MOD 01 DJR Steuerliches Info Center Form

What is the MOD 01 DJR Steuerliches info center

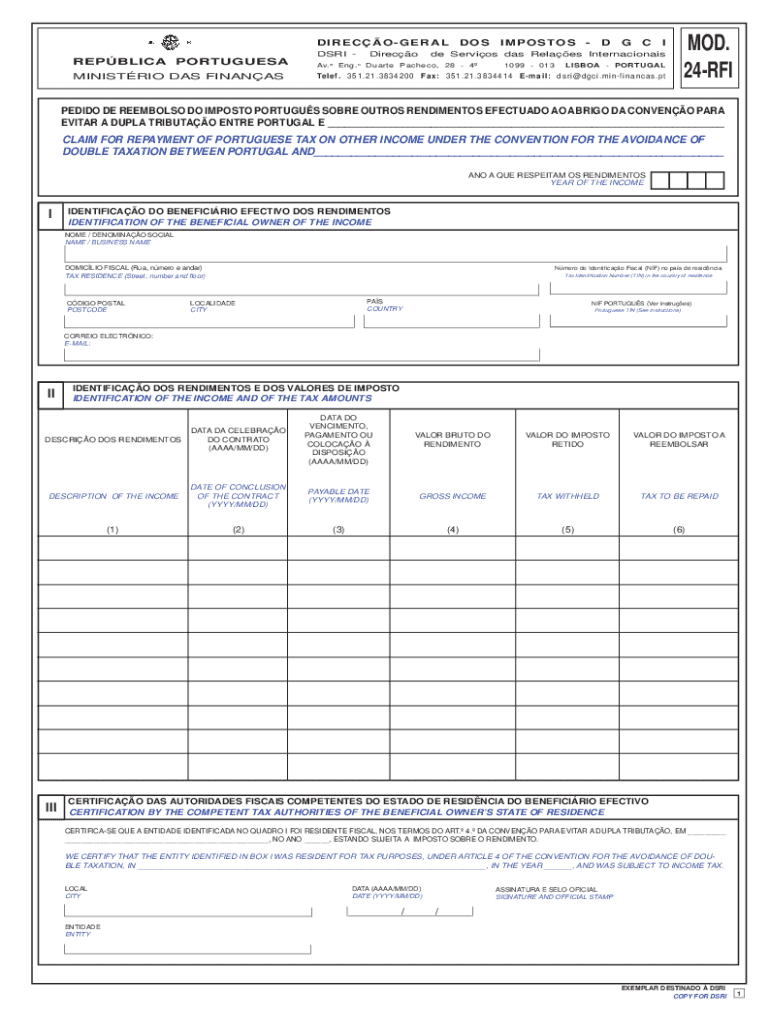

The MOD 01 DJR Steuerliches info center is a specific form used for tax-related purposes within the United States. This document typically serves as a means for individuals or businesses to report financial information to the relevant tax authorities. Understanding its purpose is crucial for ensuring compliance with tax regulations and for accurate reporting of income and deductions.

How to use the MOD 01 DJR Steuerliches info center

Using the MOD 01 DJR Steuerliches info center involves several steps to ensure that all required information is accurately captured. Users should first gather necessary financial documents, such as income statements and expense receipts. Next, fill out the form with precise details, ensuring that all sections are completed according to the guidelines. After completing the form, it's important to review the information for accuracy before submission.

Steps to complete the MOD 01 DJR Steuerliches info center

Completing the MOD 01 DJR Steuerliches info center requires a systematic approach. Begin by obtaining the latest version of the form. Follow these steps:

- Gather all relevant financial documents.

- Fill out personal identification information at the top of the form.

- Provide detailed financial information, including income and deductions.

- Double-check all entries for accuracy.

- Sign and date the form as required.

Legal use of the MOD 01 DJR Steuerliches info center

The legal use of the MOD 01 DJR Steuerliches info center is governed by federal and state tax laws. To ensure that the form is legally binding, it must be completed accurately and submitted within the designated deadlines. Compliance with relevant tax regulations is essential to avoid penalties and ensure that the information provided is accepted by tax authorities.

Filing Deadlines / Important Dates

Filing deadlines for the MOD 01 DJR Steuerliches info center can vary based on the tax year and the type of filer. Generally, individual tax returns are due by April fifteenth, while extensions may be available. It is crucial to be aware of these deadlines to avoid late filing penalties and ensure timely processing of the form.

Required Documents

To successfully complete the MOD 01 DJR Steuerliches info center, certain documents are required. These typically include:

- W-2 forms from employers.

- 1099 forms for additional income.

- Receipts for deductible expenses.

- Previous year’s tax return for reference.

Form Submission Methods (Online / Mail / In-Person)

The MOD 01 DJR Steuerliches info center can be submitted through various methods. Taxpayers may choose to file online using approved e-filing software, which often provides a user-friendly interface for completing the form. Alternatively, the form can be mailed to the appropriate tax authority or submitted in person at designated offices. Each method has its own processing times and requirements, so it's important to choose the one that best suits individual needs.

Quick guide on how to complete mod 01 djr steuerliches info center

Effortlessly Prepare MOD 01 DJR Steuerliches info center on Any Device

Digital document management has become increasingly popular among companies and individuals. It serves as an ideal environmentally friendly substitute to traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all necessary tools to create, alter, and electronically sign your documents swiftly and without hassle. Manage MOD 01 DJR Steuerliches info center on any device with airSlate SignNow's Android or iOS applications and streamline any document-related procedure today.

The easiest method to modify and electronically sign MOD 01 DJR Steuerliches info center without difficulty

- Locate MOD 01 DJR Steuerliches info center and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize essential sections of the documents or obscure confidential information using tools that airSlate SignNow specifically provides for that purpose.

- Generate your signature with the Sign feature, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your adjustments.

- Select your preferred method to send your form, via email, SMS, invitation link, or download it to your PC.

Say goodbye to lost or misplaced files, lengthy form searching, or errors that require reprinting new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Modify and electronically sign MOD 01 DJR Steuerliches info center and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the mod 01 djr steuerliches info center

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the MOD 01 DJR Steuerliches info center?

The MOD 01 DJR Steuerliches info center is a comprehensive digital platform designed to streamline actions related to taxation and compliance. It provides users with essential tools and information, ensuring they can manage their tax-related documents efficiently. By utilizing airSlate SignNow, businesses benefit from a user-friendly interface to handle their documents related to the MOD 01 DJR Steuerliches info center.

-

How can airSlate SignNow help with the MOD 01 DJR Steuerliches info center?

airSlate SignNow facilitates the signing and management of documents linked to the MOD 01 DJR Steuerliches info center. With its seamless eSigning capabilities, users can quickly prepare, send, and sign important tax documents without hassle. This ensures timely compliance and minimizes errors associated with traditional paper processes.

-

What are the pricing options for using airSlate SignNow with the MOD 01 DJR Steuerliches info center?

airSlate SignNow offers flexible pricing plans tailored to different business needs, including the MOD 01 DJR Steuerliches info center. Users can select from various tiers, ensuring they find a solution that fits their budget while maximizing the platform's features. Check our website for detailed pricing information and any ongoing promotions.

-

Does airSlate SignNow provide integration with other tools for the MOD 01 DJR Steuerliches info center?

Yes, airSlate SignNow integrates beautifully with a range of productivity tools and platforms essential for managing the MOD 01 DJR Steuerliches info center. Whether it's CRM systems, cloud storage services, or project management software, our integrations enhance workflow efficiency. This allows users to work seamlessly across platforms, improving document management.

-

What features does airSlate SignNow offer for the MOD 01 DJR Steuerliches info center?

airSlate SignNow is packed with features beneficial for users navigating the MOD 01 DJR Steuerliches info center. Key features include customizable templates, automated workflows, and real-time tracking of document status. These tools simplify the management of tax documents, making the entire process more efficient.

-

How secure is airSlate SignNow for handling the MOD 01 DJR Steuerliches info center documents?

Security is paramount when dealing with the MOD 01 DJR Steuerliches info center and airSlate SignNow prioritizes document safety. The platform employs advanced encryption methods and complies with regulatory standards to ensure your sensitive information remains protected. Users can confidently send and sign documents knowing their data is secure.

-

Can I use airSlate SignNow on mobile devices for the MOD 01 DJR Steuerliches info center?

Absolutely! airSlate SignNow is designed to be mobile-responsive, allowing users to access the MOD 01 DJR Steuerliches info center on various devices. This means you can manage and sign your documents from anywhere, whether you're in the office or on the go, enhancing your workflow flexibility.

Get more for MOD 01 DJR Steuerliches info center

- Cochise college transcripts form

- Form k template

- Disney vendor portal form

- By signing this release and cancellation of contract for sale and purchase release buyer form

- Tesserino funghi capanne di marcarolo form

- Clinical field experience verification form

- Microbiology request form

- Permission form for vision screening

Find out other MOD 01 DJR Steuerliches info center

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself

- Help Me With Electronic signature Missouri Government Rental Application

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement

- Electronic signature New Jersey Government Promissory Note Template Online

- Electronic signature Michigan Education LLC Operating Agreement Myself

- How To Electronic signature Massachusetts Finance & Tax Accounting Quitclaim Deed

- Electronic signature Michigan Finance & Tax Accounting RFP Now

- Electronic signature Oklahoma Government RFP Later

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online