Child Benefit and Your Tax ReturnexplainedKWA Tax 2022

What is the Child Benefit And Your Tax Return explained KWA Tax

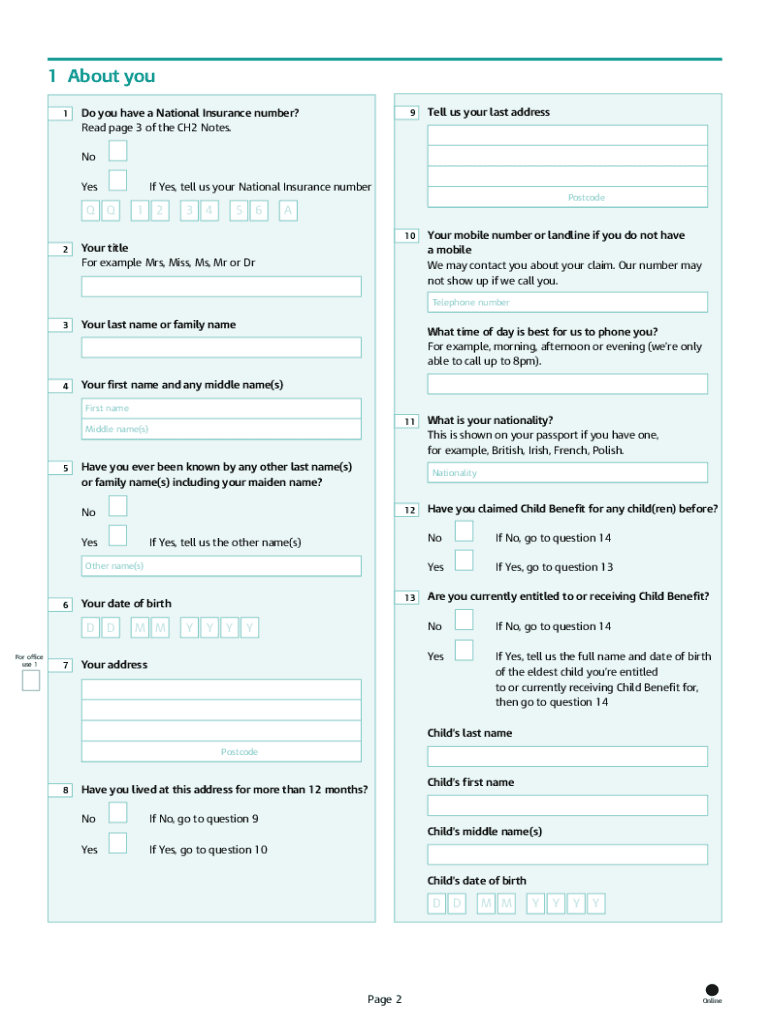

The Child Benefit and Your Tax Return explained KWA Tax form is designed to help taxpayers understand how child benefits impact their tax obligations. Child benefits are government payments made to families to assist with the costs of raising children. This form outlines the eligibility criteria, the amount families can receive, and how these benefits should be reported on tax returns. Understanding this form is crucial for ensuring compliance with tax regulations and maximizing potential benefits.

Steps to complete the Child Benefit And Your Tax Return explained KWA Tax

Completing the Child Benefit and Your Tax Return explained KWA Tax form involves several key steps:

- Gather necessary documentation, including Social Security numbers for all children and income information.

- Determine eligibility based on income thresholds and the number of qualifying children.

- Fill out the form accurately, ensuring all sections are completed to avoid delays.

- Review the form for accuracy before submission to minimize errors.

- Submit the form through the appropriate method, whether online or via mail.

Legal use of the Child Benefit And Your Tax Return explained KWA Tax

The Child Benefit and Your Tax Return explained KWA Tax form must be completed in accordance with federal and state tax laws. This includes adhering to regulations regarding the reporting of child benefits on tax returns. The form is legally binding when filled out correctly and submitted on time. It is essential to ensure that all information provided is truthful and accurate to avoid penalties or legal issues.

Eligibility Criteria

To qualify for child benefits, certain eligibility criteria must be met. Generally, the following factors are considered:

- The taxpayer must have a qualifying child under the age of 17.

- Income limits apply, which may vary based on filing status and the number of children.

- The child must be a U.S. citizen, national, or resident alien.

- The taxpayer must be the primary caregiver or have custody of the child.

Required Documents

When completing the Child Benefit and Your Tax Return explained KWA Tax form, several documents are necessary:

- Social Security cards for each child.

- Proof of income, such as W-2 forms or tax returns from the previous year.

- Any documentation related to custody arrangements, if applicable.

- Identification documents for the taxpayer, including a driver's license or state ID.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines for the Child Benefit and Your Tax Return explained KWA Tax form. Typically, the deadline for submitting tax returns is April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. It is advisable to check the IRS website for any updates regarding deadlines and to ensure timely submission to avoid penalties.

Quick guide on how to complete child benefit and your tax returnexplainedkwa tax

Accomplish Child Benefit And Your Tax ReturnexplainedKWA Tax effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-conscious substitute for conventional printed and signed documents, enabling you to locate the appropriate form and store it securely online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents quickly, without any hold-ups. Manage Child Benefit And Your Tax ReturnexplainedKWA Tax on any platform using airSlate SignNow's Android or iOS applications, and enhance any document-driven process today.

How to modify and electronically sign Child Benefit And Your Tax ReturnexplainedKWA Tax with ease

- Obtain Child Benefit And Your Tax ReturnexplainedKWA Tax and select Get Form to begin.

- Utilize the tools available to finalize your form.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the information and click on the Done button to save your changes.

- Choose how you wish to submit your form: via email, SMS, invite link, or download it to your computer.

Eliminate the worry of lost or misfiled documents, daunting form searches, or errors requiring new printouts. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Child Benefit And Your Tax ReturnexplainedKWA Tax and ensure excellent communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct child benefit and your tax returnexplainedkwa tax

Create this form in 5 minutes!

How to create an eSignature for the child benefit and your tax returnexplainedkwa tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the relationship between Child Benefit and your tax return?

The Child Benefit and your tax return are closely related, as receiving Child Benefit may affect your tax calculations. Specifically, if you or your partner's income exceeds a certain threshold, you may be required to pay back some or all of the benefit. Understanding this connection is essential to ensure accurate tax reporting.

-

How does airSlate SignNow help with documenting Child Benefit for tax purposes?

airSlate SignNow streamlines the process of tracking and documenting Child Benefit payments, making it easier to incorporate them into your tax return. With our platform, you can securely eSign and store documents related to Child Benefit, ensuring you have everything ready for tax season.

-

Are there any costs associated with using airSlate SignNow for tax return documentation?

Yes, airSlate SignNow offers a variety of pricing plans designed to fit various budgets, making it a cost-effective solution for managing paperwork related to Child Benefit and your tax return. Check our pricing page for details on the plans available.

-

What features does airSlate SignNow offer to assist with tax-related documents?

Key features of airSlate SignNow include customizable templates for tax documents, secure eSigning, and automated workflows. These tools enable you to efficiently handle all aspects of your Child Benefit and your tax return documentation.

-

Is airSlate SignNow easy to integrate with other financial tools?

Absolutely! airSlate SignNow seamlessly integrates with popular accounting and financial software, enhancing your ability to manage Child Benefit and your tax return. This integration allows for streamlined data transfer and better organization of your financial documents.

-

Can I track changes to my Child Benefit documents within airSlate SignNow?

Yes, airSlate SignNow provides robust tracking features that allow you to monitor changes made to your Child Benefit documents. You can view the history of edits and updates, ensuring you have a complete view of your tax-related paperwork.

-

How does airSlate SignNow ensure the security of my financial documents?

Security is a top priority for airSlate SignNow, especially for sensitive financial documents concerning Child Benefit and your tax return. Our platform utilizes advanced encryption and secure storage to protect all your important information from unauthorized access.

Get more for Child Benefit And Your Tax ReturnexplainedKWA Tax

Find out other Child Benefit And Your Tax ReturnexplainedKWA Tax

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Form

- How Can I eSign Hawaii Government Form

- Help Me With eSign Hawaii Healthcare / Medical PDF

- How To eSign Arizona High Tech Document

- How Can I eSign Illinois Healthcare / Medical Presentation

- Can I eSign Hawaii High Tech Document

- How Can I eSign Hawaii High Tech Document

- How Do I eSign Hawaii High Tech Document

- Can I eSign Hawaii High Tech Word

- How Can I eSign Hawaii High Tech Form

- How Do I eSign New Mexico Healthcare / Medical Word