Tc 96 336 2019

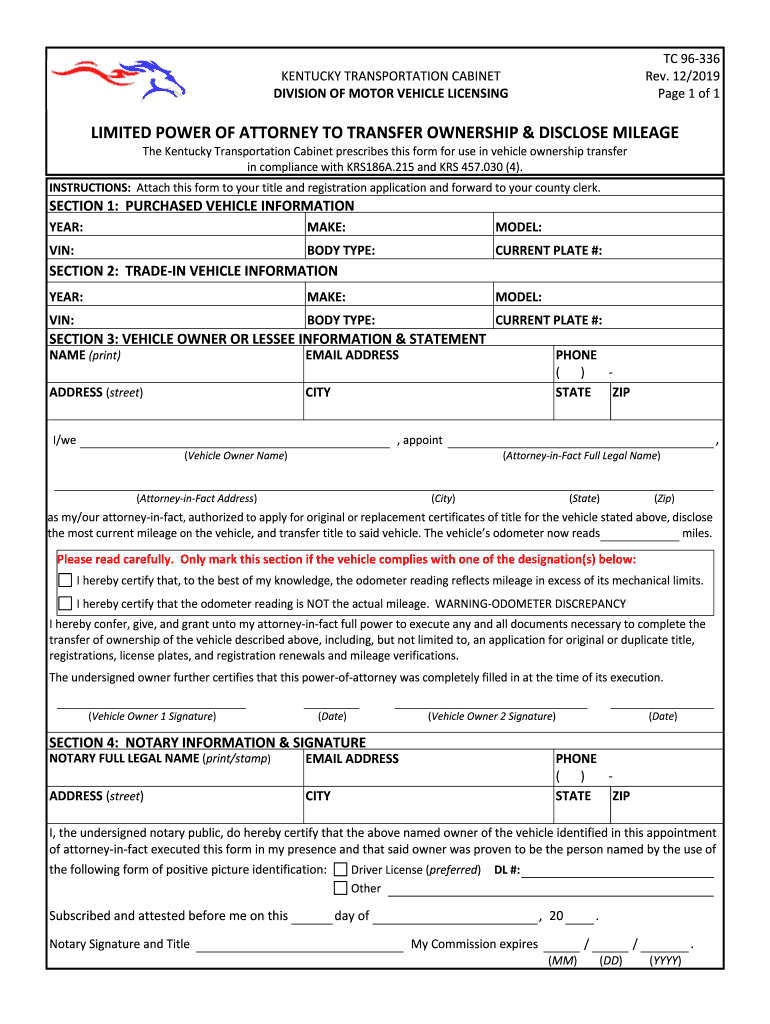

What is the TC 96 336?

The TC 96 336 is a specific form used within the United States for various administrative purposes. It is essential for individuals or businesses to understand its function and relevance in their specific context. This form may be necessary for compliance with state regulations or for fulfilling specific legal requirements. Understanding the TC 96 336 ensures that users can navigate their obligations effectively.

How to Use the TC 96 336

Utilizing the TC 96 336 involves several key steps that ensure proper completion and submission. First, gather all necessary information and documents that pertain to the form's requirements. Next, fill out the form accurately, ensuring that all fields are completed as per the guidelines. After filling out the form, review it for any errors or omissions before submission. This careful approach helps in avoiding delays or issues with processing.

Steps to Complete the TC 96 336

Completing the TC 96 336 requires a systematic approach to ensure accuracy. Follow these steps:

- Gather required information, including personal or business details.

- Access the TC 96 336 form, either in digital format or as a hard copy.

- Carefully fill in each section, adhering to any specific instructions provided.

- Double-check all entries for accuracy and completeness.

- Sign and date the form where required.

- Submit the form through the appropriate channels, whether online, by mail, or in person.

Legal Use of the TC 96 336

The legal use of the TC 96 336 is governed by specific regulations that ensure its validity. For the form to be considered legally binding, it must be completed accurately and submitted in accordance with applicable laws. This includes adhering to any state-specific requirements and ensuring that all signatures are appropriately executed. Understanding these legal aspects is crucial for users to avoid potential disputes or compliance issues.

Who Issues the Form

The TC 96 336 is typically issued by a designated governmental agency or department responsible for the specific area of regulation it pertains to. This may include state agencies or federal bodies, depending on the context in which the form is used. Knowing the issuing authority can help users understand the form's legitimacy and the framework within which it operates.

Required Documents

When completing the TC 96 336, certain documents may be required to support the information provided. These documents can include identification, proof of residency, or any other relevant paperwork that substantiates the claims made on the form. It is essential to check the specific requirements related to the TC 96 336 to ensure that all necessary documentation is included, facilitating a smooth processing experience.

Filing Deadlines / Important Dates

Filing deadlines for the TC 96 336 can vary based on the specific context in which the form is used. It is important to be aware of these deadlines to ensure timely submission and compliance with regulations. Missing a filing deadline may result in penalties or complications, so users should mark these dates clearly and plan accordingly to avoid any issues.

Quick guide on how to complete tc 96 336 489332589

Finalize Tc 96 336 effortlessly on any device

Web-based document handling has become widely accepted by businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, enabling you to obtain the correct format and securely archive it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Tc 96 336 on any platform with airSlate SignNow's Android or iOS applications and enhance any document-oriented operation today.

Steps to modify and eSign Tc 96 336 with ease

- Find Tc 96 336 and then click Get Form to initiate the process.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your electronic signature with the Sign tool, which takes moments and carries the same legal validity as a conventional handwritten signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose your method of delivering your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your selection. Edit and eSign Tc 96 336 to ensure clear communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tc 96 336 489332589

Create this form in 5 minutes!

How to create an eSignature for the tc 96 336 489332589

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is tc 96 336 in relation to airSlate SignNow?

tc 96 336 refers to a specific regulatory guideline that affects document signing processes. With airSlate SignNow, you can ensure compliance with these regulations, making it easier for your business to manage eSignatures securely and efficiently.

-

How does airSlate SignNow assist with tc 96 336 compliance?

airSlate SignNow provides robust features designed to meet tc 96 336 compliance requirements. By utilizing our advanced encryption and audit trails, you can be confident that your eSigned documents adhere to the necessary legal frameworks.

-

What features does airSlate SignNow offer for handling tc 96 336 documents?

Our platform includes customizable workflows, automated reminders, and easy document tracking, all essential for managing tc 96 336 documents. These features streamline the eSigning process while ensuring that every signed document is compliant.

-

Is airSlate SignNow cost-effective for businesses dealing with tc 96 336?

Yes, airSlate SignNow offers a variety of pricing plans tailored for businesses that need to comply with tc 96 336 guidelines. Our affordable solutions allow you to manage document signing without exceeding your budget, providing excellent value for compliance.

-

Can I integrate airSlate SignNow with other tools to manage tc 96 336 processes?

Absolutely, airSlate SignNow integrates seamlessly with various third-party applications, enhancing your ability to manage tc 96 336 documentation. This integration capability allows for a more efficient workflow, connecting your existing tools with our eSignature platform.

-

What are the benefits of using airSlate SignNow for tc 96 336 compliance?

Using airSlate SignNow helps streamline your document management, ensuring compliance with tc 96 336. Our user-friendly interface and secure eSigning capabilities increase efficiency, reduce processing time, and enhance overall productivity.

-

How secure is airSlate SignNow for handling tc 96 336 documents?

Security is a top priority for airSlate SignNow, particularly when dealing with tc 96 336 documents. We implement advanced security measures such as encryption, multi-factor authentication, and regular audits to protect sensitive information.

Get more for Tc 96 336

Find out other Tc 96 336

- Electronic signature Kentucky Mechanic's Lien Free

- Electronic signature Maine Mechanic's Lien Fast

- Can I Electronic signature North Carolina Mechanic's Lien

- How To Electronic signature Oklahoma Mechanic's Lien

- Electronic signature Oregon Mechanic's Lien Computer

- Electronic signature Vermont Mechanic's Lien Simple

- How Can I Electronic signature Virginia Mechanic's Lien

- Electronic signature Washington Mechanic's Lien Myself

- Electronic signature Louisiana Demand for Extension of Payment Date Simple

- Can I Electronic signature Louisiana Notice of Rescission

- Electronic signature Oregon Demand for Extension of Payment Date Online

- Can I Electronic signature Ohio Consumer Credit Application

- eSignature Georgia Junior Employment Offer Letter Later

- Electronic signature Utah Outsourcing Services Contract Online

- How To Electronic signature Wisconsin Debit Memo

- Electronic signature Delaware Junior Employment Offer Letter Later

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form