Form as 6042 1

What is the Form As 6042 1

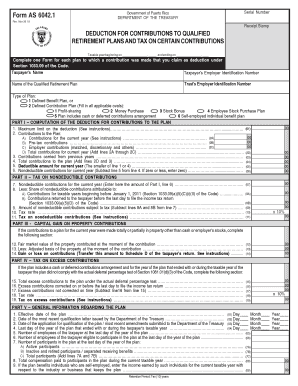

The Form As 6042 1 is a specific document used primarily in Puerto Rico for tax purposes. It is designed to facilitate the reporting of certain income types and tax obligations. This form is essential for individuals and businesses operating within Puerto Rico, ensuring compliance with local tax laws. Understanding the purpose of this form is crucial for accurate tax reporting and avoiding potential penalties.

How to use the Form As 6042 1

Using the Form As 6042 1 involves several steps to ensure that all required information is accurately reported. First, gather all necessary financial documents, including income statements and any relevant tax records. Next, carefully fill out the form, ensuring that all fields are completed with accurate data. After completing the form, review it for any errors before submission. It is important to keep a copy for your records, as this may be needed for future reference or audits.

Steps to complete the Form As 6042 1

Completing the Form As 6042 1 requires attention to detail. Follow these steps for successful completion:

- Obtain the latest version of the form from the appropriate tax authority.

- Provide your personal information, including name, address, and taxpayer identification number.

- Report all relevant income sources accurately, ensuring that figures match your financial documents.

- Complete any additional sections as required, such as deductions or credits.

- Review the entire form for accuracy and completeness before signing.

Legal use of the Form As 6042 1

The legal use of the Form As 6042 1 is governed by Puerto Rico's tax regulations. To be considered valid, the form must be completed accurately and submitted by the designated deadlines. Failure to use the form correctly can result in penalties, including fines or additional tax liabilities. It is essential to ensure compliance with all legal requirements to avoid complications with tax authorities.

Required Documents

When filling out the Form As 6042 1, certain documents are necessary to support the information provided. These may include:

- Income statements, such as W-2s or 1099s.

- Proof of deductions or credits claimed.

- Any previous tax returns that may be relevant.

- Identification documents, such as a Social Security number or taxpayer identification number.

Form Submission Methods

The Form As 6042 1 can be submitted through various methods, depending on the preferences of the filer. Options typically include:

- Online submission through the Puerto Rico Department of Treasury's website.

- Mailing the completed form to the appropriate tax office.

- In-person submission at designated tax offices.

Quick guide on how to complete form as 6042 1 446382539

Easily Prepare Form As 6042 1 on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an excellent eco-friendly alternative to traditional printed and signed paperwork, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents promptly without any hold-ups. Handle Form As 6042 1 on any platform using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

Effortlessly Modify and Electronically Sign Form As 6042 1

- Obtain Form As 6042 1 and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize key sections of your documents or obscure sensitive information using tools specifically designed by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the details and then click on the Done button to save your changes.

- Choose your preferred method to submit your form, whether by email, text message (SMS), invite link, or by downloading it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Form As 6042 1 while ensuring excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form as 6042 1 446382539

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form as 6042 1 in airSlate SignNow?

Form as 6042 1 is a specific document template designed for ease of use in airSlate SignNow. It allows businesses to streamline their document workflows by simplifying the signature process, ensuring compliance, and improving overall efficiency.

-

How can I integrate form as 6042 1 with my existing software?

airSlate SignNow offers seamless integration options for form as 6042 1 with various software platforms, including CRM and ERP systems. By utilizing API solutions, businesses can easily incorporate this form into their existing workflows for enhanced functionality.

-

What are the pricing options for using form as 6042 1?

airSlate SignNow offers flexible pricing plans to accommodate businesses looking to use form as 6042 1. Whether you are a small business or a large enterprise, you can choose a plan that suits your budget and includes full access to this document type.

-

Are there any benefits to using form as 6042 1 for my business?

Using form as 6042 1 can signNowly benefit your business by reducing processing times and improving accuracy in document handling. The ability to eSign and manage this form digitally enhances productivity and reduces paper waste.

-

Can I customize form as 6042 1 to suit my needs?

Yes, airSlate SignNow allows users to customize form as 6042 1 to meet specific business requirements. You can add fields, adjust layouts, and incorporate your branding to ensure the document aligns with your corporate identity.

-

Is form as 6042 1 compliant with legal standards?

airSlate SignNow ensures that form as 6042 1 complies with all relevant legal standards for electronic signatures. This compliance provides peace of mind for businesses and helps avoid legal issues related to document validation.

-

How does the eSigning process work for form as 6042 1?

The eSigning process for form as 6042 1 is straightforward. Users simply upload the document, add necessary signers, and send it for signature. Signers are notified via email, allowing them to sign securely from any device.

Get more for Form As 6042 1

- Subcontractors package rhode island form

- Ri theft form

- Identity theft prevention package rhode island form

- Rhode island identity form

- Identity theft by known imposter package rhode island form

- Rhode island personal form

- Essential documents for the organized traveler package rhode island form

- Essential documents for the organized traveler package with personal organizer rhode island form

Find out other Form As 6042 1

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF