Assumption of Mortgage Form

What is the assumption of mortgage form

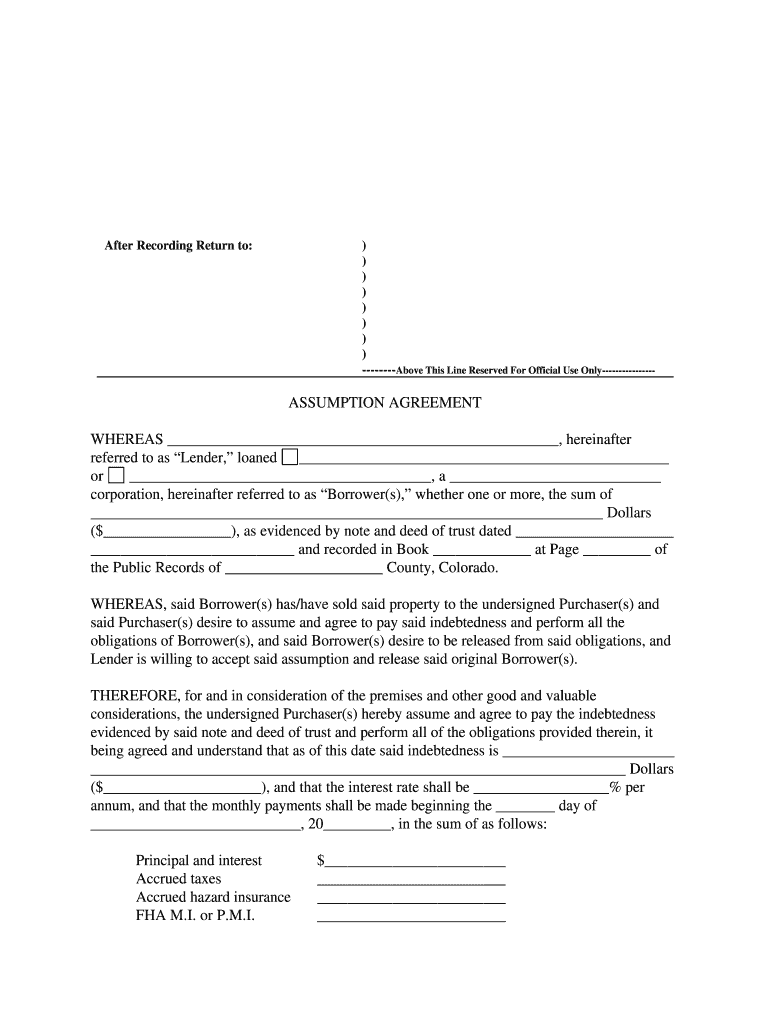

The assumption of mortgage form is a legal document that allows a borrower to take over the mortgage obligations of another borrower. This form is essential in transactions where the current homeowner wishes to transfer their mortgage to a new buyer, enabling the buyer to assume the existing loan terms. The assumption request form typically includes details such as the original loan amount, interest rate, and payment schedule, which are critical for both parties to understand their financial responsibilities.

Steps to complete the assumption of mortgage form

Completing the assumption of mortgage form involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including the original mortgage documents and personal identification for both the current homeowner and the buyer. Next, fill out the form with the required details, ensuring that all information is accurate and up to date. After completing the form, both parties should review it for any errors or omissions. Finally, submit the form to the mortgage lender for approval, along with any required documentation.

Legal use of the assumption of mortgage form

The assumption of mortgage form is legally binding when executed correctly. To ensure its legality, the form must comply with relevant federal and state laws governing mortgage assumptions. This includes obtaining written consent from the lender, as many mortgage agreements contain a due-on-sale clause that requires lender approval before a mortgage can be assumed. Additionally, both parties must provide valid signatures, and the form should be notarized if required by state law to enhance its legal standing.

Key elements of the assumption of mortgage form

Several key elements must be included in the assumption of mortgage form for it to be valid. These elements typically consist of:

- Borrower Information: Names and contact details of both the current homeowner and the buyer.

- Loan Details: Information about the existing mortgage, including the loan amount, interest rate, and payment terms.

- Property Description: A detailed description of the property associated with the mortgage.

- Lender Approval: A section for the lender to provide consent for the mortgage assumption.

- Signatures: Signatures of all parties involved, including witnesses if necessary.

How to obtain the assumption of mortgage form

The assumption of mortgage form can typically be obtained from the mortgage lender or financial institution that holds the original loan. Many lenders provide these forms on their websites for easy access. Additionally, legal and financial advisors may have templates or examples of the form that can be customized for specific situations. It is essential to ensure that the correct version of the form is used, as requirements may vary by lender and state.

Form submission methods

Once the assumption of mortgage form is completed, it can be submitted to the lender through various methods. Common submission methods include:

- Online Submission: Many lenders offer online portals where forms can be uploaded and submitted electronically.

- Mail: The completed form can be printed and mailed to the lender's designated address.

- In-Person: Some borrowers may choose to deliver the form in person at the lender's office for immediate processing.

Quick guide on how to complete assumption of mortgage form

Complete Assumption Of Mortgage Form seamlessly on any device

Online document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, as you can locate the appropriate form and securely store it online. airSlate SignNow provides you with all the tools you need to create, modify, and eSign your documents quickly without delays. Manage Assumption Of Mortgage Form on any platform with airSlate SignNow Android or iOS applications and enhance any document-based task today.

How to modify and eSign Assumption Of Mortgage Form effortlessly

- Find Assumption Of Mortgage Form and click Get Form to begin.

- Utilize the tools we offer to fill in your form.

- Select important sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Forget about lost or misfiled documents, laborious form searching, or mistakes that necessitate printing new document versions. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Edit and eSign Assumption Of Mortgage Form and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the assumption of mortgage form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an assumption request form?

An assumption request form is a document that allows parties to request the assumption of obligations under a contract. By using airSlate SignNow, users can easily create and send an assumption request form for eSigning, ensuring compliance and proper record-keeping.

-

How can I create an assumption request form with airSlate SignNow?

Creating an assumption request form with airSlate SignNow is straightforward. Simply log into your account, use the document creation tools to build your form, and then send it for eSignature. This process helps streamline contract management for your business.

-

Is there a cost associated with using airSlate SignNow for the assumption request form?

Yes, airSlate SignNow offers various pricing plans to fit different business needs. By choosing the right plan, you can create and send unlimited assumption request forms, making it a cost-effective solution for your document management.

-

What features does airSlate SignNow offer for managing an assumption request form?

airSlate SignNow includes several features for managing an assumption request form, such as customizable templates, automated workflow options, and secure eSignature capabilities. These features enhance your ability to efficiently manage documents and track their status.

-

Can I integrate airSlate SignNow with other tools for assumption request forms?

Absolutely! airSlate SignNow integrates seamlessly with a variety of applications, allowing you to enhance the functionality of your assumption request form. This includes integrations with CRM systems, cloud storage solutions, and more, which can help streamline your workflow.

-

What are the benefits of using airSlate SignNow for an assumption request form?

Using airSlate SignNow for your assumption request form offers numerous benefits. It simplifies the signing process, saves time, enhances security, and provides you with audit trails for compliance purposes. This is ideal for businesses looking to optimize their document management.

-

How secure is the assumption request form on airSlate SignNow?

Security is a top priority at airSlate SignNow. Your assumption request form is protected with multiple layers of security, including encryption, secure cloud storage, and compliance with industry standards. You can trust that your documents are safe and confidential.

Get more for Assumption Of Mortgage Form

Find out other Assumption Of Mortgage Form

- eSign Rhode Island High Tech Promissory Note Template Simple

- How Do I eSign South Carolina High Tech Work Order

- eSign Texas High Tech Moving Checklist Myself

- eSign Texas High Tech Moving Checklist Secure

- Help Me With eSign New Hampshire Government Job Offer

- eSign Utah High Tech Warranty Deed Simple

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter