willing to negotiate terms with each. For instance, the seller might counter one offer at a higher price while suggesting different contingencies to another. This approach allows the seller to maximize their options and potentially secure a better deal.

Obtaining the Multiple Counter Offer in Wisconsin

The Multiple Counter Offer form can typically be obtained through real estate agencies, legal offices, or online resources that provide real estate forms. It is important to use a version that complies with Wisconsin regulations to ensure its validity. Many real estate professionals have templates available that can be customized for specific transactions.

Quick guide on how to complete multiple counter offers real estate wisconsin form

Cross your t's and dot your i's on Multiple Counter Offer Wisconsin

Negotiating contracts, managing listings, arranging meetings, and property showings—realtors and real estate professionals balance a plethora of responsibilities daily. Many of these tasks involve numerous documents, such as Multiple Counter Offer Wisconsin, that need to be completed within specified timeframes and as precisely as possible.

airSlate SignNow is a comprehensive platform that assists professionals in real estate to reduce the document workload, allowing them to focus more on their clients' goals throughout the entire negotiation process and helping them secure the optimal terms in the agreement.

How to complete Multiple Counter Offer Wisconsin with airSlate SignNow:

- Go to the Multiple Counter Offer Wisconsin page or utilize our library’s search functionality to find what you require.

- Click on Get form—you’ll be swiftly directed to the editor.

- Begin filling out the form by selecting the editable fields and entering your information.

- Add fresh text and modify its properties if necessary.

- Choose the Sign option in the top toolbar to create your signature.

- Explore additional features available for annotating and streamlining your form, such as drawing, highlighting, adding shapes, and more.

- Open the comment tab and add remarks regarding your form.

- Complete the process by downloading, sharing, or sending your form to your designated users or organizations.

Eliminate paper once and for all and enhance the home buying process with our user-friendly and robust platform. Experience increased convenience when verifying Multiple Counter Offer Wisconsin and other real estate documents online. Try our solution today!

Create this form in 5 minutes or less

FAQs

-

How can I get out of a real estate counter-offer that I signed?

This is a sticky one.My understanding of the situation is: The seller sent you a counter offer that included the language you mentioned above stating that you would pay the difference if it under-appraised, and you have signed that offer. It has not yet under-appraised, but you’d like to know, if it did, what your recourse might be, apart from just paying the difference out of pocket.I deal with this situation all the time with buyers, and it’s a complicated one.First, what are your state’s rules about other outs in the contract? In Texas, we have something called an option period, during which a buyer can exit the contract for any reason or no reason. (It’s awesome. You should buy property in Texas.) It’s usually about 7 days. I recommend that the buyers order their appraisal immediately, and we ask the lender to rush the appraisal, with the expectation we’ll get it back while we’re still in option period. Then, if the home does under-appraise by more than they are willing to pay, they just exit on option. Nice, clean, legal.I would think every state has some kind of inspection and repair clause, but I couldn’t tell you how this might work outside of Texas. Find out from your Realtor how it works in your state. Speaking of which, if you’re undertaking a complicated home purchase like this, I hope you’re using a good Realtor!Outside of option period in Texas, the buyer’s ability to exit the contract gets much grayer and carries more legal liability. You need to be able to make a reasonable argument that you’re exiting the contract for the reason you say you are. So, for example, could you get out on buyer credit approval? Maybe, but you’re asking the lender to basically bluff for you and hoping the seller doesn’t ask too many questions. Could you get out on your title commitment clause? Could you refuse to close if the seller asks to move the closing date one day out or asks to make some other minor revision to the contract? Or could you terminate based on the HOA or condo docs? Yes to all of the above, but if you’re really terminating over appraisal, but you claim to be terminating over something else, you’re playing a risky game. Possibly a risky game that involves a lawyer, which is my least favorite kind of game.Now to your question about earnest money deposit. It is a common misconception that your earnest money deposit is your only skin in the game, but it’s not. Usually, if a buyer walks away from a contract the seller will just keep your earnest money, but it’s not the most they can do. They can demand “specific performance,” or demand you close. If they feel your violation of the contract caused them more damages than your earnest money is worth, they can sue you for the damages they feel they suffered. What if you accepted this language because you were competing with multiple offers, say a slightly lower cash offer, and you agreed to the language so they’d accept yours instead? The seller could make the argument you cost them $310,000 (the cash offer), and that your earnest money just won’t cut it.The short answer, consult your Realtor about the common outs in your state, and then consult a lawyer if you think you’re likely to have to terminate on a clause other than option, or something similar.Lastly, in the future, try this. I often recommend my buyers not agree to cover any under-appraisal, but rather up to a specific amount. For example “not to exceed $10,000” or whatever.Good luck! You can message me directly on Quora, or find me on my Zillow profile.

-

Where do residential real estate companies get their forms from (i.e., offer to purchase, addendum, counters, etc.)? How often are they updated?

Most states have standardized forms to simplify this for all parties to a residential transaction. Keep in mind that commercial transactions are a lot more cavalier. As it is assumed that someone purchasing commercial property is somewhat savvy, the government does not aim to regulate and “protect” these individuals as heavily. Florida has the Florida Real Estate Commission (FREC), which governs real estate brokerage activity and provides guidance on best practices. Most states have something comparable that puts together these forms you reference.

-

Is my real estate agent being honest? He said he has to pay $100 to Zillow each time someone fills out the contact listing agent form on my house. True?

Not to my knowledge. In my area, the way Zillow works is it pulls listings from the MLS (multiple listing service) unless I check a box that says the seller prohibits this. So it’s no more work for me to list your property on Zillow than in the MLS. Zillow sells real estate agents “leads” (queries about specific properties) or (in a new program) takes a % of the brokerage fee after a property has closed. Contacting agents online is free to both parties.

-

How likely is it for me to win a lawsuit where a seller wants to back out of a signed commercial real estate offer/contract?

Obligatory legalese: I’m not a lawyer and you should consult one for legal advice.Generally speaking, if you have performed as specified in the contract, including putting in deposit, removing any applicable contingencies, and informing seller of your intent to close, then I think you have a pretty good case.However, in practical terms, it’s not clear if you should go to court. Lawyers are expensive and, depending on the contract and the state you’re in, you may not be able to get back your expenses, even if you win. And any case, even a winning one, is going to take a long time to complete; is it really worth your time and aggravation?

Create this form in 5 minutes!

How to create an eSignature for the multiple counter offers real estate wisconsin form

How to create an eSignature for the Multiple Counter Offers Real Estate Wisconsin Form online

How to generate an eSignature for your Multiple Counter Offers Real Estate Wisconsin Form in Google Chrome

How to generate an eSignature for signing the Multiple Counter Offers Real Estate Wisconsin Form in Gmail

How to create an eSignature for the Multiple Counter Offers Real Estate Wisconsin Form from your smartphone

How to generate an electronic signature for the Multiple Counter Offers Real Estate Wisconsin Form on iOS

How to make an eSignature for the Multiple Counter Offers Real Estate Wisconsin Form on Android OS

People also ask

-

What is an escalation clause in real estate?

An escalation clause in real estate is a provision in a purchase agreement that enables a buyer to automatically increase their offer price if a competing bid is submitted. This clause is particularly useful in competitive markets, ensuring potential buyers remain in contention for a property without continuous renegotiation.

-

How does an escalation clause affect the purchase price?

An escalation clause affects the purchase price by allowing the buyer's offer to increase incrementally to a predetermined limit, typically based on the competing offer. This ensures that the buyer can secure the property without overextending their budget upfront.

-

What are the benefits of using an escalation clause in real estate transactions?

The benefits of using an escalation clause in real estate transactions include increased competitiveness and the ability to outbid other buyers without initially committing to a higher price. This strategic tool can strengthen a buyer’s offer and increase the likelihood of securing the desired property.

-

How do I draft an effective escalation clause?

To draft an effective escalation clause, clearly outline the maximum offer price, the amount the offer will increase by, and the verification process for competing offers. A well-structured clause ensures clarity and protects the buyer’s interests while adhering to contractual obligations in real estate deals.

-

Can I use airSlate SignNow to facilitate documents involving an escalation clause?

Yes, you can use airSlate SignNow to facilitate all documents involving an escalation clause in real estate agreements. Our platform offers an efficient way to eSign and manage your documents securely, making it easy to handle clauses and other important transaction details.

-

What integrations does airSlate SignNow offer for real estate professionals?

airSlate SignNow offers integrations with various real estate platforms and applications, enhancing the workflow for professionals in the industry. These integrations streamline document management and ensure that features like escalation clauses are easily incorporated into contracts.

-

Is airSlate SignNow cost-effective for real estate transactions?

Yes, airSlate SignNow is a cost-effective solution for real estate transactions, providing a range of features at competitive pricing. Our platform allows users to efficiently manage paperwork, including documents related to escalation clauses, ensuring both affordability and convenience.

Get more for Multiple Counter Offer Wisconsin

Find out other Multiple Counter Offer Wisconsin

- How Can I Sign North Dakota Share Transfer Agreement Template

- Sign Oklahoma Debt Settlement Agreement Template Online

- Can I Sign Oklahoma Debt Settlement Agreement Template

- Sign Pennsylvania Share Transfer Agreement Template Now

- Sign Nevada Stock Purchase Agreement Template Later

- Sign Arkansas Indemnity Agreement Template Easy

- Sign Oklahoma Stock Purchase Agreement Template Simple

- Sign South Carolina Stock Purchase Agreement Template Fast

- Sign California Stock Transfer Form Template Online

- How Do I Sign California Stock Transfer Form Template

- How Can I Sign North Carolina Indemnity Agreement Template

- How Do I Sign Delaware Stock Transfer Form Template

- Help Me With Sign Texas Stock Purchase Agreement Template

- Help Me With Sign Nevada Stock Transfer Form Template

- Can I Sign South Carolina Stock Transfer Form Template

- How Can I Sign Michigan Promissory Note Template

- Sign New Mexico Promissory Note Template Now

- Sign Indiana Basketball Registration Form Now

- Sign Iowa Gym Membership Agreement Later

- Can I Sign Michigan Gym Membership Agreement