Amended Tax & Wage ReportForm 5208D Employment Security

What is the Amended Tax & Wage Report Form 5208D Employment Security

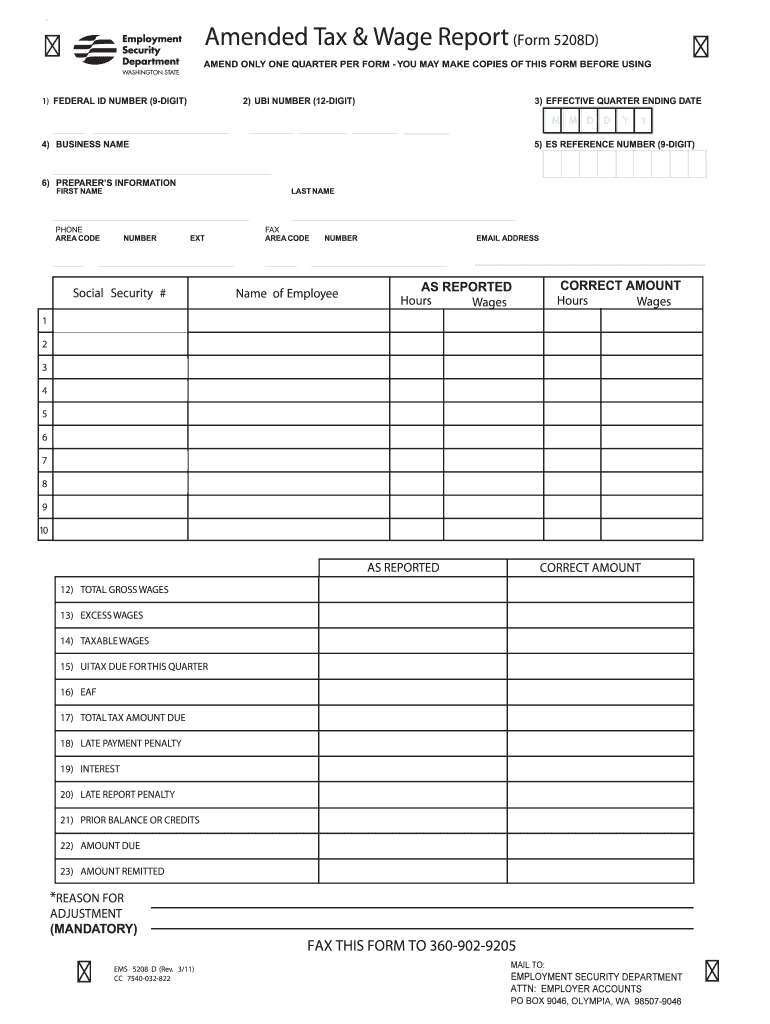

The Amended Tax & Wage Report Form 5208D Employment Security is a crucial document used by employers in the United States to report corrections to previously submitted wage and tax information. This form is essential for ensuring that employee records are accurate and up-to-date, which is vital for compliance with state and federal employment regulations. By amending prior submissions, employers can rectify errors related to employee wages, hours worked, and tax withholdings, thereby maintaining the integrity of their payroll records.

Steps to Complete the Amended Tax & Wage Report Form 5208D Employment Security

Completing the Amended Tax & Wage Report Form 5208D requires careful attention to detail. Here are the key steps to follow:

- Gather necessary information, including previous reports and employee details.

- Clearly indicate the amendments being made, specifying which sections of the original report are being corrected.

- Ensure that all calculations are accurate, particularly regarding wages and tax withholdings.

- Sign and date the form to validate the amendments.

- Submit the amended form to the appropriate state employment security agency.

Legal Use of the Amended Tax & Wage Report Form 5208D Employment Security

To be legally binding, the Amended Tax & Wage Report Form 5208D must comply with various regulatory standards. This includes adherence to the Electronic Signatures in Global and National Commerce (ESIGN) Act, which allows for electronic signatures to be legally recognized. Employers should ensure that they are using a secure platform for submission, which maintains compliance with relevant laws and protects sensitive employee data.

How to Obtain the Amended Tax & Wage Report Form 5208D Employment Security

The Amended Tax & Wage Report Form 5208D can typically be obtained from the website of the state employment security agency or department of labor. Many states provide downloadable PDF versions of the form, which can be filled out electronically or printed for manual completion. It is advisable to check for the most current version to ensure compliance with updated regulations.

Filing Deadlines / Important Dates

Employers must be aware of specific filing deadlines associated with the Amended Tax & Wage Report Form 5208D. Generally, amendments should be filed as soon as discrepancies are identified to avoid potential penalties. Each state may have different deadlines, so it is essential to consult the state employment security agency for precise dates and requirements.

Penalties for Non-Compliance

Failure to properly file the Amended Tax & Wage Report Form 5208D can result in significant penalties for employers. These may include fines, interest on unpaid taxes, and potential legal action. It is crucial for employers to correct any inaccuracies promptly to mitigate the risk of penalties and ensure compliance with employment laws.

Quick guide on how to complete amended tax ampampamp wage reportform 5208d employment security

Easily prepare Amended Tax & Wage ReportForm 5208D Employment Security on any device

Digital document management has gained traction among companies and individuals. It serves as a perfect environmentally friendly alternative to traditional printed and signed forms, as you can obtain the correct template and securely store it online. airSlate SignNow equips you with all the necessary tools to swiftly create, modify, and eSign your documents without delays. Manage Amended Tax & Wage ReportForm 5208D Employment Security across any platform with airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

The easiest way to edit and eSign Amended Tax & Wage ReportForm 5208D Employment Security effortlessly

- Obtain Amended Tax & Wage ReportForm 5208D Employment Security and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize relevant sections of the documents or redact sensitive information with features that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or disorganized files, tedious form searching, or mistakes requiring new document prints. airSlate SignNow fulfills all your document management needs with just a few clicks from your preferred device. Alter and eSign Amended Tax & Wage ReportForm 5208D Employment Security while ensuring excellent communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the amended tax ampampamp wage reportform 5208d employment security

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Amended Tax & Wage Report Form 5208D Employment Security?

The Amended Tax & Wage Report Form 5208D Employment Security is a document used to correct previously filed employment tax reports. This form ensures compliance with state regulations and allows businesses to amend errors in wage reporting and taxes. Utilizing this form can help prevent penalties and ensure accurate records with employment security agencies.

-

How can airSlate SignNow help with the Amended Tax & Wage Report Form 5208D Employment Security?

airSlate SignNow provides a streamlined platform for completing and eSigning the Amended Tax & Wage Report Form 5208D Employment Security. Its user-friendly interface allows businesses to easily fill out, review, and send the form to the appropriate agency without hassle. This feature saves time and ensures that your reports are submitted promptly.

-

Is there a cost associated with using airSlate SignNow for the Amended Tax & Wage Report Form 5208D Employment Security?

airSlate SignNow offers competitive pricing plans that cater to various business needs for handling documents like the Amended Tax & Wage Report Form 5208D Employment Security. Plans vary based on features and usage, ensuring that businesses can find a solution that fits their budget. Additionally, the cost-effectiveness of using this platform can lead to savings by reducing errors and enhancing productivity.

-

Can I integrate airSlate SignNow with other software for filing the Amended Tax & Wage Report Form 5208D Employment Security?

Yes, airSlate SignNow seamlessly integrates with various business applications, making it easier to manage the Amended Tax & Wage Report Form 5208D Employment Security. Integration with accounting and payroll software ensures that data flows smoothly, reducing manual entry and increasing accuracy. This interoperability enhances your filing experience and saves valuable time.

-

What features does airSlate SignNow offer for the Amended Tax & Wage Report Form 5208D Employment Security?

airSlate SignNow offers several features for handling the Amended Tax & Wage Report Form 5208D Employment Security, including electronic signatures, customizable templates, and secure cloud storage. These features simplify the document management process while ensuring compliance and enhancing data security. The ability to track document status also provides peace of mind for businesses.

-

Are there training resources available for using airSlate SignNow with the Amended Tax & Wage Report Form 5208D Employment Security?

Absolutely! airSlate SignNow provides a variety of training resources, including tutorials, webinars, and customer support, to assist users with the Amended Tax & Wage Report Form 5208D Employment Security. These resources make it easy for businesses to understand how to effectively use the platform and optimize their form filing process. Our support team is also available to answer any specific questions.

-

How secure is the information provided in the Amended Tax & Wage Report Form 5208D Employment Security using airSlate SignNow?

The security of your information is a top priority for airSlate SignNow. All data related to the Amended Tax & Wage Report Form 5208D Employment Security is protected with industry-standard encryption and secure access protocols. Additionally, the platform undergoes regular security audits to ensure compliance with data protection regulations.

Get more for Amended Tax & Wage ReportForm 5208D Employment Security

- Adddrop university of alaska anchorage uaa alaska form

- Download membership form chefs association of ghana

- Sample company profile form

- Mv37 form

- Ab circle pro manual form

- Texas arkansas exemption form

- Christmas iou certificate 300x232 christmas iou printable certificate form

- Creative director contract template form

Find out other Amended Tax & Wage ReportForm 5208D Employment Security

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure

- How Do I Electronic signature Colorado Government POA

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself

- Help Me With Electronic signature Missouri Government Rental Application

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement

- Electronic signature New Jersey Government Promissory Note Template Online