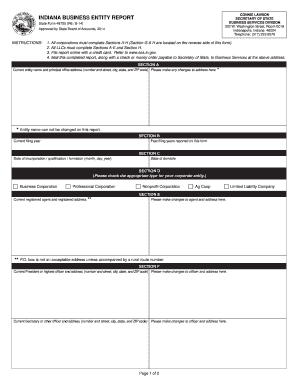

Business Entity Report Form

What is the Business Entity Report

The Indiana business entity report is a legal document required for businesses operating in the state of Indiana. This report provides essential information about the business, including its name, address, and the names of its officers or members. It serves as a means for the state to maintain updated records on all registered entities, ensuring compliance with state regulations. Businesses must file this report annually to remain in good standing and avoid penalties.

Steps to complete the Business Entity Report

Completing the Indiana business entity report involves several straightforward steps:

- Gather necessary information, such as the business name, address, and details of officers or members.

- Access the Indiana business entity report form online through the Indiana Secretary of State's website.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the information for accuracy and completeness before submission.

- Submit the report electronically or via mail, depending on your preference.

Legal use of the Business Entity Report

The Indiana business entity report is legally binding and must be filed in accordance with state laws. It is used by various governmental agencies to verify the legitimacy of a business and to ensure that it complies with state regulations. Failure to file the report can result in penalties, including the potential dissolution of the business entity. Therefore, understanding the legal implications of this report is crucial for business owners.

Filing Deadlines / Important Dates

Businesses in Indiana must file their business entity report annually. The deadline for filing is typically the end of the anniversary month of the business's formation. For example, if a business was formed in March, the report is due by March 31 each year. It is essential to keep track of these deadlines to avoid late fees or penalties.

Form Submission Methods (Online / Mail / In-Person)

The Indiana business entity report can be submitted through various methods:

- Online: The preferred method is to file electronically via the Indiana Secretary of State's online portal.

- Mail: Businesses can print the completed form and mail it to the appropriate state office.

- In-Person: Reports can also be submitted in person at designated state offices.

Key elements of the Business Entity Report

When completing the Indiana business entity report, several key elements must be included:

- Business Name: The official name of the business as registered with the state.

- Principal Office Address: The primary location where the business operates.

- Registered Agent: The individual or entity designated to receive legal documents on behalf of the business.

- Officers or Members: Names and addresses of individuals who manage or own the business.

Quick guide on how to complete business entity report

Complete Business Entity Report effortlessly on any device

Web-based document management has gained traction among organizations and individuals. It offers an excellent eco-friendly substitute to conventional printed and signed documents, allowing you to obtain the correct form and safely store it online. airSlate SignNow equips you with all the tools required to create, amend, and eSign your documents quickly without delays. Manage Business Entity Report on any system with airSlate SignNow Android or iOS applications and enhance any document-related workflow today.

How to amend and eSign Business Entity Report with ease

- Locate Business Entity Report and click Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Emphasize pertinent parts of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes seconds and possesses the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), or invite link, or download it to your PC.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your requirements in document management with just a few clicks from your preferred device. Modify and eSign Business Entity Report and ensure superior communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the business entity report

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an Indiana business entity report?

An Indiana business entity report is a required filing that businesses in Indiana must submit to maintain good standing with the state. It provides essential information about your business, including its address, officers, and registered agent. Staying compliant with the Indiana business entity report is crucial to avoid penalties and ensure your business operates legally.

-

How often do I need to file an Indiana business entity report?

In Indiana, businesses are required to file an Indiana business entity report every two years. This ensures that your business's information remains current and compliant with state regulations. Failing to timely file the report can lead to administrative dissolution or penalties.

-

What are the costs associated with filing an Indiana business entity report?

The fees for filing an Indiana business entity report vary depending on the type of business entity you have registered. Typically, the cost ranges from $20 to $30, but it is important to check the latest fees on the Indiana Secretary of State's website. Utilizing airSlate SignNow can help streamline the payment process for your Indiana business entity report.

-

Can I amend my Indiana business entity report after filing?

Yes, if you need to make changes to your Indiana business entity report after filing, you can submit an amendment. It is important to correct any discrepancies promptly to maintain compliance with Indiana business regulations. airSlate SignNow can assist with electronically amending and resubmitting your report efficiently.

-

What information do I need to provide for the Indiana business entity report?

When filing your Indiana business entity report, you will need to provide essential information such as your business name, principal office address, officers' names, and registered agent details. Ensuring this information is accurate is crucial for meeting state's requirements and maintaining your business's good standing.

-

How can airSlate SignNow assist with my Indiana business entity report?

airSlate SignNow offers an easy-to-use platform for preparing, signing, and submitting your Indiana business entity report. The solution simplifies the document workflow, allowing you to manage filings efficiently and stay compliant with state regulations. With its cost-effective features, airSlate SignNow helps you save time and resources.

-

Are there benefits to using airSlate SignNow for my Indiana business entity report?

Yes, using airSlate SignNow for your Indiana business entity report offers numerous benefits such as reducing paperwork, automating reminders, and ensuring timely submissions. It also provides a secure platform for e-signatures and document storage, enhancing your overall business compliance and organization.

Get more for Business Entity Report

- Qantas student connect form

- Chapter 16 worksheet 2 and notes on histograms form

- Fingerprint matching worksheet answers form

- Drainage postural pdf form

- 49 cfr part 40 form

- Snap 38 rev 1019 0819 issue obsoletestate of lo form

- Isp idaho form

- Harmonised application form application for schengen visa turkish visa application through www visa govharmonised application

Find out other Business Entity Report

- How To Sign Massachusetts Copyright License Agreement

- How Do I Sign Vermont Online Tutoring Services Proposal Template

- How Do I Sign North Carolina Medical Records Release

- Sign Idaho Domain Name Registration Agreement Easy

- Sign Indiana Domain Name Registration Agreement Myself

- Sign New Mexico Domain Name Registration Agreement Easy

- How To Sign Wisconsin Domain Name Registration Agreement

- Sign Wyoming Domain Name Registration Agreement Safe

- Sign Maryland Delivery Order Template Myself

- Sign Minnesota Engineering Proposal Template Computer

- Sign Washington Engineering Proposal Template Secure

- Sign Delaware Proforma Invoice Template Online

- Can I Sign Massachusetts Proforma Invoice Template

- How Do I Sign Oklahoma Equipment Purchase Proposal

- Sign Idaho Basic rental agreement or residential lease Online

- How To Sign Oregon Business agreements

- Sign Colorado Generic lease agreement Safe

- How Can I Sign Vermont Credit agreement

- Sign New York Generic lease agreement Myself

- How Can I Sign Utah House rent agreement format