Small Estate Affidavit 2012-2026

What is the Small Estate Affidavit

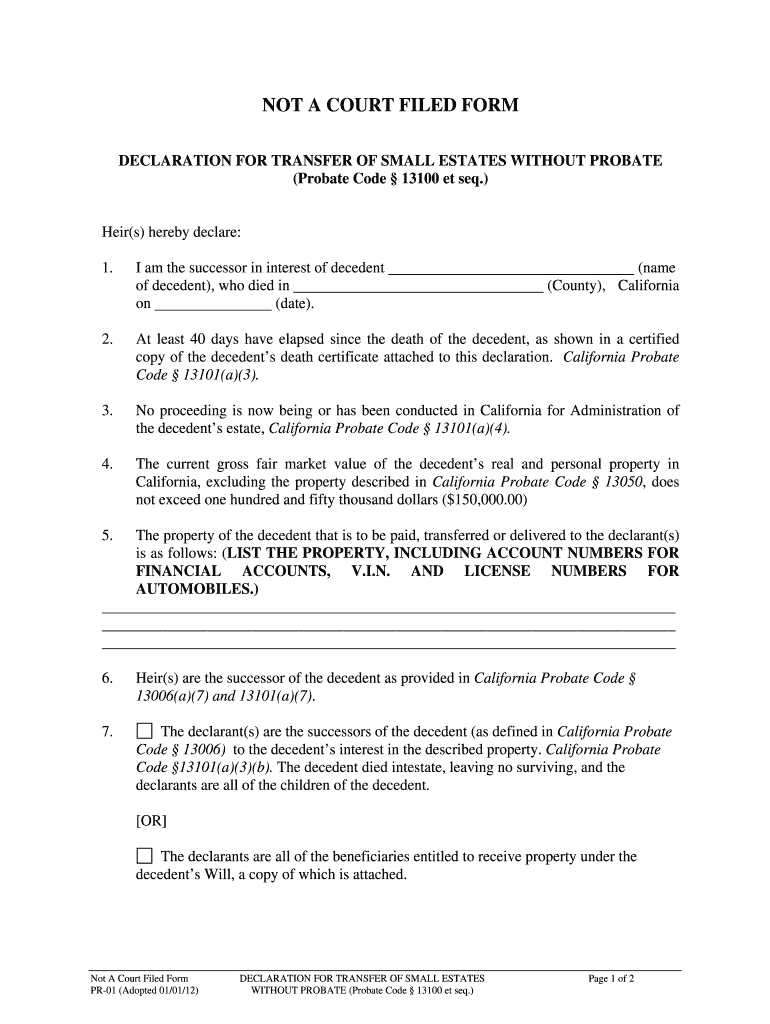

The small estate affidavit in California is a legal document that allows individuals to transfer assets of a deceased person without going through the probate process. This form is typically used when the total value of the deceased's assets is below a certain threshold, which is currently set at $166,250. The affidavit serves as a declaration by the heir or beneficiary, affirming their right to the deceased's property. It simplifies the process of asset transfer and is designed to expedite the distribution of the estate to rightful heirs.

How to use the Small Estate Affidavit

To use the small estate affidavit, the heir or beneficiary must complete the form accurately, providing necessary details about the deceased, including their name, date of death, and a description of the assets to be transferred. Once the affidavit is filled out, it must be signed in front of a notary public. After notarization, the affidavit can be presented to financial institutions, title companies, or other entities holding the deceased's assets. This document enables the heir to claim the property without the need for probate court intervention.

Steps to complete the Small Estate Affidavit

Completing the small estate affidavit involves several key steps:

- Gather necessary information about the deceased, including their full name, date of death, and details about the assets.

- Obtain the small estate affidavit form, which can be found online or through legal resources.

- Fill out the form accurately, ensuring all required fields are completed.

- Sign the affidavit in front of a notary public to validate the document.

- Submit the notarized affidavit to the relevant institutions to claim the assets.

Key elements of the Small Estate Affidavit

Several key elements must be included in the small estate affidavit to ensure its validity:

- The full name and address of the affiant (the person claiming the estate).

- The name of the deceased and their date of death.

- A detailed description of the assets being claimed, including their estimated value.

- A statement affirming that the total value of the estate does not exceed the statutory limit.

- Signatures of the affiant and a notary public.

Required Documents

When preparing the small estate affidavit, certain documents are typically required:

- The completed small estate affidavit form.

- A certified copy of the deceased's death certificate.

- Any relevant documentation proving ownership of the assets, such as bank statements or property deeds.

Eligibility Criteria

To be eligible to use the small estate affidavit in California, the following criteria must be met:

- The total value of the deceased's assets must be less than $166,250.

- The affiant must be an heir or a beneficiary named in the deceased's will or under California intestacy laws.

- At least 40 days must have passed since the date of death.

Quick guide on how to complete small estate affidavit california 2012 form

Complete and submit your Small Estate Affidavit swiftly

Reliable tools for digital document interchange and verification are essential for enhancing processes and the continual progress of your forms. When handling legal documents and signing a Small Estate Affidavit, the right signature solution can save you signNow time and resources with each submission.

Locate, fill, modify, authorize, and distribute your legal papers with airSlate SignNow. This platform provides everything necessary to create efficient paper submission workflows. Its extensive legal forms repository and user-friendly navigation can assist you in finding your Small Estate Affidavit rapidly, and the editor featuring our signature capability will let you complete and endorse it immediately.

Authorize your Small Estate Affidavit in a few straightforward steps

- Access the Small Estate Affidavit you require in our repository through search or catalog pages.

- Examine the form details and preview it to confirm it meets your needs and state criteria.

- Click Get form to open it for modification.

- Fill out the form using the detailed toolbar.

- Inspect the information you've entered and click the Sign tool to endorse your document.

- Select one of three methods to affix your signature.

- Complete the adjustments and save the file in your repository, then download it on your device or share it instantly.

Simplify every aspect of your document preparation and validation with airSlate SignNow. Experience a more effective online solution that carefully considers all aspects of managing your documents.

Create this form in 5 minutes or less

FAQs

-

How do I fill out Form B under the Insolvency and Bankruptcy code? Does the affidavit require a stamp paper?

Affidavit is always on stamp paper

-

If I open a small t-shirt store on Etsy or Storenvy, do I need to fill out a DBA form?

The short answer is no, however I would recommend that you do get yourself an LLC. A Limited Liability Corporation is very inexpensive and easy to get and will protect you in case of any sort of legal issue.In short if someone were to take legal action against you due to say defamation or creative license issues the LLC would help protect monies you make from your regular job or your personal belongings.Filling out the paperwork isn’t difficult and costs under $50 last I checked but if you don’t feel comfortable doing it yourself you can find several companies online (just google “get an llc”) that will do it for a fee of about $99 plus the fee for the LLC.

-

Which forms do I fill out for taxes in California? I have a DBA/sole proprietorship company with less than $1000 in profit. How many forms do I fill out? This is really overwhelming. Do I need to fill the Form 1040-ES? Did the deadline pass?

You need to file two tax returns- one Federal Tax Form and another California State income law.My answer to your questions are for Tax Year 2018The limitation date for tax year 15.04.2018Federal Tax return for Individual is Form 1040 . Since you are carrying on proprietorship business, you will need to fill the Schedule C in Form 1040Form 1040 -ES , as the name suggests is for paying estimated tax for the current year. This is not the actual tax return form. Please note that while Form 1040, which is the return form for individuals, relates to the previous year, the estimated tax form (Form 1040-EZ ) calculates taxes for the current year.As far as , the tax return under tax laws of Californa State is concerned, the Schedule CA (540) Form is to be used for filing state income tax return . You use your federal information (forms 1040) to fill out your 540 FormPrashanthttp://irstaxapp.com

Create this form in 5 minutes!

How to create an eSignature for the small estate affidavit california 2012 form

How to create an eSignature for the Small Estate Affidavit California 2012 Form online

How to generate an eSignature for the Small Estate Affidavit California 2012 Form in Chrome

How to generate an electronic signature for signing the Small Estate Affidavit California 2012 Form in Gmail

How to make an eSignature for the Small Estate Affidavit California 2012 Form right from your mobile device

How to make an electronic signature for the Small Estate Affidavit California 2012 Form on iOS devices

How to make an eSignature for the Small Estate Affidavit California 2012 Form on Android OS

People also ask

-

What is a small estate affidavit in California?

A small estate affidavit in California is a legal document that allows heirs to claim property of a deceased person without going through the lengthy probate process. This affidavit is typically used when the total value of the estate is below a certain threshold, which simplifies the transfer of assets.

-

Who is eligible to use a small estate affidavit in California?

In California, individuals who are heirs to the estate may use a small estate affidavit if the total value of the estate falls below $166,250. Eligible heirs include the spouse, domestic partner, children, or other designated beneficiaries, making it easier to access the deceased's assets.

-

How much does it cost to file a small estate affidavit in California?

The cost to file a small estate affidavit in California can vary depending on the county and any associated court fees. Generally, the process can be completed at a low cost, especially when utilizing solutions like airSlate SignNow for document preparation and eSigning.

-

What documents are required to complete a small estate affidavit in California?

To complete a small estate affidavit in California, you typically need a copy of the deceased’s death certificate, the small estate affidavit form, and any necessary identification. Using airSlate SignNow can help streamline the document gathering process with easily accessible templates.

-

Can I use airSlate SignNow to complete my small estate affidavit in California?

Yes, airSlate SignNow provides an easy-to-use platform to create, edit, and eSign your small estate affidavit in California. With templates and electronic signatures, it simplifies the process and ensures that your documents are legally binding.

-

What are the benefits of using airSlate SignNow for a small estate affidavit?

Using airSlate SignNow for a small estate affidavit in California offers numerous benefits such as time savings, convenience, and reduced costs. The platform allows for quick collaboration and secure document management, making the entire process hassle-free.

-

Is it necessary to consult a lawyer for a small estate affidavit in California?

While it's not mandatory to consult a lawyer for a small estate affidavit in California, having legal guidance can ensure that all requirements are met correctly. Utilizing airSlate SignNow can simplify the preparation, yet seeking professional advice can help avoid potential pitfalls.

Get more for Small Estate Affidavit

Find out other Small Estate Affidavit

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors