Fuel Tax Template States Form

What is the Fuel Tax Template States Form

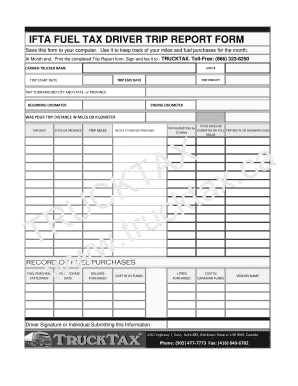

The Fuel Tax Template States Form is a crucial document used by businesses and individuals to report and pay fuel taxes to state authorities. This form is designed to ensure compliance with state regulations regarding fuel consumption and taxation. It typically includes details such as the type of fuel used, the amount consumed, and the corresponding tax owed. Understanding this form is essential for maintaining accurate records and fulfilling tax obligations.

How to use the Fuel Tax Template States Form

Using the Fuel Tax Template States Form involves several key steps. First, gather all necessary information regarding your fuel usage, including the types of fuel purchased and the quantities. Next, accurately fill out the form with this information, ensuring that all entries are correct to avoid penalties. Once completed, the form can be submitted electronically or by mail, depending on state requirements. Familiarizing yourself with the specific instructions for your state is important to ensure proper usage.

Steps to complete the Fuel Tax Template States Form

Completing the Fuel Tax Template States Form requires careful attention to detail. Follow these steps:

- Collect all relevant fuel purchase records.

- Identify the applicable tax rates for each type of fuel.

- Fill in your business or personal information at the top of the form.

- List the fuel types and corresponding quantities consumed.

- Calculate the total tax owed based on the quantities and rates.

- Review the form for accuracy before submission.

Legal use of the Fuel Tax Template States Form

The legal use of the Fuel Tax Template States Form hinges on its compliance with state regulations. To be considered valid, the form must be filled out accurately and submitted within the designated timeframes. It is important to retain copies of submitted forms and any supporting documents for record-keeping purposes. Misrepresentation or failure to file can lead to penalties, making it essential to understand the legal implications of using this form.

State-specific rules for the Fuel Tax Template States Form

Each state has its own rules and regulations governing the Fuel Tax Template States Form. These can include specific filing deadlines, tax rates, and additional documentation requirements. It is vital to consult your state’s tax authority or website to obtain the most accurate and up-to-date information. Being aware of these state-specific rules can help ensure compliance and avoid unnecessary penalties.

Filing Deadlines / Important Dates

Filing deadlines for the Fuel Tax Template States Form vary by state and can be influenced by factors such as the type of business and fuel usage. Generally, forms must be submitted quarterly or annually, depending on the state’s regulations. Keeping track of these important dates is crucial for timely submissions and avoiding late fees. It is advisable to create a calendar reminder for these deadlines to ensure compliance.

Quick guide on how to complete fuel tax template states form

Complete Fuel Tax Template States Form seamlessly on any device

Digital document management has gained traction among companies and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to locate the appropriate form and safely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents swiftly without interruptions. Manage Fuel Tax Template States Form on any platform using airSlate SignNow's Android or iOS applications and simplify your document-related tasks today.

How to modify and electronically sign Fuel Tax Template States Form effortlessly

- Locate Fuel Tax Template States Form and then click Get Form to begin.

- Employ the tools we offer to fill out your form.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Verify all details and then click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, cumbersome form searches, or errors that necessitate printing additional document copies. airSlate SignNow addresses all your document management needs in a few clicks from your preferred device. Modify and electronically sign Fuel Tax Template States Form and guarantee effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fuel tax template states form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Fuel Tax Template States Form?

The Fuel Tax Template States Form is a customizable document designed for businesses to accurately report fuel tax obligations across different states. With this template, users can simplify the task of filling out and submitting necessary forms to meet state regulations efficiently.

-

How does airSlate SignNow help with the Fuel Tax Template States Form?

airSlate SignNow provides an intuitive platform for creating, signing, and managing the Fuel Tax Template States Form seamlessly. Our solution ensures that users can complete their documentation quickly while maintaining compliance and accuracy in their submissions.

-

Is the Fuel Tax Template States Form customizable?

Yes, the Fuel Tax Template States Form offered by airSlate SignNow is fully customizable. You can easily modify the template to include specific details relevant to your business needs, ensuring that it meets all your state requirements.

-

What features does airSlate SignNow offer for fuel tax documentation?

airSlate SignNow includes features such as eSignature integration, document templates, real-time tracking, and reminders for the Fuel Tax Template States Form. These functionalities streamline the process, making it easier to manage and submit forms on time.

-

How can I integrate the Fuel Tax Template States Form with other software?

airSlate SignNow supports various integrations with popular accounting and financial software that enhance the functionality of the Fuel Tax Template States Form. This allows for smooth data transfer and helps keep your records consistent and up to date.

-

What are the pricing options for using the Fuel Tax Template States Form in airSlate SignNow?

airSlate SignNow offers flexible pricing plans depending on your business size and needs for using the Fuel Tax Template States Form. You can choose from monthly or annual billing options, ensuring you find a plan that fits your budget and requirements.

-

What benefits does the Fuel Tax Template States Form provide?

Using the Fuel Tax Template States Form helps streamline tax reporting processes, reduces errors, and saves time. This increases efficiency for businesses as they can focus on their core activities while ensuring compliance with state fuel tax regulations.

Get more for Fuel Tax Template States Form

Find out other Fuel Tax Template States Form

- eSignature Maine Business purchase agreement Simple

- eSignature Arizona Generic lease agreement Free

- eSignature Illinois House rental agreement Free

- How To eSignature Indiana House rental agreement

- Can I eSignature Minnesota House rental lease agreement

- eSignature Missouri Landlord lease agreement Fast

- eSignature Utah Landlord lease agreement Simple

- eSignature West Virginia Landlord lease agreement Easy

- How Do I eSignature Idaho Landlord tenant lease agreement

- eSignature Washington Landlord tenant lease agreement Free

- eSignature Wisconsin Landlord tenant lease agreement Online

- eSignature Wyoming Landlord tenant lease agreement Online

- How Can I eSignature Oregon lease agreement

- eSignature Washington Lease agreement form Easy

- eSignature Alaska Lease agreement template Online

- eSignature Alaska Lease agreement template Later

- eSignature Massachusetts Lease agreement template Myself

- Can I eSignature Arizona Loan agreement

- eSignature Florida Loan agreement Online

- eSignature Florida Month to month lease agreement Later