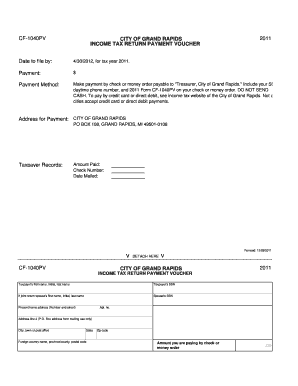

Michigan Income Tax Return Form

What is the Michigan Income Tax Return

The Michigan income tax return is a form that residents of Michigan must complete to report their income and calculate their tax liability to the state. This return is essential for individuals and businesses to comply with state tax laws. The form typically includes sections for reporting various types of income, deductions, and credits that may apply. Understanding what this form entails is crucial for ensuring accurate reporting and compliance with state regulations.

Steps to complete the Michigan Income Tax Return

Completing the Michigan income tax return involves several key steps that ensure accuracy and compliance. Here is a structured approach to filling out the form:

- Gather necessary documents, including W-2s, 1099s, and any other income statements.

- Determine your filing status, which can affect your tax rates and deductions.

- Fill out the form by entering your income, deductions, and any applicable credits.

- Review the completed form for accuracy, ensuring all information is correct.

- Submit the form either electronically or by mail, following the submission guidelines.

Required Documents

To successfully complete the Michigan income tax return, certain documents are necessary. These include:

- W-2 forms from employers, detailing annual wages and tax withholdings.

- 1099 forms for other income sources, such as freelance work or interest earned.

- Records of any deductions or credits you plan to claim, such as receipts for educational expenses or medical costs.

- Previous year’s tax return, which can provide useful reference points.

Form Submission Methods

The Michigan income tax return can be submitted through various methods, providing flexibility for taxpayers. The available submission methods include:

- Online filing through the Michigan Department of Treasury's e-filing system, which allows for quick processing.

- Mailing a paper return to the appropriate address, ensuring it is postmarked by the filing deadline.

- In-person submission at designated state offices, which may be available during tax season.

Legal use of the Michigan Income Tax Return

The Michigan income tax return must be completed in accordance with state laws to be considered legally valid. This includes providing accurate information, signing the return, and adhering to submission deadlines. Failure to comply with these legal requirements can result in penalties or audits by the Michigan Department of Treasury.

Filing Deadlines / Important Dates

Filing deadlines for the Michigan income tax return are critical to avoid penalties. Typically, the deadline for submitting your return is April 15 of each year, aligning with federal tax deadlines. However, if this date falls on a weekend or holiday, the deadline may be extended. It is important to stay informed about any changes to these dates to ensure timely filing.

Quick guide on how to complete michigan income tax return

Finalize Michigan Income Tax Return seamlessly on any gadget

Web-based document management has become increasingly popular among companies and individuals. It provides an excellent eco-friendly substitute for conventional printed and signed papers, as it allows you to obtain the correct form and securely store it online. airSlate SignNow provides all the tools you require to create, alter, and eSign your documents swiftly without any delays. Manage Michigan Income Tax Return on any gadget using airSlate SignNow Android or iOS applications and enhance any document-driven process today.

How to modify and eSign Michigan Income Tax Return with ease

- Locate Michigan Income Tax Return and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your eSignature using the Sign tool, which takes seconds and holds the same legal significance as a conventional handwritten signature.

- Verify all the details and click the Done button to save your changes.

- Select how you would like to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious document searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any gadget of your preference. Modify and eSign Michigan Income Tax Return and ensure excellent communication at any stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the michigan income tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an MI income tax return?

An MI income tax return is a form that residents of Michigan must file to report their income and determine their tax liability for the state. It is essential for individuals and businesses to ensure compliance with state tax regulations. Properly filing your MI income tax return can help you avoid penalties and maximize potential refunds.

-

How does airSlate SignNow help with MI income tax returns?

airSlate SignNow simplifies the process of preparing and signing documents related to your MI income tax return. Our platform offers easy-to-use eSignature features and document management tools that help ensure your tax documents are completed accurately and securely. Streamlining this process can save you time and reduce the risk of errors.

-

What are the pricing options for airSlate SignNow for preparing MI income tax returns?

airSlate SignNow offers a variety of pricing plans tailored to meet your needs, whether you're an individual or a small business. Each plan provides access to essential features that can assist with your MI income tax return preparation and signing. Visit our pricing page to find the best option that suits your requirements.

-

Can airSlate SignNow integrate with other tax preparation software for MI income tax returns?

Yes, airSlate SignNow can integrate with various tax preparation software platforms, making it easier for you to manage your MI income tax return documents. This functionality enhances your workflow by allowing seamless document sharing and electronic signing. Check our integrations page for a list of compatible software.

-

What features does airSlate SignNow offer for signing MI income tax return documents?

airSlate SignNow provides robust features for signing MI income tax return documents, including customizable templates, advanced security options, and real-time tracking. These features enhance the signing experience and ensure that your documents are legally binding. Our standard eSignature capabilities comply with all necessary regulations.

-

Is airSlate SignNow secure for handling MI income tax return information?

Absolutely! airSlate SignNow employs top-notch security measures to protect your MI income tax return information. We utilize bank-level encryption, secure data storage, and compliant practices to ensure your sensitive tax documents remain confidential and secure throughout the signing process.

-

How can I get support while preparing my MI income tax return with airSlate SignNow?

Our customer support team is readily available to assist you while preparing your MI income tax return using airSlate SignNow. You can access support through various channels, including live chat, email, and an extensive knowledge base. We're committed to helping you navigate any challenges you may encounter.

Get more for Michigan Income Tax Return

Find out other Michigan Income Tax Return

- Help Me With eSign Ohio Product Defect Notice

- eSign Mississippi Sponsorship Agreement Free

- eSign North Dakota Copyright License Agreement Free

- How Do I eSign Idaho Medical Records Release

- Can I eSign Alaska Advance Healthcare Directive

- eSign Kansas Client and Developer Agreement Easy

- eSign Montana Domain Name Registration Agreement Now

- eSign Nevada Affiliate Program Agreement Secure

- eSign Arizona Engineering Proposal Template Later

- eSign Connecticut Proforma Invoice Template Online

- eSign Florida Proforma Invoice Template Free

- Can I eSign Florida Proforma Invoice Template

- eSign New Jersey Proforma Invoice Template Online

- eSign Wisconsin Proforma Invoice Template Online

- eSign Wyoming Proforma Invoice Template Free

- eSign Wyoming Proforma Invoice Template Simple

- How To eSign Arizona Agreement contract template

- eSign Texas Agreement contract template Fast

- eSign Massachusetts Basic rental agreement or residential lease Now

- How To eSign Delaware Business partnership agreement