Ifta 101mn Formpdffillercom

What is the Ifta 101mn Formpdffillercom

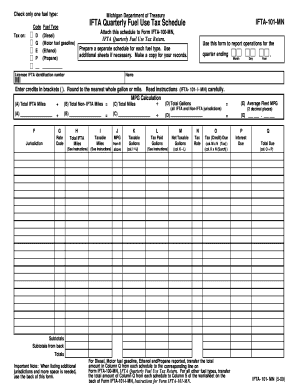

The Ifta 101mn Formpdffillercom is a specific document used for reporting fuel tax information for interstate commercial vehicle operations. It is part of the International Fuel Tax Agreement (IFTA), which simplifies the reporting of fuel use by motor carriers operating in multiple jurisdictions. This form is essential for ensuring compliance with state fuel tax laws and helps streamline the tax payment process across participating states.

How to use the Ifta 101mn Formpdffillercom

Using the Ifta 101mn Formpdffillercom involves several steps to ensure accurate reporting. First, gather all necessary fuel purchase records and mileage logs for the reporting period. Next, fill out the form with details such as the total miles driven, fuel consumed, and taxes owed for each jurisdiction. After completing the form, review it for accuracy before submitting it to the appropriate state agency. This ensures compliance and helps avoid penalties.

Steps to complete the Ifta 101mn Formpdffillercom

Completing the Ifta 101mn Formpdffillercom requires careful attention to detail. Follow these steps:

- Collect all relevant data, including fuel purchases and mileage for each state.

- Enter the total miles driven and fuel consumed for each jurisdiction on the form.

- Calculate the tax owed based on the rates applicable in each state.

- Double-check all entries for accuracy and completeness.

- Submit the form by the designated deadline to avoid penalties.

Legal use of the Ifta 101mn Formpdffillercom

The Ifta 101mn Formpdffillercom is legally binding when completed accurately and submitted on time. Compliance with IFTA regulations ensures that motor carriers meet their fuel tax obligations across different states. It is crucial to adhere to the legal requirements set forth by the jurisdictions involved, as failure to do so may result in penalties or audits. Using a reliable platform for electronic submission can enhance the legal validity of the form.

Filing Deadlines / Important Dates

Filing deadlines for the Ifta 101mn Formpdffillercom are typically set quarterly. Carriers must submit their forms by the last day of the month following the end of each quarter. For example, the deadlines are usually April 30, July 31, October 31, and January 31. Staying aware of these dates is essential to avoid late fees and ensure compliance with tax regulations.

Penalties for Non-Compliance

Non-compliance with the Ifta 101mn Formpdffillercom can lead to significant penalties. These may include fines, interest on unpaid taxes, and potential audits by state authorities. Additionally, repeated non-compliance can result in the suspension of a carrier’s operating authority. It is vital for motor carriers to file their forms accurately and on time to avoid these consequences.

Quick guide on how to complete ifta 101mn formpdffillercom

Prepare Ifta 101mn Formpdffillercom with ease on any device

Digital document management has gained traction among companies and individuals. It offers a perfect environmentally friendly alternative to conventional printed and signed papers, as you can locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents promptly without delays. Handle Ifta 101mn Formpdffillercom on any platform with airSlate SignNow Android or iOS applications and simplify any document-related procedure today.

How to modify and electronically sign Ifta 101mn Formpdffillercom effortlessly

- Locate Ifta 101mn Formpdffillercom and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the information and click on the Done button to save your changes.

- Choose how you wish to send your form, by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choosing. Edit and electronically sign Ifta 101mn Formpdffillercom and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ifta 101mn formpdffillercom

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Ifta 101mn FormsignNowcom and why is it important?

The Ifta 101mn FormsignNowcom is a crucial document for tracking and reporting fuel tax for commercial vehicles operating in multiple jurisdictions. By utilizing this form, businesses can ensure compliance with state regulations and simplify their fuel tax reporting processes.

-

How can airSlate SignNow assist with the Ifta 101mn FormsignNowcom?

airSlate SignNow makes it easy to fill out, sign, and send the Ifta 101mn FormsignNowcom digitally. Our platform provides an intuitive interface that ensures you can complete and submit your forms quickly and accurately, reducing the likelihood of errors.

-

What features does airSlate SignNow offer for managing the Ifta 101mn FormsignNowcom?

Our platform includes features such as templates for the Ifta 101mn FormsignNowcom, real-time tracking, and automated reminders. These features streamline the filing process, allowing you to focus on your business rather than paperwork.

-

Is airSlate SignNow cost-effective for handling the Ifta 101mn FormsignNowcom?

Yes, airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. By automating the process of filing the Ifta 101mn FormsignNowcom, our solution can save you both time and money, making it a worthy investment for your company.

-

Can airSlate SignNow integrate with other software for the Ifta 101mn FormsignNowcom?

Absolutely! airSlate SignNow seamlessly integrates with various accounting and fleet management software to streamline the process of completing the Ifta 101mn FormsignNowcom. This ensures that all relevant data is easily accessible and up-to-date across all platforms.

-

What are the benefits of using airSlate SignNow for the Ifta 101mn FormsignNowcom?

Using airSlate SignNow for the Ifta 101mn FormsignNowcom signNowly enhances your document management efficiency. Our platform ensures secure electronic signatures, reduces paperwork, and simplifies compliance, ultimately saving you valuable time and resources.

-

How secure is airSlate SignNow when handling the Ifta 101mn FormsignNowcom?

Security is a top priority at airSlate SignNow. We employ robust encryption and authentication measures to protect your sensitive information related to the Ifta 101mn FormsignNowcom, ensuring your documents remain confidential and secure.

Get more for Ifta 101mn Formpdffillercom

- Cr91 form

- Computerized affidavit of confirmation form

- Pde 338 p level ii recommendation form

- Caesars docagent form

- Exclusive right to sell listing contract for real estateabc form

- Instructions and booklets on the courts website form

- 201 se 6th street room 385 form

- General motion form for peoria municipal court

Find out other Ifta 101mn Formpdffillercom

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors