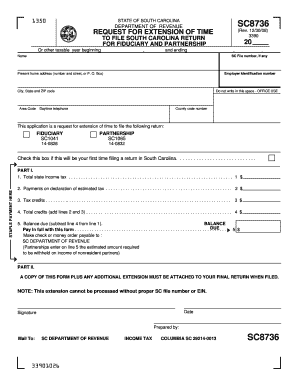

Sc 8736 Form

What is the SC 8736?

The SC 8736 form is a specific document used primarily in the United States for various administrative purposes. It serves as an official record for certain transactions or declarations, depending on the context in which it is utilized. This form is often required by government agencies, businesses, or financial institutions to ensure compliance with regulatory standards. Understanding the purpose and requirements of the SC 8736 is essential for individuals and organizations looking to navigate the complexities of formal documentation.

How to Use the SC 8736

Using the SC 8736 involves several steps to ensure that the form is completed accurately and submitted correctly. First, gather all necessary information and documentation required to fill out the form. This may include personal identification details, financial information, or other relevant data. Next, carefully complete each section of the form, ensuring that all fields are filled out as required. After completing the form, review it for accuracy before submission. Depending on the specific requirements associated with the SC 8736, you may need to submit it online, by mail, or in person.

Steps to Complete the SC 8736

Completing the SC 8736 involves a systematic approach to ensure accuracy and compliance. Follow these steps:

- Gather all necessary information and documents.

- Read the instructions carefully to understand the requirements.

- Fill out the form, ensuring all fields are completed as needed.

- Double-check the information for accuracy and completeness.

- Submit the form through the appropriate method, whether online, by mail, or in person.

Following these steps will help ensure that your SC 8736 form is processed without delays or issues.

Legal Use of the SC 8736

The legal use of the SC 8736 is governed by specific regulations and guidelines that must be adhered to. This form must be filled out truthfully and accurately, as any discrepancies can lead to legal complications. In many cases, the SC 8736 may require signatures or additional documentation to validate its contents. It is crucial to understand the legal implications of submitting this form, as it may be subject to audits or reviews by relevant authorities.

Key Elements of the SC 8736

The SC 8736 includes several key elements that are essential for its validity and acceptance. These elements typically include:

- Identification information of the individual or entity submitting the form.

- Details relevant to the purpose of the form, such as financial data or transaction specifics.

- Signature or acknowledgment of the information provided.

- Any additional documentation that may be required to support the submission.

Ensuring that all key elements are present and correctly filled out is vital for the successful processing of the SC 8736.

Form Submission Methods

The SC 8736 can be submitted through various methods, depending on the requirements set by the issuing authority. Common submission methods include:

- Online submission through designated portals or websites.

- Mailing the completed form to the appropriate agency or office.

- In-person submission at designated locations.

Choosing the correct submission method is important to ensure timely processing and compliance with any deadlines associated with the SC 8736.

Quick guide on how to complete sc 8736

Complete Sc 8736 effortlessly on any device

Digital document management has become prevalent among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely save it online. airSlate SignNow equips you with all the resources required to create, edit, and electronically sign your documents promptly without hold-ups. Manage Sc 8736 on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to alter and eSign Sc 8736 seamlessly

- Find Sc 8736 and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of your documents or redact sensitive information with the tools airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal authority as a conventional wet ink signature.

- Review the details and then click the Done button to save your updates.

- Select how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, exhausting form searches, or mistakes that require the printing of new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and eSign Sc 8736 and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sc 8736

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form sc8736 and why do I need it?

The form sc8736 is a specific document that businesses may need for various administrative requirements. It streamlines the application process and ensures compliance with regulations. Utilizing airSlate SignNow to manage form sc8736 helps you send and eSign it efficiently, saving time and reducing errors.

-

How does airSlate SignNow simplify the process of handling form sc8736?

airSlate SignNow provides an intuitive platform that allows users to easily create, send, and eSign form sc8736. It eliminates the hassles of printing and scanning documents, making the process seamless. With templates and automated workflows, you can handle form sc8736 more efficiently than ever.

-

What features does airSlate SignNow offer for form sc8736?

AirSlate SignNow offers a variety of features specifically designed to enhance the handling of form sc8736. These include eSignature capabilities, document tracking, and customization options. With secure storage and compliance features, managing form sc8736 is both safe and effective.

-

Can I integrate airSlate SignNow with other software for form sc8736 management?

Yes, airSlate SignNow integrates seamlessly with various applications to enhance the management of form sc8736. Whether you use CRM systems, cloud storage, or business management software, our integrations ensure a smooth workflow. This connectivity enables easy access and collaboration on form sc8736.

-

What pricing options are available for using airSlate SignNow for form sc8736?

AirSlate SignNow offers flexible pricing plans to suit different needs when managing form sc8736. Whether you're a freelancer or a large enterprise, you'll find an option that works for you. Our pricing is competitive and designed to deliver value for robust features like eSigning and document management.

-

Is airSlate SignNow secure for handling sensitive form sc8736 data?

Absolutely! airSlate SignNow employs top-notch security measures to protect your form sc8736 and any other sensitive data. With encryption, secure access, and compliance with industry standards, you can trust that your documents are safe. This ensures peace of mind when eSigning form sc8736.

-

How can I track the status of my form sc8736 once sent?

Tracking the status of your form sc8736 is easy with airSlate SignNow. You can receive real-time updates and notifications when recipients view or sign your document. This feature allows you to stay informed and manage your agreements efficiently.

Get more for Sc 8736

Find out other Sc 8736

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document