Cpa Form 2

What is the CPA Form 2?

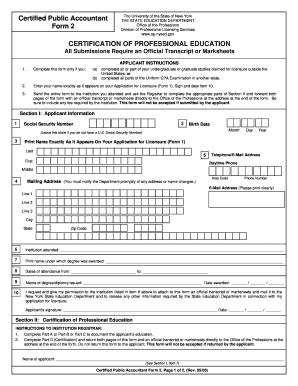

The CPA Form 2, also known as the CPA application form, is a critical document used by individuals seeking to obtain a Certified Public Accountant (CPA) license in the United States. This form is specifically tailored for applicants who have met the educational and experience requirements set forth by the state licensing boards. The form collects essential information about the applicant's qualifications, including education history, work experience, and personal identification details.

Completing the CPA Form 2 accurately is vital, as it serves as the foundation for the licensing process. Each state may have its own version of the form, but the core elements remain consistent across jurisdictions, ensuring that applicants provide the necessary information for evaluation.

How to Use the CPA Form 2

Using the CPA Form 2 involves several steps to ensure that all required information is accurately provided. First, applicants should download the form from their state board of accountancy's website or access it through a trusted digital platform. Once obtained, applicants should carefully read the instructions accompanying the form to understand the specific requirements for their state.

Next, applicants must fill out the form completely, providing details such as educational background, relevant work experience, and personal identification. It is crucial to double-check all entries for accuracy, as any discrepancies can lead to delays in processing. After completing the form, applicants can submit it according to the guidelines provided, which may include online submission, mailing a physical copy, or delivering it in person to the appropriate office.

Steps to Complete the CPA Form 2

Completing the CPA Form 2 requires a systematic approach to ensure all information is accurately recorded. Follow these steps:

- Gather Required Documents: Collect transcripts, proof of work experience, and identification documents that may be needed to complete the form.

- Download the Form: Access the CPA Form 2 from your state board's website or a trusted source.

- Read Instructions: Familiarize yourself with the specific requirements and instructions for your state to avoid mistakes.

- Fill Out the Form: Provide all requested information, ensuring accuracy and completeness.

- Review Your Submission: Check for any errors or omissions before finalizing your submission.

- Submit the Form: Follow the submission guidelines, whether online, by mail, or in person.

Legal Use of the CPA Form 2

The CPA Form 2 is legally binding once completed and submitted. It serves as an official request for licensure and must adhere to the regulations set forth by the state board of accountancy. To ensure its legal standing, applicants must provide truthful and accurate information, as any false statements can lead to disqualification or revocation of licensure.

Additionally, the form must comply with various legal frameworks governing eSignatures and digital document submissions, ensuring that the electronic version of the form is treated with the same legal weight as a paper document. Understanding these legal implications is crucial for applicants to navigate the licensing process effectively.

Required Documents for the CPA Form 2

When completing the CPA Form 2, applicants must provide several supporting documents to validate their qualifications. These typically include:

- Transcripts: Official academic records from accredited institutions demonstrating the completion of required accounting courses.

- Proof of Work Experience: Documentation verifying relevant work experience under the supervision of a licensed CPA.

- Identification Documents: A government-issued ID, such as a driver's license or passport, to confirm identity.

- Additional Forms: Some states may require supplementary forms or affidavits related to character references or background checks.

Ensuring that all required documents are included with the CPA Form 2 is essential for a smooth application process.

Form Submission Methods

Submitting the CPA Form 2 can be done through various methods, depending on the preferences of the state board of accountancy. Common submission methods include:

- Online Submission: Many states offer an online portal where applicants can fill out and submit the form electronically.

- Mail: Applicants may also choose to print the completed form and send it via postal mail to the designated office.

- In-Person Submission: Some applicants prefer to deliver the form in person, allowing for immediate confirmation of receipt.

Each submission method has its own timeline for processing, so applicants should be aware of the expected time frames for their chosen method.

Quick guide on how to complete cpa form 2

Effortlessly Prepare Cpa Form 2 on Any Device

Digital document management has become increasingly popular among organizations and individuals. It offers a sustainable alternative to conventional printed and signed documents, allowing you to obtain the correct format and safely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your files quickly and without delays. Manage Cpa Form 2 on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

Effortlessly Edit and eSign Cpa Form 2

- Locate Cpa Form 2 and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Mark important sections of your documents or obscure sensitive details with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign function, which takes only seconds and carries the same legal validity as a traditional ink signature.

- Review all the details and click the Done button to finalize your changes.

- Select your preferred method for submitting your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Cpa Form 2 while ensuring outstanding communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the cpa form 2

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a CPA form and how does it work with airSlate SignNow?

A CPA form is a crucial document used by certified public accountants for various financial tasks. With airSlate SignNow, you can easily create, send, and eSign CPA forms securely. Our platform ensures that all signatories can collaborate on the document in real-time, streamlining your accounting processes.

-

How do I create a CPA form using airSlate SignNow?

Creating a CPA form with airSlate SignNow is simple. Start by choosing a template or uploading your document, then use our intuitive editor to add fields for signatures, dates, and other necessary information. Once your CPA form is ready, you can send it out for eSignature seamlessly.

-

Is there a cost associated with using airSlate SignNow for CPA forms?

Yes, airSlate SignNow offers various pricing plans designed to fit the needs of businesses of all sizes. Our packages are cost-effective, allowing you to manage unlimited CPA forms without breaking the bank. You can explore our website for detailed pricing tiers and choose the one that suits your requirements.

-

What features does airSlate SignNow offer for CPA forms?

airSlate SignNow provides a range of features to enhance your CPA form management. Key offerings include customizable templates, real-time collaboration, automated reminders, and secure cloud storage. These features work together to simplify the signing process and improve overall productivity.

-

Can I integrate airSlate SignNow with other tools for CPA form management?

Absolutely! airSlate SignNow seamlessly integrates with various tools and platforms such as CRM systems, cloud storage services, and document management software. This allows you to streamline your workflow and manage your CPA forms more efficiently across all your favorite applications.

-

How secure is the data on my CPA forms with airSlate SignNow?

Security is our top priority at airSlate SignNow. We use advanced encryption techniques and multi-factor authentication to protect your CPA forms and sensitive information. You can rest assured that your documents are safe and secure during the entire signing process.

-

Can I track the status of my CPA forms in airSlate SignNow?

Yes, tracking the status of your CPA forms is easy with airSlate SignNow. Our platform provides you with real-time updates on when a document has been sent, viewed, or completed. This feature helps you stay organized and ensures that your CPA forms are handled promptly.

Get more for Cpa Form 2

Find out other Cpa Form 2

- Help Me With eSign Kentucky Legal Quitclaim Deed

- eSign Louisiana Legal Limited Power Of Attorney Online

- How Can I eSign Maine Legal NDA

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free

- How Can I eSign Hawaii Non-Profit Cease And Desist Letter

- Can I eSign Florida Non-Profit Residential Lease Agreement

- eSign Idaho Non-Profit Business Plan Template Free

- eSign Indiana Non-Profit Business Plan Template Fast