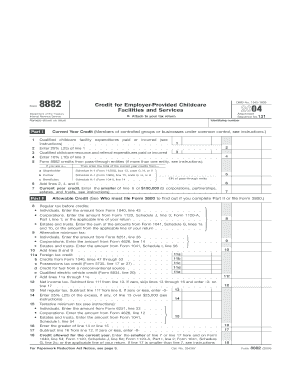

Form 8882

What is the Form 8882

The Form 8882, officially known as the IRS Form 8882, is a tax form used by eligible taxpayers to claim a tax credit for certain qualified expenses related to the purchase of electric vehicles. This form is part of the Internal Revenue Service's efforts to promote environmentally friendly practices by incentivizing the use of electric vehicles. The credit can significantly reduce the amount of tax owed, making it an important consideration for individuals and businesses looking to invest in electric vehicles.

How to use the Form 8882

Using the Form 8882 involves several steps to ensure that taxpayers can accurately claim their tax credit. First, taxpayers must gather all necessary documentation related to their electric vehicle purchase, including the vehicle's make, model, and year, as well as the purchase price. After completing the form, it is essential to attach it to the taxpayer's annual tax return. This ensures that the IRS can process the claim effectively. Properly filling out the form and providing accurate information will help avoid delays in receiving the tax credit.

Steps to complete the Form 8882

Completing the Form 8882 requires careful attention to detail. Follow these steps:

- Begin by entering personal information, including name, address, and Social Security number.

- Provide details about the electric vehicle, such as the make, model, and year of manufacture.

- Indicate the purchase price of the vehicle and any other qualifying expenses.

- Calculate the total tax credit based on the information provided.

- Review the completed form for accuracy before submission.

Ensuring that all information is complete and correct will help facilitate a smooth processing of the tax credit claim.

Legal use of the Form 8882

The legal use of the Form 8882 is governed by IRS regulations, which outline the eligibility criteria for claiming the electric vehicle tax credit. Taxpayers must ensure that they meet all requirements, including owning a qualified electric vehicle and using it for personal or business purposes. It is crucial to maintain accurate records of the vehicle purchase and any related expenses. Failure to comply with these regulations may result in penalties or denial of the tax credit.

Filing Deadlines / Important Dates

Filing deadlines for the Form 8882 align with the annual tax return deadlines set by the IRS. Typically, individual taxpayers must file their returns by April fifteenth of each year. However, if taxpayers require an extension, they may have until October fifteenth to submit their forms. It is important to stay informed about any changes in deadlines to ensure timely filing and avoid potential penalties.

Eligibility Criteria

To be eligible for the tax credit claimed through the Form 8882, taxpayers must meet specific criteria. These include:

- Purchasing a qualified electric vehicle that meets the IRS specifications.

- Using the vehicle primarily for personal or business use.

- Filing a federal tax return for the year in which the vehicle was purchased.

Understanding these criteria is essential for taxpayers to determine their eligibility and maximize their tax benefits.

Quick guide on how to complete form 8882

Effortlessly Prepare Form 8882 on Any Device

Digital document management has become increasingly favored by organizations and individuals alike. It offers an ideal sustainable substitute for conventional printed and signed documents, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow equips you with all the resources needed to create, modify, and electronically sign your documents quickly without delays. Handle Form 8882 on any device using the airSlate SignNow applications for Android or iOS and enhance any document-related process today.

The easiest way to modify and electronically sign Form 8882 effortlessly

- Find Form 8882 and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of your documents or redact sensitive information with tools specifically available in airSlate SignNow.

- Generate your signature using the Sign feature, which takes moments and carries the same legal validity as a traditional ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form: via email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, frustrating form searches, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any preferred device. Edit and electronically sign Form 8882 and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8882

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 8882 and how does it benefit businesses?

Form 8882 is a tax form used to claim a credit for the cost of certain business property. By using form 8882, businesses can effectively reduce their tax liability, making it an essential tool for maximizing financial savings.

-

How can airSlate SignNow help me with form 8882?

airSlate SignNow streamlines the process of preparing and eSigning form 8882. Our platform ensures that all necessary information is filled in accurately, allowing you to focus on your business without worrying about paperwork.

-

Is there a cost associated with using form 8882 through airSlate SignNow?

Using airSlate SignNow to manage form 8882 is cost-effective. Our pricing model is designed to suit businesses of all sizes, ensuring you only pay for the features you need while saving on overall document management costs.

-

What features does airSlate SignNow offer for handling form 8882?

Our platform provides various features for form 8882, including customizable templates, secure eSigning, document tracking, and integration with popular business applications, enhancing the overall efficiency of your workflow.

-

Can I integrate airSlate SignNow with other software for form 8882?

Yes, airSlate SignNow allows seamless integration with various applications, enhancing the functionality of form 8882 management. This ensures you can automate workflows and access documents from different platforms effortlessly.

-

What security measures does airSlate SignNow implement for form 8882?

airSlate SignNow prioritizes your data security, utilizing industry-standard encryption and secure storage protocols for form 8882. Our commitment to compliance and data protection safeguards your sensitive information throughout the signing process.

-

How can I track the status of my form 8882 using airSlate SignNow?

With airSlate SignNow, you can easily track the status of your form 8882 in real-time. Our dashboard provides updates on who has signed, who still needs to sign, and overall progress, ensuring you stay informed throughout the process.

Get more for Form 8882

Find out other Form 8882

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple