Etrade 1099 Form

What is the Etrade 1099 Form

The Etrade 1099 Form is a tax document that reports income generated from various investment activities, such as dividends, interest, and capital gains. This form is essential for individuals who have engaged in trading or investing through Etrade, as it provides the necessary information for accurate tax filing. The IRS requires taxpayers to report this income on their federal tax returns, making the Etrade 1099 Form a crucial component in the tax preparation process.

How to use the Etrade 1099 Form

Using the Etrade 1099 Form involves several key steps. First, gather all relevant financial documents and statements from your Etrade account. The form will detail your earnings for the tax year, including any transactions that resulted in capital gains or losses. Once you have the form, you can input the information into your tax software or provide it to your tax preparer. It is important to ensure that all amounts are accurately reported to avoid potential issues with the IRS.

Steps to complete the Etrade 1099 Form

Completing the Etrade 1099 Form requires careful attention to detail. Follow these steps for a smooth process:

- Review your Etrade account statements to ensure all transactions are accounted for.

- Locate the Etrade 1099 Form in your account or download it from the Etrade website.

- Fill in the required fields, including your personal information and income details.

- Double-check all entries for accuracy, particularly the amounts reported.

- Submit the completed form as part of your tax return by the appropriate deadline.

Legal use of the Etrade 1099 Form

The legal use of the Etrade 1099 Form is governed by IRS regulations. Taxpayers must report all income accurately to comply with tax laws. Failure to report income from the Etrade 1099 Form can lead to penalties or audits. It is essential to keep a copy of the form for your records, as it serves as proof of income and can be requested by the IRS during an audit.

Filing Deadlines / Important Dates

Filing deadlines for the Etrade 1099 Form align with the general tax filing timeline. Typically, the IRS requires that the form be submitted by April fifteenth of the following tax year. However, if the fifteenth falls on a weekend or holiday, the deadline may be extended. It is advisable to check the IRS website for any updates regarding filing deadlines to ensure compliance.

Examples of using the Etrade 1099 Form

There are various scenarios in which the Etrade 1099 Form is utilized. For instance, if an individual sells stocks and realizes a capital gain, that gain must be reported using the form. Additionally, if a taxpayer receives dividends from their investments, those amounts will also be included on the Etrade 1099 Form. Each example illustrates the importance of accurate reporting to maintain compliance with tax regulations.

Quick guide on how to complete etrade 1099 form

Easily Prepare Etrade 1099 Form on Any Device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, since you can access the correct template and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents promptly without delays. Manage Etrade 1099 Form on any device using the airSlate SignNow apps for Android or iOS and enhance any document-centered workflow today.

The Simplest Way to Edit and eSign Etrade 1099 Form Effortlessly

- Locate Etrade 1099 Form and click on Get Form to begin.

- Make use of the tools available to complete your document.

- Highlight pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your preference. Modify and eSign Etrade 1099 Form and ensure excellent communication at all stages of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the etrade 1099 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

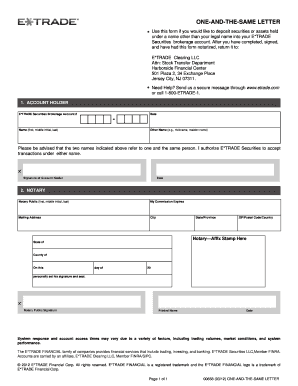

What is the meaning of 'one in the same letter' in the context of signing documents?

The phrase 'one in the same letter' refers to having multiple signatories acknowledged within a single document. This is especially relevant for legal agreements where it's essential to confirm that all parties are in agreement through one cohesive document. airSlate SignNow simplifies this process, allowing you to manage and collect eSignatures efficiently.

-

How does airSlate SignNow ensure the security of documents signed with 'one in the same letter'?

airSlate SignNow prioritizes document security by utilizing advanced encryption methods to protect your files. When multiple parties sign 'one in the same letter,' our platform provides audit trails and secure storage options, ensuring that your agreements are protected against unauthorized access.

-

What features does airSlate SignNow offer for 'one in the same letter' signing?

Our platform provides various features to facilitate 'one in the same letter' signing, including customizable templates, bulk sending options, and reminders for signatories. These features streamline the signing process, making it easier for businesses to gather approvals quickly and efficiently.

-

Is there a cost associated with using airSlate SignNow for 'one in the same letter' documents?

Yes, airSlate SignNow offers flexible pricing plans that cater to different business needs, including those that require handling 'one in the same letter' agreements. We provide a cost-effective solution with features tailored to ensure you get the most value from your eSignatures.

-

Can I integrate airSlate SignNow with other software for managing 'one in the same letter' contracts?

Absolutely! airSlate SignNow integrates seamlessly with several applications and CRMs, allowing you to manage 'one in the same letter' contracts conveniently. Our integrations facilitate a smoother workflow, enabling you to synchronously handle documents across platforms.

-

What are the benefits of using airSlate SignNow for collective contracts like 'one in the same letter'?

Using airSlate SignNow for 'one in the same letter' contracts enhances collaboration and speeds up the approval process. With easy eSigning and document tracking, your team can focus on what matters most while ensuring that all parties are in agreement and legally covered.

-

What types of documents can be signed as 'one in the same letter' with airSlate SignNow?

You can use airSlate SignNow to eSign various documents as 'one in the same letter,' including contracts, agreements, and compliance forms. Our platform supports multiple file formats, ensuring that any document requiring multiple signatures can be handled efficiently.

Get more for Etrade 1099 Form

Find out other Etrade 1099 Form

- eSignature New Hampshire Rental lease agreement Simple

- eSignature Nebraska Rental lease agreement forms Fast

- eSignature Delaware Rental lease agreement template Fast

- eSignature West Virginia Rental lease agreement forms Myself

- eSignature Michigan Rental property lease agreement Online

- Can I eSignature North Carolina Rental lease contract

- eSignature Vermont Rental lease agreement template Online

- eSignature Vermont Rental lease agreement template Now

- eSignature Vermont Rental lease agreement template Free

- eSignature Nebraska Rental property lease agreement Later

- eSignature Tennessee Residential lease agreement Easy

- Can I eSignature Washington Residential lease agreement

- How To eSignature Vermont Residential lease agreement form

- How To eSignature Rhode Island Standard residential lease agreement

- eSignature Mississippi Commercial real estate contract Fast

- eSignature Arizona Contract of employment Online

- eSignature Texas Contract of employment Online

- eSignature Florida Email Contracts Free

- eSignature Hawaii Managed services contract template Online

- How Can I eSignature Colorado Real estate purchase contract template