Mo W 4p Form

What is the Mo W 4p

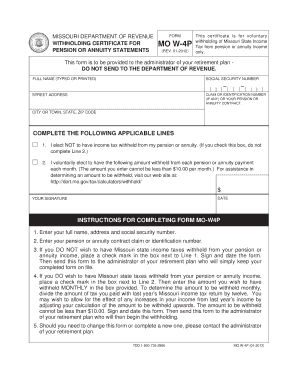

The Mo W 4p form is a specific document used in the context of tax withholding for employees in the state of Missouri. It is designed to help employers determine the correct amount of state income tax to withhold from employees' paychecks. This form is essential for ensuring compliance with state tax regulations and helps employees manage their tax obligations effectively.

How to use the Mo W 4p

To use the Mo W 4p form, employees must fill it out accurately and submit it to their employer. The form requires personal information, including the employee's name, address, and Social Security number. Additionally, employees must indicate their filing status and any allowances they wish to claim. Employers will use this information to calculate the appropriate tax withholding from each paycheck.

Steps to complete the Mo W 4p

Completing the Mo W 4p form involves several straightforward steps:

- Obtain the Mo W 4p form from your employer or download it from the Missouri Department of Revenue website.

- Fill in your personal details, including your name, address, and Social Security number.

- Select your filing status and indicate the number of allowances you are claiming.

- Review the completed form for accuracy.

- Submit the form to your employer for processing.

Legal use of the Mo W 4p

The Mo W 4p form is legally binding when completed correctly and submitted to the employer. It complies with Missouri state tax laws, ensuring that employers withhold the correct amount of state income tax. Employees should keep a copy of the completed form for their records, as it may be necessary for future reference or tax filings.

Key elements of the Mo W 4p

Several key elements make up the Mo W 4p form:

- Personal Information: This includes the employee's name, address, and Social Security number.

- Filing Status: Employees must indicate whether they are single, married, or head of household.

- Allowances: The number of allowances claimed affects the amount of tax withheld.

- Signature: The employee must sign and date the form to validate it.

IRS Guidelines

While the Mo W 4p form is specific to Missouri, it is important to understand how it aligns with IRS guidelines. Employees should ensure that the information provided on the Mo W 4p is consistent with their federal tax filings. This consistency helps avoid discrepancies that could lead to issues during tax season.

Quick guide on how to complete mo w 4p

Prepare Mo W 4p seamlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed documents, as you can locate the correct form and securely keep it online. airSlate SignNow equips you with all the tools required to create, edit, and sign your documents quickly without delays. Manage Mo W 4p on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The easiest way to modify and sign Mo W 4p effortlessly

- Obtain Mo W 4p and click Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools specifically offered by airSlate SignNow for this purpose.

- Generate your signature using the Sign feature, which takes moments and holds the same legal significance as a conventional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you want to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from your chosen device. Modify and sign Mo W 4p and ensure outstanding communication at any phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the mo w 4p

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the mo w 4p form and how does it work?

The mo w 4p form is a state-specific tax withholding form used by employers in Missouri. It allows employees to indicate their tax withholding preferences to ensure the correct amount of taxes is deducted from their paychecks. Using airSlate SignNow, businesses can easily send the mo w 4p form to employees for electronic signature, streamlining the onboarding process.

-

How can airSlate SignNow help with the management of mo w 4p forms?

airSlate SignNow enables businesses to manage mo w 4p forms efficiently by providing an easy-to-use platform for digital signatures. Users can create, send, and store these forms securely in a digital format, which reduces paperwork and enhances compliance. This efficiency helps companies to keep up with tax regulations effectively.

-

Is there a cost associated with sending mo w 4p forms through airSlate SignNow?

Yes, airSlate SignNow offers several pricing plans to accommodate different business needs, including sending mo w 4p forms. Pricing is based on features and number of users, ensuring that businesses of all sizes can find a cost-effective solution. Additionally, transparent pricing ensures there are no hidden fees when managing your documents.

-

What features does airSlate SignNow provide for mo w 4p document management?

With airSlate SignNow, users can access a range of features for managing mo w 4p documents, including customizable templates, automated workflows, and secure storage options. These features enhance the overall efficiency of the document signing process, making it convenient for both employers and employees. The platform also provides real-time tracking, so users can see when forms are signed.

-

Can I integrate airSlate SignNow with my existing HR software for mo w 4p forms?

Absolutely! airSlate SignNow offers integrations with various HR software tools, allowing for seamless handling of mo w 4p forms and other related documents. This integration helps automate the data entry process, reduces human errors, and ensures compliance with tax laws. Businesses can enjoy a smooth workflow by connecting airSlate SignNow with their existing systems.

-

How secure is the process of signing mo w 4p forms with airSlate SignNow?

Security is a priority at airSlate SignNow, especially when handling sensitive documents like mo w 4p forms. The platform uses advanced encryption and secure servers to protect your data during transmission and storage. Additionally, it complies with industry standards, which ensures that both employers and employees can sign documents safely.

-

What are the benefits of using airSlate SignNow for mo w 4p forms?

Using airSlate SignNow for managing mo w 4p forms offers numerous benefits, including faster processing times, reduced administrative workload, and improved accuracy. By digitizing the signing process, businesses can ensure that forms are signed efficiently, helping to maintain compliance with tax regulations. Furthermore, the convenience of remote signing makes it easier for employees to complete these forms timely.

Get more for Mo W 4p

- Email deferments to edmanage form

- Voluntary acknowledgement of paternity oregon form

- Ccl 0015 form

- Cell division homework 2 answer key form

- Lesson 9 1 exponents practice and problem solving a b answer key form

- Sample ballot bexar county form

- Department of homeland security omb control number form

- Form i 601a instructions for application for provisional

Find out other Mo W 4p

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors