Central Texas College W2 Form

What is the Central Texas College W2 Form

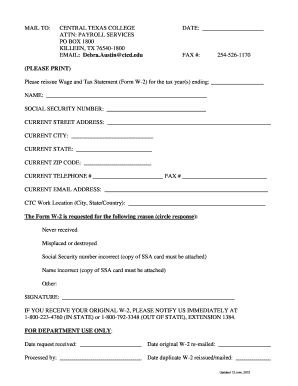

The Central Texas College W2 Form is a tax document provided by Central Texas College to its employees. This form reports the annual wages earned and the taxes withheld from those earnings. It is essential for employees to accurately complete their tax returns, as it provides the necessary information to the Internal Revenue Service (IRS). The W2 form includes details such as the employee's total earnings, Social Security wages, Medicare wages, and federal and state tax withholdings.

How to obtain the Central Texas College W2 Form

To obtain the Central Texas College W2 Form, employees can access it through the college's payroll or human resources department. Typically, the form is made available electronically via the college's employee portal. Employees may also request a physical copy if needed. It is important to ensure that the information on the form is accurate and reflects the employee's earnings for the tax year.

Steps to complete the Central Texas College W2 Form

Completing the Central Texas College W2 Form involves several key steps:

- Review the form for accuracy, ensuring that personal information such as name, address, and Social Security number are correct.

- Verify the total wages and tax withholdings reported on the form match your pay stubs.

- Use the information provided on the W2 to fill out your federal and state tax returns.

- Keep a copy of the form for your records, as it may be required for future reference or audits.

Legal use of the Central Texas College W2 Form

The Central Texas College W2 Form is legally binding and must comply with IRS regulations. Employees are required to use this form to report their income accurately. Failure to report income or discrepancies in the W2 can lead to penalties from the IRS. It is crucial for employees to ensure that the form is filled out correctly and submitted on time to avoid any legal issues.

Key elements of the Central Texas College W2 Form

Key elements of the Central Texas College W2 Form include:

- Employee Information: This section includes the employee's name, address, and Social Security number.

- Employer Information: Details about Central Texas College, including its name, address, and Employer Identification Number (EIN).

- Wage and Tax Information: This section outlines total earnings, Social Security wages, Medicare wages, and federal and state tax withholdings.

- State Information: If applicable, this includes state wages and state tax withheld.

Filing Deadlines / Important Dates

Filing deadlines for the Central Texas College W2 Form are aligned with IRS requirements. Generally, employers must provide employees with their W2 forms by January thirty-first of each year. Employees must file their tax returns by April fifteenth. It is essential to be aware of these dates to ensure compliance and avoid penalties.

Quick guide on how to complete central texas college w2 form

Prepare Central Texas College W2 Form effortlessly on any device

Online document management has gained traction among organizations and individuals. It offers a perfect environmentally friendly alternative to conventional printed and signed documents, since you can easily locate the appropriate form and securely keep it online. airSlate SignNow equips you with all the tools you need to create, alter, and eSign your documents swiftly without complications. Manage Central Texas College W2 Form on any platform with airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

The simplest method to modify and eSign Central Texas College W2 Form without hassle

- Locate Central Texas College W2 Form and click on Get Form to begin.

- Use the tools we provide to complete your document.

- Highlight important sections of the documents or conceal sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you would like to share your form, through email, SMS, or invite link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Edit and eSign Central Texas College W2 Form and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the central texas college w2 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Central Texas College W2 Form?

The Central Texas College W2 Form is a tax document that reports an employee's annual wages and the amount of taxes withheld from their paycheck. This form is essential for filing federal and state taxes. Employers and employees can easily access and send these forms using airSlate SignNow to ensure timely compliance.

-

How does airSlate SignNow simplify obtaining the Central Texas College W2 Form?

airSlate SignNow streamlines the process of obtaining the Central Texas College W2 Form by allowing employees to request and receive their forms digitally. This reduces paper handling and expedites the delivery of essential tax documents. With our platform, you can track the status and ensure all parties have signed off on the required forms.

-

What are the costs associated with using airSlate SignNow for the Central Texas College W2 Form?

Using airSlate SignNow for managing the Central Texas College W2 Form involves various pricing tiers designed to suit different organizational needs. We offer flexible subscription plans that cater to both small businesses and large institutions. This cost-effective solution simplifies the process without compromising quality.

-

Can I integrate airSlate SignNow with other tools for managing the Central Texas College W2 Form?

Yes, airSlate SignNow supports integration with various tools and platforms to enhance the management of the Central Texas College W2 Form. This allows you to sync data across your systems, making it easier to manage documents and streamline workflows. Popular integrations include cloud storage services and accounting software that facilitate efficient processing.

-

What features does airSlate SignNow offer for the Central Texas College W2 Form?

airSlate SignNow provides several features for managing the Central Texas College W2 Form, including eSigning, document sharing, and secure storage. Our platform also allows you to create templates, automate workflows, and set reminders for submission deadlines. These features make the process convenient and compliant with legal standards.

-

Is airSlate SignNow secure for handling personal information on the Central Texas College W2 Form?

Absolutely, airSlate SignNow prioritizes security for handling personal information on the Central Texas College W2 Form. We utilize advanced encryption and security protocols to protect sensitive data against unauthorized access. Our commitment to compliance ensures that your documents are handled with the highest level of safety.

-

What benefits do employers gain by using airSlate SignNow for the Central Texas College W2 Form?

Employers benefit signNowly from using airSlate SignNow for the Central Texas College W2 Form by saving time, reducing costs, and improving accuracy. The platform automates tasks that traditionally consume considerable resources, allowing HR teams to focus on strategic initiatives. Moreover, the ease of use fosters better employee engagement during tax season.

Get more for Central Texas College W2 Form

Find out other Central Texas College W2 Form

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document