IRA DISTRIBUTION REQUEST Scottrade Form

What is the IRA Distribution Request Scottrade?

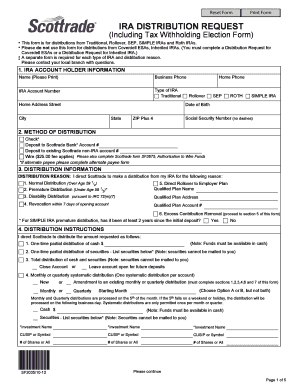

The IRA Distribution Request Scottrade form is a crucial document for individuals looking to withdraw funds from their Individual Retirement Accounts (IRAs). This form facilitates the process of requesting distributions, allowing account holders to access their retirement savings. It is essential to understand the purpose of this form, as it ensures that withdrawals are processed correctly and in compliance with IRS regulations.

How to Use the IRA Distribution Request Scottrade

Using the IRA Distribution Request Scottrade form involves several straightforward steps. First, ensure you have your account information readily available, including your account number and personal identification details. Next, fill out the form accurately, specifying the amount you wish to withdraw and the distribution method. Once completed, submit the form according to the instructions provided, either online or via mail, to initiate the withdrawal process.

Steps to Complete the IRA Distribution Request Scottrade

Completing the IRA Distribution Request Scottrade form requires careful attention to detail. Follow these steps:

- Gather necessary information, including your personal details and account number.

- Indicate the type of distribution you are requesting, such as a one-time withdrawal or a series of payments.

- Specify the amount you wish to withdraw and the method of payment, whether by check or direct deposit.

- Review the form for accuracy before submission to avoid delays.

- Submit the form according to the provided guidelines.

Legal Use of the IRA Distribution Request Scottrade

The legal use of the IRA Distribution Request Scottrade form is governed by IRS regulations. It is vital to ensure that the withdrawals comply with the rules surrounding IRAs to avoid penalties. Properly completing and submitting this form ensures that the distribution is recognized as valid by both Scottrade and the IRS, safeguarding your retirement funds and maintaining compliance with tax laws.

Required Documents

When submitting the IRA Distribution Request Scottrade form, certain documents may be required to verify your identity and account status. Typically, you may need to provide:

- A copy of your government-issued identification, such as a driver's license or passport.

- Proof of your Social Security number or taxpayer identification number.

- Any additional documentation that supports your withdrawal request, depending on the type of distribution.

Form Submission Methods

The IRA Distribution Request Scottrade form can be submitted through various methods to accommodate different preferences. You may choose to submit the form online through the Scottrade platform, ensuring a quick and efficient process. Alternatively, you can print the form and mail it to the designated address provided by Scottrade. In some cases, in-person submissions may also be available at local branches.

Quick guide on how to complete ira distribution request scottrade

Complete IRA DISTRIBUTION REQUEST Scottrade effortlessly on any device

Online document management has become increasingly popular among businesses and individuals alike. It offers an excellent environmentally friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the resources you need to create, modify, and electronically sign your documents quickly and without delays. Handle IRA DISTRIBUTION REQUEST Scottrade on any platform utilizing airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to modify and electronically sign IRA DISTRIBUTION REQUEST Scottrade effortlessly

- Find IRA DISTRIBUTION REQUEST Scottrade and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight important sections of the documents or mask sensitive data using tools provided specifically by airSlate SignNow for that purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Choose your preferred method to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or mistakes that necessitate printing additional document copies. airSlate SignNow addresses all your document management requirements with just a few clicks from any device you choose. Edit and electronically sign IRA DISTRIBUTION REQUEST Scottrade and ensure exceptional communication at any point of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ira distribution request scottrade

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the scottrade login process?

The scottrade login process is designed to be straightforward and user-friendly. Simply visit the official Scottrade website and enter your username and password to access your account. If you experience any issues during the scottrade login, there are recovery options available to help regain access securely.

-

Is there a cost associated with using the scottrade login?

Accessing the scottrade login itself is free, but depending on your trading activities, there may be fees associated with trading and certain account features. It’s important to review the pricing structure to understand potential costs involved with using your Scottrade account after logging in.

-

What features can I access after scottrade login?

After completing your scottrade login, you will have access to a variety of features including trading tools, account management, and market research. Users can also manage their portfolios, view transaction history, and utilize educational resources provided through the platform.

-

What are the benefits of using the scottrade login for trading?

The scottrade login provides you with immediate access to a robust trading platform that enhances your trading experience. Benefits include real-time market data, advanced trading tools, and integration with third-party analytics services, allowing you to make informed trading decisions.

-

Can I recover my account after a scottrade login failure?

Yes, if you encounter difficulties during the scottrade login process, recovery options are readily available. Users can reset their passwords or unlock their accounts through the Scottrade support section, ensuring you can regain access swiftly and securely.

-

Does airSlate SignNow integrate with the Scottrade platform?

Yes, airSlate SignNow can be integrated with the Scottrade platform to enhance document handling alongside your trading activities. This integration allows users to effortlessly manage and eSign documents related to their trading, streamlining workflow for better efficiency.

-

What security measures are in place for my scottrade login?

Your scottrade login is protected by advanced security measures, including SSL encryption and two-factor authentication. These features help ensure that your sensitive trading information and personal data remain secure during each login session.

Get more for IRA DISTRIBUTION REQUEST Scottrade

- Ceo evaluation template form

- Pema dap 2 designation of agent resolution dauphincounty form

- Spill kit checklist pdf 212003208 form

- Can public pass asia brewery road form

- Us custom letterhead form

- Form 1709 ssa

- Jomec ethical approval form cardiff university redirect cf ac

- Form st 101 7 report of clothing and footwear sales

Find out other IRA DISTRIBUTION REQUEST Scottrade

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself

- eSign West Virginia Education Resignation Letter Secure

- eSign Education PDF Wyoming Mobile