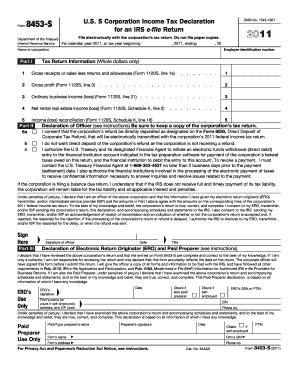

Form 8453 S

What is the Form 8453 S

The Form 8453 S is a crucial document used in the United States for electronically filing tax returns. It serves as a declaration that the taxpayer has submitted their return electronically and authorizes the e-filing service provider to submit the return on their behalf. This form is particularly relevant for taxpayers who are filing their returns through specific software or services, ensuring that all necessary authorizations are in place for compliance with IRS regulations.

How to use the Form 8453 S

Using the Form 8453 S involves a few straightforward steps. First, ensure that you have completed your tax return using an approved e-filing software. Once your return is ready, you will need to fill out the Form 8453 S, which includes essential information such as your name, Social Security number, and the details of the return being filed. After completing the form, you will sign it electronically, which verifies your consent for the e-filing service to submit your return to the IRS on your behalf.

Steps to complete the Form 8453 S

Completing the Form 8453 S requires attention to detail. Here are the key steps:

- Gather necessary information: Collect your personal details, including your name, address, and Social Security number.

- Fill out the form: Input the required information accurately, ensuring all fields are completed as instructed.

- Review the information: Double-check for any errors or omissions to avoid complications during the filing process.

- Sign the form: Use an electronic signature to validate your authorization for the e-filing service to submit your return.

- Submit the form: Follow the instructions provided by your e-filing service to ensure the Form 8453 S is submitted alongside your tax return.

Legal use of the Form 8453 S

The legal validity of the Form 8453 S hinges on its compliance with IRS guidelines and electronic signature laws. When completed correctly, it serves as a legally binding document that confirms your intent to file electronically. The form must be signed using a secure electronic signature solution that meets the requirements set forth by the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA). This ensures that the form is recognized as valid and enforceable in legal contexts.

Key elements of the Form 8453 S

Several key elements must be included in the Form 8453 S to ensure its effectiveness:

- Taxpayer Information: Name, address, and Social Security number of the taxpayer.

- Return Information: Details about the tax return being filed, including the type of return and any applicable schedules.

- Signature: An electronic signature that confirms the taxpayer's authorization for e-filing.

- Declaration: A statement affirming that the information provided is accurate and complete to the best of the taxpayer's knowledge.

Form Submission Methods

The Form 8453 S can be submitted through various methods, depending on how the taxpayer is filing their return. Typically, it is submitted electronically alongside the tax return through the e-filing software. In some cases, if the return cannot be filed electronically, the form may need to be printed and mailed to the IRS. It's essential to follow the specific instructions provided by the e-filing service to ensure proper submission and compliance with IRS requirements.

Quick guide on how to complete form 8453 s

Complete Form 8453 S effortlessly on any device

Web-based document management has become favored by companies and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the tools necessary to produce, modify, and eSign your documents quickly without delays. Handle Form 8453 S on any device with airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to alter and eSign Form 8453 S with ease

- Find Form 8453 S and click Get Form to get going.

- Utilize the tools we offer to finish your document.

- Emphasize important sections of your documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes seconds and holds the same legal validity as a traditional hand-signed signature.

- Review all the details and click the Done button to save your alterations.

- Decide how you want to share your form, via email, text message (SMS), invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Form 8453 S and ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8453 s

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 8453-S and why do I need it?

Form 8453-S is a declaration document used by S corporations to authenticate electronic filing of tax returns. By using airSlate SignNow, you can easily eSign and submit this important form, simplifying your tax filing process and ensuring compliance.

-

How does airSlate SignNow facilitate the completion of Form 8453-S?

airSlate SignNow provides a user-friendly interface for filling out and eSigning Form 8453-S. You can upload your document, fill in the necessary information, and send it securely for signatures, making the process seamless and efficient.

-

Is there a cost associated with using airSlate SignNow for Form 8453-S?

Yes, airSlate SignNow operates on a subscription model, offering various pricing plans suitable for businesses of all sizes. The cost depends on the features you need, but the investment is worthwhile given the savings in time and effort when managing Form 8453-S.

-

Can I save my Form 8453-S documents within airSlate SignNow?

Absolutely! airSlate SignNow allows you to securely store and manage your Form 8453-S documents in the cloud. This feature simplifies future access and reduces the risk of losing important tax documents.

-

What integrations does airSlate SignNow offer for Form 8453-S?

airSlate SignNow integrates seamlessly with various applications, including CRM and accounting software. This makes it easy to incorporate Form 8453-S into your existing workflows, enhancing overall productivity.

-

How can using airSlate SignNow improve my business’s efficiency with Form 8453-S?

By using airSlate SignNow, you can streamline the eSigning process for Form 8453-S, which saves time that can be used for other important tasks. This efficiency leads to faster turnaround times and improved organization of your documents.

-

Is airSlate SignNow secure for handling Form 8453-S?

Yes, airSlate SignNow implements robust security measures, including data encryption and secure servers, to protect your Form 8453-S and any personal information. You can confidently manage your documents knowing they are safe.

Get more for Form 8453 S

Find out other Form 8453 S

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF

- How Do I Electronic signature Georgia Car Dealer Document