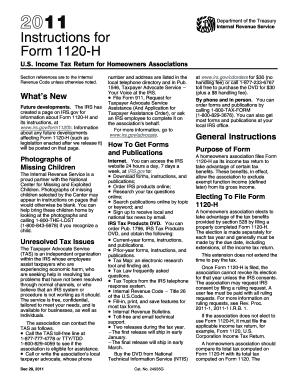

Form 1120 H Instructions

What is the Form 1120 H Instructions

The Form 1120 H Instructions provide guidance for homeowners associations (HOAs) in the United States on how to file their federal income tax return. This form is specifically designed for associations that meet certain criteria, allowing them to report their income and expenses accurately. Understanding these instructions is essential for compliance with IRS regulations and ensuring that the association maintains its tax-exempt status.

Steps to complete the Form 1120 H Instructions

Completing the Form 1120 H requires several steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements, expense reports, and any relevant receipts. Next, follow the instructions carefully, filling out each section of the form with the required information. Pay attention to the specific eligibility criteria for filing this form, as associations must meet certain conditions to qualify. Finally, review the completed form for any errors before submission to avoid penalties.

Legal use of the Form 1120 H Instructions

Using the Form 1120 H Instructions legally involves adhering to IRS guidelines and ensuring that all information provided is truthful and accurate. The form must be filed by eligible homeowners associations, which typically include those that operate primarily for the benefit of their members and do not earn significant income outside of membership dues. Misuse of the form or providing false information can lead to penalties, including fines and loss of tax-exempt status.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1120 H are crucial for homeowners associations to avoid penalties. Generally, the form must be filed by the 15th day of the fourth month following the end of the association's tax year. For associations operating on a calendar year, this typically means the deadline is April 15. It is advisable to mark these dates on a calendar and prepare the necessary documentation well in advance to ensure timely submission.

Required Documents

To complete the Form 1120 H, homeowners associations need to gather specific documents. These include financial statements detailing income and expenses, a list of members and their contributions, and any supporting documentation for deductions claimed. Having these documents organized and readily available will facilitate a smoother filing process and help ensure compliance with IRS requirements.

Examples of using the Form 1120 H Instructions

Homeowners associations can utilize the Form 1120 H Instructions in various scenarios. For instance, a small HOA with limited income may use the form to report membership dues and associated expenses, ensuring they maintain their tax-exempt status. Alternatively, larger associations with more complex financial situations can also benefit from these instructions to accurately report income from events or services provided to members, ensuring all income is accounted for correctly.

Quick guide on how to complete form 1120 h instructions 1649214

Complete Form 1120 H Instructions seamlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-conscious alternative to traditional printed and signed documents, as you can easily locate the right form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly without delays. Manage Form 1120 H Instructions on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The simplest way to alter and electronically sign Form 1120 H Instructions with ease

- Locate Form 1120 H Instructions and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your electronic signature using the Sign tool, which only takes seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click the Done button to save your changes.

- Select your preferred method of sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require reprinting new copies. airSlate SignNow addresses your needs in document management in just a few clicks from any chosen device. Alter and electronically sign Form 1120 H Instructions to guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 1120 h instructions 1649214

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the key features of airSlate SignNow for handling form 1120 H instructions?

airSlate SignNow offers a range of features specifically designed to assist you with form 1120 H instructions. These include easy document sending, eSigning, and tracking capabilities, which streamline the process of managing tax documents. Additionally, the platform is user-friendly, making it simple for businesses to navigate their compliance needs.

-

How does airSlate SignNow simplify the completion of form 1120 H instructions?

With airSlate SignNow, completing form 1120 H instructions becomes a hassle-free task. The platform allows users to fill out forms electronically, reducing paper waste and errors associated with manual entry. Furthermore, built-in templates ensure that you follow the correct format, saving time and effort in the process.

-

Is there a cost associated with using airSlate SignNow for form 1120 H instructions?

Yes, airSlate SignNow offers flexible pricing plans to meet various business needs for form 1120 H instructions. These plans are cost-effective, ensuring that businesses of all sizes can access the necessary tools without breaking the bank. You can explore the pricing options on our website to find the best fit for your requirements.

-

Can I integrate airSlate SignNow with other software for form 1120 H instructions?

Absolutely! airSlate SignNow supports multiple integrations that can enhance your experience while handling form 1120 H instructions. You can easily connect it with popular applications like Google Drive, Dropbox, and CRMs to centralize your document management workflow.

-

What benefits can I expect from using airSlate SignNow for form 1120 H instructions?

Using airSlate SignNow for form 1120 H instructions offers numerous benefits, including enhanced efficiency, reduced turnaround times, and improved accuracy. The platform allows for real-time collaboration, making it easy to gather necessary signatures and approvals quickly. Ultimately, this results in a smoother and more productive tax filing experience.

-

Is training or support available for using airSlate SignNow with form 1120 H instructions?

Yes, airSlate SignNow provides comprehensive support and training resources for users handling form 1120 H instructions. Whether you prefer self-guided tutorials, FAQs, or direct assistance from our customer support team, we ensure you have everything you need for seamless usage. Our goal is to empower you to use the platform effectively.

-

What types of documents can I sign alongside form 1120 H instructions?

Besides form 1120 H instructions, airSlate SignNow allows you to handle a variety of documents, including contracts, agreements, and consent forms. This versatility means you can centralize your document signing process in one platform, saving you valuable time and effort. It's perfect for businesses that regularly manage different forms and contracts.

Get more for Form 1120 H Instructions

- C 104g form

- Onelink order form

- Suspicious transaction report template form

- Pension slip format

- Monthly detail of receipts and disbursements form 4208 ksvfw

- Attachment 2307 a family care community attendant services and primary home care rights and responsibilities attachment 2307 a form

- Services dmv de govformsvehservformssignature authorizations division of motor vehicles

- Tax department fax 781 849 5596 request for form w 2g rep

Find out other Form 1120 H Instructions

- Electronic signature Maryland Business Operations NDA Myself

- Electronic signature Washington Car Dealer Letter Of Intent Computer

- Electronic signature Virginia Car Dealer IOU Fast

- How To Electronic signature Virginia Car Dealer Medical History

- Electronic signature Virginia Car Dealer Separation Agreement Simple

- Electronic signature Wisconsin Car Dealer Contract Simple

- Electronic signature Wyoming Car Dealer Lease Agreement Template Computer

- How Do I Electronic signature Mississippi Business Operations Rental Application

- Electronic signature Missouri Business Operations Business Plan Template Easy

- Electronic signature Missouri Business Operations Stock Certificate Now

- Electronic signature Alabama Charity Promissory Note Template Computer

- Electronic signature Colorado Charity Promissory Note Template Simple

- Electronic signature Alabama Construction Quitclaim Deed Free

- Electronic signature Alaska Construction Lease Agreement Template Simple

- Electronic signature Construction Form Arizona Safe

- Electronic signature Kentucky Charity Living Will Safe

- Electronic signature Construction Form California Fast

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe