Skip a Pay Form Atlanta Postal Credit Union

What is the Skip A Pay Form Atlanta Postal Credit Union

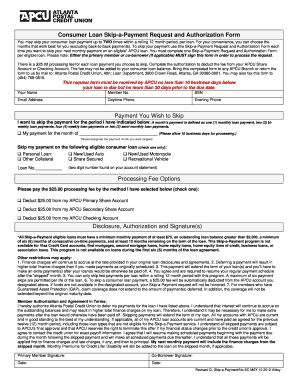

The Skip A Pay form from Atlanta Postal Credit Union (APCU) is a financial document that allows members to temporarily defer their loan payments. This option can be beneficial for those facing unexpected financial challenges, such as medical emergencies or job loss. By completing this form, members can request to skip a payment on eligible loans, providing them with some financial relief during difficult times.

How to use the Skip A Pay Form Atlanta Postal Credit Union

Using the Skip A Pay form is straightforward. Members can access the form through the Atlanta Postal Credit Union website or mobile app. Once they have the form, they need to fill it out with the required information, including their account details and the specific loan for which they wish to skip a payment. After completing the form, members can submit it electronically through the APCU app or print it out and send it via mail or in person to their local branch.

Steps to complete the Skip A Pay Form Atlanta Postal Credit Union

Completing the Skip A Pay form involves several key steps:

- Access the form through the APCU website or app.

- Fill in your personal information, including your name, account number, and loan details.

- Indicate which payment you wish to skip and provide any additional required information.

- Review the form for accuracy to ensure all details are correct.

- Submit the form electronically or print it out for mailing or in-person delivery.

Legal use of the Skip A Pay Form Atlanta Postal Credit Union

The Skip A Pay form is legally binding once it is completed and submitted according to the guidelines set by Atlanta Postal Credit Union. To ensure its validity, members must adhere to the terms outlined in the form, including any eligibility criteria and submission deadlines. This adherence helps protect both the member and the credit union, ensuring that the process is compliant with applicable financial regulations.

Key elements of the Skip A Pay Form Atlanta Postal Credit Union

Several key elements are essential for the Skip A Pay form to be processed correctly:

- Member Information: Personal details such as name, address, and account number.

- Loan Information: Specific details about the loan for which the payment is being skipped.

- Signature: The member's signature is required to validate the request.

- Submission Date: The date the form is submitted is crucial for processing.

Eligibility Criteria

To qualify for the Skip A Pay option, members must meet certain eligibility criteria set by Atlanta Postal Credit Union. Typically, this includes having an account in good standing, not having previously skipped a payment within a specified timeframe, and ensuring that the loan is not in default. Members are encouraged to review these criteria before submitting their request to avoid delays in processing.

Quick guide on how to complete skip a pay form atlanta postal credit union

Accomplish Skip A Pay Form Atlanta Postal Credit Union seamlessly on any device

Digital document management has become increasingly favored among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the correct form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and electronically sign your documents quickly and efficiently. Manage Skip A Pay Form Atlanta Postal Credit Union on any platform using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to modify and electronically sign Skip A Pay Form Atlanta Postal Credit Union effortlessly

- Obtain Skip A Pay Form Atlanta Postal Credit Union and click on Get Form to begin.

- Utilize the features we provide to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information using tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, a process that takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to store your modifications.

- Select how you wish to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious document searches, or errors requiring the printing of new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Modify and electronically sign Skip A Pay Form Atlanta Postal Credit Union while ensuring effective communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the skip a pay form atlanta postal credit union

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What does it mean to APCU skip a payment?

APCU skip a payment refers to the option provided by APCU to temporarily defer a scheduled payment on your loan or credit account. This can help ease financial stress during unexpected circumstances. It’s important to check eligibility and the terms associated with the APCU skip a payment feature.

-

How can I apply for the APCU skip a payment?

To apply for the APCU skip a payment, you typically need to log into your APCU online account or contact their customer service. Ensure to review any requirements and deadlines for submitting your request. Applying early can help ensure you successfully use the APCU skip a payment option.

-

Are there any fees associated with the APCU skip a payment?

Generally, there may be fees associated with the APCU skip a payment option, depending on your specific loan terms. It's recommended to review your loan agreement or contact APCU for detailed information. Being informed about these fees is essential when considering the APCU skip a payment option.

-

Can I use the APCU skip a payment benefit more than once?

The ability to use the APCU skip a payment benefit multiple times often depends on your loan type and APCU’s policies. Some loans allow it once per year, while others may have different rules. Be sure to verify your eligibility with APCU for any future APCU skip a payment requests.

-

What types of loans are eligible for the APCU skip a payment program?

Typically, various loan types such as auto loans and personal loans may be eligible for the APCU skip a payment program. However, each loan may have different criteria. Check with APCU to confirm which specific loans qualify for the APCU skip a payment feature.

-

How does APCU skip a payment impact my credit score?

Using the APCU skip a payment option may affect your credit score in nuanced ways, particularly regarding payment history. Generally, if arranged properly, it shouldn’t negatively impact your score. Always ensure that your payments are administered correctly to maintain a positive credit standing when utilizing the APCU skip a payment feature.

-

What benefits does the APCU skip a payment feature provide?

The APCU skip a payment feature provides signNow financial relief by allowing you to defer payments during tough times. This can improve cash flow and help you manage unexpected expenses. Utilizing this feature strategically makes the APCU skip a payment option beneficial for many members.

Get more for Skip A Pay Form Atlanta Postal Credit Union

- Sample printable forms for a incident follow up

- Jfs 20125 form

- Noise survey template 76949891 form

- Courtesy driving form

- Sb 3209 wisconsin acknowledgement of manufactured home title surrender sb 3209 title surrender form

- Phone 6082662112web httpdsps wi govemail d form

- Form 2500 118 2500 118 pdf

- Doa applying for a new raffle license wisconsin department of form

Find out other Skip A Pay Form Atlanta Postal Credit Union

- eSign New York Courts Business Plan Template Later

- Can I eSign North Carolina Courts Limited Power Of Attorney

- eSign North Dakota Courts Quitclaim Deed Safe

- How To eSign Rhode Island Sports Quitclaim Deed

- Help Me With eSign Oregon Courts LLC Operating Agreement

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple

- eSign Utah Courts Last Will And Testament Free

- eSign Ohio Police LLC Operating Agreement Mobile

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement

- eSign Wyoming Courts Quitclaim Deed Simple

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure