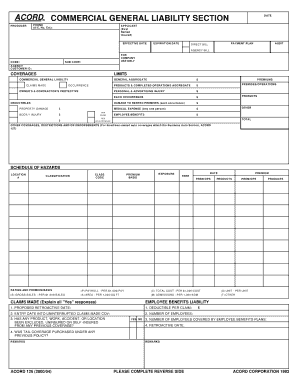

COMMERCIAL GENERAL LIABILITY SECTION DATE Form

Understanding the Texas Commercial General Liability Section Date

The Texas commercial general liability section date is a crucial document for businesses operating within the state. It outlines the liability coverage that protects against claims of bodily injury, property damage, and personal injury. This form is essential for ensuring that businesses have the necessary protection in place to operate safely and legally. Understanding its components can help business owners make informed decisions regarding their insurance needs.

Steps to Complete the Texas Commercial General Liability Section Date

Completing the Texas commercial general liability section date involves several key steps:

- Gather necessary information about your business, including its legal structure, location, and the nature of its operations.

- Identify the specific coverage limits and deductibles that align with your business needs.

- Provide accurate details about any previous claims or incidents that may affect your coverage.

- Review the form for completeness and accuracy before submission.

Legal Use of the Texas Commercial General Liability Section Date

The legal use of the Texas commercial general liability section date is defined by state regulations and insurance laws. This form must be filled out accurately and submitted to ensure that the coverage is valid. Businesses must comply with all relevant legal requirements to avoid potential liabilities and ensure that their insurance is enforceable in court. Understanding these legal frameworks is essential for maintaining compliance and protecting your business interests.

Key Elements of the Texas Commercial General Liability Section Date

Several key elements are critical to the Texas commercial general liability section date:

- Coverage Types: This includes bodily injury, property damage, and personal injury coverage.

- Policy Limits: The maximum amount the insurer will pay for claims under the policy.

- Exclusions: Specific situations or damages that are not covered by the policy.

- Endorsements: Additional provisions that can modify the standard coverage.

Obtaining the Texas Commercial General Liability Section Date

Obtaining the Texas commercial general liability section date typically involves contacting an insurance provider or broker. They can guide you through the process of acquiring the necessary coverage. It is important to compare different policies and providers to find the best fit for your business needs. Additionally, ensure that the provider is licensed to operate in Texas and has a good reputation within the industry.

State-Specific Rules for the Texas Commercial General Liability Section Date

Texas has specific rules governing the commercial general liability section date that businesses must adhere to. These regulations outline the minimum coverage requirements and stipulate how claims should be handled. Familiarizing yourself with these state-specific rules is vital to ensure compliance and to avoid potential legal issues. Businesses should consult with legal or insurance professionals to navigate these regulations effectively.

Quick guide on how to complete commercial general liability section date

Finish COMMERCIAL GENERAL LIABILITY SECTION DATE effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides you with all the tools needed to create, modify, and eSign your documents quickly without delays. Manage COMMERCIAL GENERAL LIABILITY SECTION DATE on any platform using airSlate SignNow applications for Android or iOS and enhance any document-related process today.

The easiest way to modify and eSign COMMERCIAL GENERAL LIABILITY SECTION DATE with ease

- Find COMMERCIAL GENERAL LIABILITY SECTION DATE and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about missing or lost documents, tedious form searches, or errors that require creating new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and eSign COMMERCIAL GENERAL LIABILITY SECTION DATE while ensuring exceptional communication throughout any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the commercial general liability section date

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Texas commercial general liability insurance?

Texas commercial general liability insurance protects businesses from claims related to bodily injury, property damage, and personal injury. This type of insurance is essential for any business operating in Texas, providing a safety net against lawsuits and financial losses that could arise from accidents or negligence.

-

Why do I need Texas commercial general liability insurance?

Having Texas commercial general liability insurance is crucial for safeguarding your business against unexpected claims. Without this coverage, a single lawsuit could lead to signNow financial distress, potentially jeopardizing your operations. It's an investment in your company's stability and reputation.

-

How much does Texas commercial general liability insurance cost?

The cost of Texas commercial general liability insurance varies based on factors such as business size, industry, and specific coverage needs. On average, small businesses can expect to pay between $400 and $1,500 annually. It's advisable to request quotes from multiple providers to find the best rates tailored to your situation.

-

What coverage options are included in Texas commercial general liability insurance?

Texas commercial general liability insurance typically includes coverage for bodily injury, property damage, personal and advertising injury, and medical payments. Each policy can be customized based on your business's needs and risks, ensuring comprehensive protection that aligns with your specific industry requirements.

-

How do I choose the right Texas commercial general liability policy?

To choose the right Texas commercial general liability policy, assess your business's unique risks and coverage requirements. Research different insurers and compare their offerings, ensuring they align with your industry standards. Consulting with a qualified insurance agent can also provide valuable insights and help tailor your policy.

-

Can I integrate airSlate SignNow with my Texas commercial general liability insurance provider?

Yes, airSlate SignNow can easily integrate with many Texas commercial general liability insurance providers, streamlining your document signing process. This integration facilitates quick contract management and enhances workflow efficiency, allowing you to focus on your business while ensuring compliance and security.

-

What are the benefits of using airSlate SignNow for Texas commercial general liability insurance documentation?

Using airSlate SignNow for Texas commercial general liability insurance documentation offers numerous benefits, including faster turnaround times and enhanced security. The intuitive platform enables businesses to send and eSign documents seamlessly, ensuring that important contracts are handled efficiently and securely.

Get more for COMMERCIAL GENERAL LIABILITY SECTION DATE

- Osha form 301 fillable

- Motion for remand form

- East west preauth form

- Wc 6 form

- Potvrda o zivotu form

- This is a legally binding contract between purchaser and mccookcentral k12 sd form

- Workers comp form 61 a

- Form 944 x rev february adjusted employers annual federal tax return or claim for refund 731664766

Find out other COMMERCIAL GENERAL LIABILITY SECTION DATE

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template