Ni 15 Form

What is the Ni 15 Form

The Ni 15 form is a tax-related document used primarily for reporting income and tax withholding for non-resident aliens in the United States. This form is essential for individuals who may not be eligible to file a standard tax return but still have income that requires reporting. Understanding the purpose of the Ni 15 form is crucial for compliance with U.S. tax laws and regulations.

How to Use the Ni 15 Form

Using the Ni 15 form involves several steps to ensure accurate reporting of income. First, gather all necessary financial documents that reflect your income and any taxes withheld. Next, fill out the form with precise information, including personal details and income sources. After completing the form, it is important to review it for accuracy before submission to avoid any potential issues with the IRS.

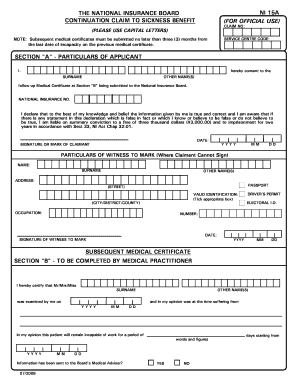

Steps to Complete the Ni 15 Form

Completing the Ni 15 form requires careful attention to detail. Begin by entering your name, address, and taxpayer identification number. Then, list all sources of income, including wages and investment income. Ensure that you report any tax withheld. After filling out all sections, sign and date the form. It is advisable to keep a copy for your records before submitting it to the appropriate tax authority.

Legal Use of the Ni 15 Form

The Ni 15 form is legally binding when filled out correctly and submitted on time. It serves as a formal declaration of income and tax withholding, which is critical for compliance with U.S. tax laws. Failing to use this form appropriately can result in penalties or legal repercussions. Therefore, understanding its legal implications is essential for non-resident aliens engaging in business or earning income in the United States.

Filing Deadlines / Important Dates

Filing deadlines for the Ni 15 form are crucial for compliance. Typically, the form must be submitted by April 15 of the following tax year. However, if you are a non-resident alien, specific rules may apply, and deadlines can vary. It is important to stay informed about any changes to filing dates to avoid late fees or penalties.

Form Submission Methods (Online / Mail / In-Person)

The Ni 15 form can be submitted through various methods. You may choose to file online, which is often the fastest option, or you can mail the completed form to the appropriate tax office. In-person submissions might be possible in certain circumstances, especially for individuals seeking assistance. Each method has its own advantages, and selecting the right one can facilitate a smoother filing process.

Required Documents

To complete the Ni 15 form, certain documents are required. These typically include proof of income, such as pay stubs or tax documents from employers, and any forms that show tax withholding. Additionally, identification documents like a passport or visa may be necessary to verify your status as a non-resident alien. Having all required documents ready can streamline the completion process and ensure accuracy.

Quick guide on how to complete ni 15 form

Complete Ni 15 Form seamlessly on any device

Digital document management has become increasingly popular among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the resources you need to create, modify, and electronically sign your documents swiftly without delays. Manage Ni 15 Form on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and eSign Ni 15 Form effortlessly

- Find Ni 15 Form and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight pertinent sections of your documents or redact sensitive information with tools provided specifically for that purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your updates.

- Select your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, or mistakes that require reprinting new copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you choose. Modify and eSign Ni 15 Form to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ni 15 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an ni15 form and how is it used?

The ni15 form is a document used in various business processes to streamline the signing and sharing of important paperwork. It ensures that all parties can sign the document electronically, making the process faster and more efficient. By using airSlate SignNow, users can easily create, send, and manage their ni15 forms online.

-

How does airSlate SignNow simplify the process of handling ni15 forms?

airSlate SignNow provides an intuitive platform that allows users to create, send, and track ni15 forms effortlessly. With its user-friendly interface, you can quickly upload your ni15 template and invite recipients to eSign. This ensures a smooth and hassle-free experience for both senders and signers.

-

What features does airSlate SignNow offer for ni15 forms?

Key features of airSlate SignNow for ni15 forms include customizable templates, automated reminders, and secure cloud storage. Additionally, users can integrate with various applications, enhancing their workflow and improving efficiency when managing ni15 forms. The platform also offers detailed tracking, allowing you to monitor the status of your documents.

-

Is there a cost associated with using airSlate SignNow for ni15 forms?

Yes, airSlate SignNow offers cost-effective pricing plans that cater to different business sizes and needs. With flexible subscription options, you can choose a plan that suits your organization's requirements for managing ni15 forms. This makes it affordable for virtually any business to implement digital signing solutions.

-

Can I integrate other tools with airSlate SignNow for managing ni15 forms?

Absolutely! airSlate SignNow supports integration with various applications, allowing users to streamline their workflow for ni15 forms. Whether you’re using CRM tools, cloud storage, or email services, you can connect them seamlessly to enhance the efficiency of managing your ni15 forms.

-

What are the security features in airSlate SignNow when handling ni15 forms?

airSlate SignNow prioritizes security by implementing robust features that protect your ni15 forms and personal information. Advanced encryption, secure cloud storage, and compliance with industry standards ensure that your documents are safe. You can have peace of mind knowing that your ni15 forms are well-protected from unauthorized access.

-

How can I track the status of my ni15 forms in airSlate SignNow?

Tracking the status of your ni15 forms in airSlate SignNow is simple and efficient. Users receive real-time notifications about when documents are viewed and signed, allowing for better management and communication. This feature helps you stay updated and ensures that no step in the process is overlooked.

Get more for Ni 15 Form

- Form cr 101 plea form with explanations and waiver of

- Cr 110jv 790 order for victim restitution judicial council form

- 2014 2019 form ca cr 112jv 792 fill online printable

- Defendants statement of assets formdunkmulque

- Defendants statement of assets california courts cagov form

- Find your court la law library form

- Fillable online cal crim form notice of appeal penal code

- Cr 130 form

Find out other Ni 15 Form

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter