Usindividual Tax Return Form

What is the Usindividual Tax Return Form

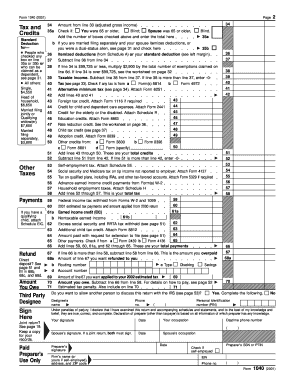

The Usindividual Tax Return Form is a crucial document used by individuals in the United States to report their income, calculate taxes owed, and claim refunds. This form is essential for ensuring compliance with federal tax laws and is typically filed annually with the Internal Revenue Service (IRS). It captures various sources of income, deductions, and credits that can affect a taxpayer's overall tax liability.

How to complete the Usindividual Tax Return Form

Completing the Usindividual Tax Return Form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary documents, including W-2s, 1099s, and any other income statements. Next, fill out personal information such as your name, address, and Social Security number. It is important to accurately report all income sources and claim any eligible deductions or credits. After completing the form, review it thoroughly for errors before submitting it to the IRS.

Legal use of the Usindividual Tax Return Form

The Usindividual Tax Return Form is legally binding when completed and submitted according to IRS guidelines. To ensure its legal standing, the form must be signed and dated by the taxpayer. Electronic submissions are also valid, provided they meet the requirements set forth by the IRS. Using a reliable eSignature tool can enhance the security and authenticity of the digital submission, ensuring compliance with eSignature laws.

Filing Deadlines / Important Dates

Filing deadlines for the Usindividual Tax Return Form are critical for compliance. Typically, the deadline for submitting the form is April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be aware of any extensions that may be available, which can provide additional time to file without incurring penalties.

Required Documents

To accurately complete the Usindividual Tax Return Form, certain documents are required. These include:

- W-2 forms from employers

- 1099 forms for freelance or contract work

- Records of other income, such as interest or dividends

- Documentation for deductions, such as mortgage interest statements or medical expenses

- Social Security numbers for dependents

Having these documents ready can streamline the filing process and help avoid errors.

Form Submission Methods

The Usindividual Tax Return Form can be submitted through various methods. Taxpayers may choose to file electronically using IRS-approved software, which often provides a more efficient and faster processing time. Alternatively, forms can be mailed directly to the IRS or submitted in person at designated IRS offices. Each method has its own advantages, and taxpayers should select the one that best suits their needs.

Quick guide on how to complete usindividual tax return form

Complete Usindividual Tax Return Form effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers a remarkable eco-friendly substitute for traditional printed and signed paperwork, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, alter, and eSign your documents promptly without delays. Manage Usindividual Tax Return Form on any platform using airSlate SignNow Android or iOS applications and enhance any document-centric procedure today.

How to adjust and eSign Usindividual Tax Return Form effortlessly

- Find Usindividual Tax Return Form and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Mark important sections of your documents or conceal sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to share your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and eSign Usindividual Tax Return Form and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the usindividual tax return form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Usindividual Tax Return Form?

The Usindividual Tax Return Form is a crucial document used by individuals in the United States to report income, calculate taxes owed, and request refunds. It's essential for compliance with the IRS mandates. Completing this form accurately can help streamline your tax filing process.

-

How can I use airSlate SignNow to complete my Usindividual Tax Return Form?

With airSlate SignNow, you can easily create, edit, and eSign your Usindividual Tax Return Form directly online. Our user-friendly platform allows you to manage your documents effortlessly, ensuring your tax filing process is quick and efficient. You can save time and reduce errors with our powerful tools.

-

Is airSlate SignNow secure for handling the Usindividual Tax Return Form?

Yes, airSlate SignNow prioritizes your security by implementing robust encryption and compliance measures. Your Usindividual Tax Return Form is protected throughout the signing process, ensuring confidentiality and integrity of your sensitive information. You can trust us for secure document management.

-

What are the costs associated with using airSlate SignNow for the Usindividual Tax Return Form?

airSlate SignNow offers various pricing plans tailored to your needs, making it cost-effective whether you are an individual or a business. Our affordable plans include features that simplify the completion and signing of your Usindividual Tax Return Form. Check our website for detailed pricing information.

-

Can I integrate airSlate SignNow with other tools for my Usindividual Tax Return Form preparation?

Absolutely! airSlate SignNow seamlessly integrates with various popular applications, allowing you to streamline the preparation of your Usindividual Tax Return Form. Using our integrations, you can enhance workflow efficiency and ensure all necessary documents are easily accessible.

-

What features does airSlate SignNow offer for my Usindividual Tax Return Form?

airSlate SignNow provides a wide range of features including eSignature, document templates, and real-time notifications for your Usindividual Tax Return Form. These tools enhance your productivity and help maintain organization during the tax filing process. Experience the ease of managing your forms with us.

-

How fast can I get my Usindividual Tax Return Form signed using airSlate SignNow?

Using airSlate SignNow, you can get your Usindividual Tax Return Form signed in minutes. Our platform ensures quick turnaround times, allowing you to streamline your tax filing and avoid last-minute delays. The efficiency of our eSigning process keeps you on track with your deadlines.

Get more for Usindividual Tax Return Form

Find out other Usindividual Tax Return Form

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer