Acd 31102 Form

What is the ACD 31102?

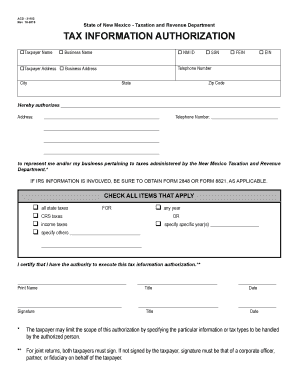

The ACD 31102 is a form used in New Mexico, specifically designed for tax information authorization. This form allows individuals or businesses to authorize another party to receive confidential tax information from the New Mexico Taxation and Revenue Department. The ACD 31102 ensures that the designated individual or entity can act on behalf of the taxpayer in matters related to their tax obligations.

Steps to Complete the ACD 31102

Completing the ACD 31102 involves several straightforward steps:

- Begin by downloading the fillable form ACD 31102 from a reliable source.

- Fill in the taxpayer's name, address, and identification number accurately.

- Provide the name and contact information of the individual or entity being authorized.

- Specify the tax types and years for which authorization is granted.

- Sign and date the form to validate the authorization.

Once completed, ensure that all information is correct before submission.

Legal Use of the ACD 31102

The ACD 31102 is legally binding when filled out correctly and signed by the taxpayer. It complies with state regulations governing tax information disclosure. The form must be submitted to the New Mexico Taxation and Revenue Department to grant the authorized party access to the taxpayer's tax records. This legal framework ensures that sensitive tax information is shared only with designated individuals or entities, safeguarding taxpayer privacy.

Form Submission Methods

The ACD 31102 can be submitted through various methods to accommodate different preferences:

- Online Submission: If available, submitting the form electronically can expedite processing.

- Mail: The completed form can be mailed to the appropriate address provided by the New Mexico Taxation and Revenue Department.

- In-Person: Taxpayers may also choose to deliver the form in person at a local office.

Choosing the right submission method can help ensure timely processing of the authorization.

Who Issues the Form?

The ACD 31102 is issued by the New Mexico Taxation and Revenue Department. This state agency is responsible for managing tax-related matters, including the authorization of individuals or entities to access taxpayer information. The department ensures that all forms are compliant with state laws and regulations, providing taxpayers with the necessary tools to manage their tax affairs effectively.

Required Documents

To complete the ACD 31102, certain documents may be necessary:

- Taxpayer Identification: A valid identification number, such as a Social Security number or Employer Identification Number, is required.

- Authorization Details: Information regarding the individual or entity being authorized must be clearly stated.

Having these documents ready can streamline the completion process and ensure accuracy.

Quick guide on how to complete acd 31102

Effortlessly Prepare Acd 31102 on Any Device

Managing documents online has surged in popularity among businesses and individuals. It offers a perfect environmentally friendly alternative to conventional printed and signed papers, allowing you to locate the necessary form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without interruptions. Handle Acd 31102 on any device using the airSlate SignNow applications for Android or iOS and simplify any document-related task today.

How to Modify and Electronically Sign Acd 31102 with Ease

- Locate Acd 31102 and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight pertinent parts of your documents or obscure sensitive information with tools designed specifically for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign feature, which takes mere seconds and holds the same legal authority as a traditional signature made with ink.

- Review all the details and click on the Done button to save your changes.

- Choose how you want to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious searches for forms, or errors that necessitate printing new paper copies. airSlate SignNow meets your document management needs within a few clicks from any device of your choice. Modify and electronically sign Acd 31102 and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the acd 31102

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is acd31102 and how does it relate to airSlate SignNow?

acd31102 refers to a specific usage case of airSlate SignNow in enhancing document management and electronic signing efficiency. This code is often used to identify particular services or features that streamline operations for businesses.

-

How much does it cost to use airSlate SignNow with acd31102?

airSlate SignNow offers various pricing plans tailored to meet the needs of businesses using acd31102. Subscription costs can vary based on the number of users and features chosen, ensuring a cost-effective solution for all.

-

What features does acd31102 provide for document signing?

Utilizing the acd31102 functionality, airSlate SignNow includes features like templates, bulk sending, and advanced security measures. These features help businesses ensure fast, reliable, and secure document signing processes.

-

Can I integrate airSlate SignNow with other applications using acd31102?

Yes, acd31102 supports seamless integrations with various third-party applications. This allows businesses to enhance their workflow by connecting airSlate SignNow to their existing systems.

-

What benefits does acd31102 bring to my business?

By implementing acd31102, businesses can enjoy improved efficiency and reduced turnaround time for document signing. The easy-to-use interface contributes to higher productivity and better customer satisfaction.

-

Is airSlate SignNow secure for handling sensitive documents with acd31102?

Absolutely! airSlate SignNow adheres to strict security protocols, making acd31102 a safe choice for signing sensitive documents. Features like encryption and authentication provide peace of mind for all users.

-

What kind of support does airSlate SignNow offer for acd31102 users?

airSlate SignNow provides comprehensive support for users utilizing acd31102, including tutorials, customer service, and resources to help navigate any challenges. This ensures that businesses can maximize their use of the platform.

Get more for Acd 31102

Find out other Acd 31102

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy