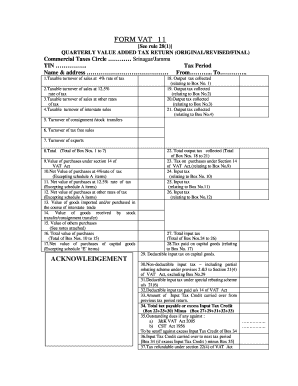

Vat 11 Form

What is the Vat 11 Form

The Vat 11 form is a crucial document used in various administrative processes, particularly in the context of taxation and compliance. This form is typically required for businesses and individuals to report value-added tax (VAT) information. It serves as a formal declaration to the relevant tax authorities, detailing the VAT collected and paid during a specific period. Understanding the purpose and requirements of the Vat 11 form is essential for ensuring compliance with tax regulations.

Steps to complete the Vat 11 Form

Completing the Vat 11 form involves several key steps to ensure accuracy and compliance. Here are the essential steps:

- Gather necessary financial records, including sales invoices and purchase receipts.

- Calculate the total VAT collected from sales and the total VAT paid on purchases.

- Fill out the Vat 11 form with the calculated figures, ensuring all sections are completed accurately.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the appropriate tax authority by the specified deadline.

Legal use of the Vat 11 Form

The legal use of the Vat 11 form is governed by various regulations that ensure its validity and enforceability. To be considered legally binding, the form must be completed accurately and submitted within the required timeframe. Compliance with relevant tax laws is crucial, as failure to do so may result in penalties or legal repercussions. It is important to maintain proper records and documentation to support the information provided in the Vat 11 form.

How to obtain the Vat 11 Form

Obtaining the Vat 11 form is a straightforward process. It is typically available through the official website of the tax authority or relevant governmental agency. Additionally, physical copies may be accessible at local tax offices. For convenience, many users opt to download the form online, ensuring they have the most current version. Always verify that you are using the correct form version to avoid compliance issues.

Required Documents

When completing the Vat 11 form, several documents are required to support the information provided. These documents may include:

- Sales invoices that detail the VAT collected.

- Purchase receipts that outline the VAT paid.

- Previous VAT returns, if applicable, for reference.

- Any additional supporting documentation required by the tax authority.

Form Submission Methods

Submitting the Vat 11 form can be done through various methods, depending on the regulations set by the tax authority. Common submission methods include:

- Online submission through the tax authority's official portal.

- Mailing a physical copy of the completed form to the designated address.

- In-person submission at local tax offices, if permitted.

Quick guide on how to complete vat 11 form

Effortlessly Prepare Vat 11 Form on Any Device

Digital document management has become increasingly popular among enterprises and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed papers, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to swiftly create, edit, and eSign your documents without interruptions. Manage Vat 11 Form on any device using airSlate SignNow's apps for Android or iOS and enhance any document-driven task today.

Edit and eSign Vat 11 Form with Ease

- Obtain Vat 11 Form and click on Get Form to start.

- Utilize the tools we offer to complete your document.

- Mark important sections of the documents or conceal sensitive information using the tools specifically designed by airSlate SignNow for that purpose.

- Create your eSignature with the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Select your preferred method for sharing your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Adjust and eSign Vat 11 Form to ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the vat 11 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is VAT11 and how does airSlate SignNow support it?

VAT11 refers to the specific form required for businesses to report and claim VAT refunds on their transactions. AirSlate SignNow allows users to easily create and eSign VAT11 documents, streamlining the filing process while ensuring compliance with tax regulations.

-

How much does airSlate SignNow cost for VAT11 document handling?

AirSlate SignNow offers flexible pricing plans that cater to various business needs, including those requiring VAT11 document handling. By subscribing to one of our plans, you can access eSigning features crucial for managing your VAT11 forms efficiently.

-

What features does airSlate SignNow offer for processing VAT11 forms?

AirSlate SignNow provides a variety of features beneficial for processing VAT11 forms, including custom templates, automated workflows, and real-time tracking of document status. These features enhance productivity and ensure that your VAT11 submissions are timely and accurate.

-

Can you integrate airSlate SignNow with other tools to manage VAT11 submissions?

Yes, airSlate SignNow offers integrations with popular business tools such as CRM systems and accounting software. These integrations can simplify the management of documents and make it easier to prepare and submit your VAT11 forms accurately.

-

What are the benefits of using airSlate SignNow for VAT11 filing?

Using airSlate SignNow for VAT11 filing offers numerous benefits, including reduced paperwork, improved accuracy in document preparation, and enhanced team collaboration. The digital signature feature ensures your VAT11 forms are legally compliant and secure.

-

Is airSlate SignNow compliant with tax regulations for VAT11?

Absolutely, airSlate SignNow is designed to comply with relevant tax regulations, including those concerning VAT11 submissions. Our platform ensures that all eSigned VAT11 documents meet the legal standards required by tax authorities.

-

How easy is it to use airSlate SignNow for VAT11-related documents?

AirSlate SignNow is user-friendly, making it easy for anyone to complete and eSign VAT11-related documents. With a simple interface, users can quickly navigate through the platform and manage their VAT11 submissions without any hassle.

Get more for Vat 11 Form

- Planning cayman online form

- Ohio provider medical prior authorization request form caresource

- Dd0137 3 pdf form

- Dcs records request form

- Form 5161 multistate loan modification agreement to a fixed rate single family uniform mortgage instruments

- Nppsc 1900 1 388607348 form

- Uno school of social work practicum agreement form unomaha

- Verification worksheet for dependent students kean university kean form

Find out other Vat 11 Form

- eSign Texas Renter's contract Mobile

- How Do I eSign Texas Renter's contract

- eSign Hawaii Sales contract template Myself

- How Can I eSign Washington Real estate sales contract template

- How To eSignature California Stock Certificate

- How Can I eSignature Texas Stock Certificate

- Help Me With eSign Florida New employee checklist

- How To eSign Illinois Rental application

- How To eSignature Maryland Affidavit of Identity

- eSignature New York Affidavit of Service Easy

- How To eSignature Idaho Affidavit of Title

- eSign Wisconsin Real estate forms Secure

- How To eSign California Real estate investment proposal template

- eSignature Oregon Affidavit of Title Free

- eSign Colorado Real estate investment proposal template Simple

- eSign Louisiana Real estate investment proposal template Fast

- eSign Wyoming Real estate investment proposal template Free

- How Can I eSign New York Residential lease

- eSignature Colorado Cease and Desist Letter Later

- How Do I eSignature Maine Cease and Desist Letter