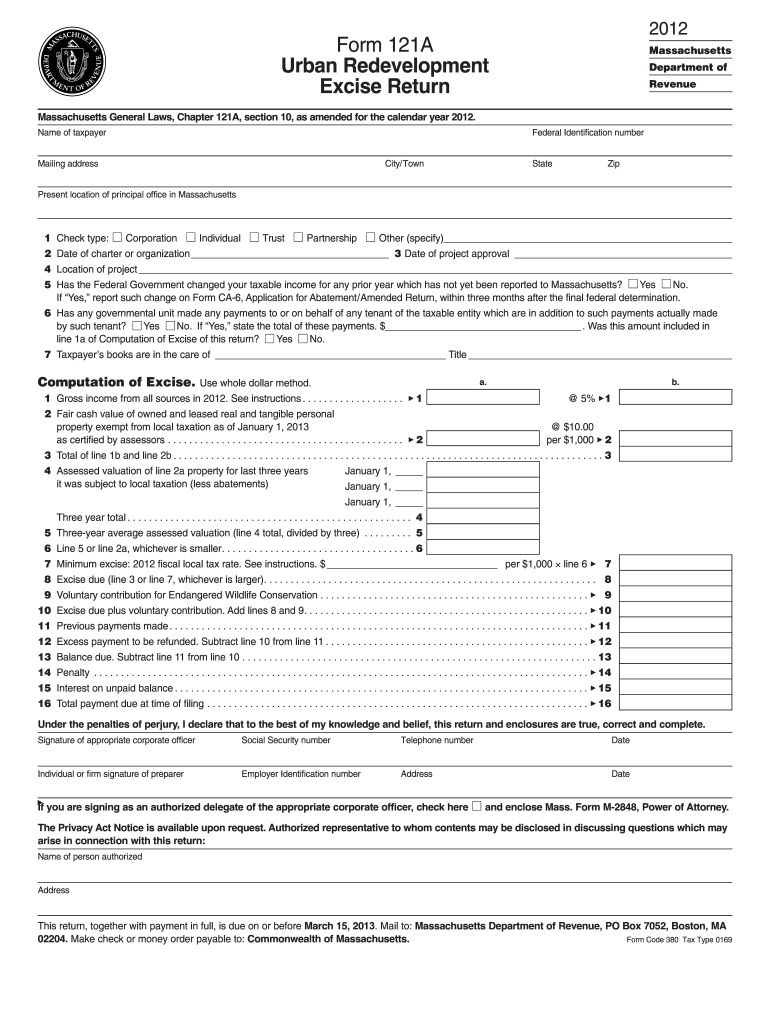

121a Return Form 2012

What is the 121a Return Form

The 121a Return Form is a tax document used primarily for reporting certain types of income and deductions to the Internal Revenue Service (IRS). This form is essential for individuals and businesses who need to disclose specific financial information, ensuring compliance with federal tax regulations. It is designed to facilitate accurate reporting and streamline the tax filing process.

How to use the 121a Return Form

Using the 121a Return Form involves several key steps. First, gather all necessary financial documents, including income statements and receipts for deductions. Next, fill out the form accurately, ensuring all information is complete and correct. After completing the form, review it for any errors before submitting it to the IRS. The form can be submitted electronically or via mail, depending on your preference and the specific requirements for your tax situation.

Steps to complete the 121a Return Form

Completing the 121a Return Form requires careful attention to detail. Follow these steps for a successful submission:

- Gather all relevant financial documents, including W-2s, 1099s, and receipts.

- Download the latest version of the 121a Return Form from the IRS website or access it through a tax preparation software.

- Fill out personal information, including your name, address, and Social Security number.

- Report all sources of income accurately, ensuring to include any applicable deductions.

- Double-check all entries for accuracy and completeness.

- Sign and date the form, either electronically or by hand if submitting a paper version.

- Submit the form by the appropriate deadline to avoid penalties.

Legal use of the 121a Return Form

The legal use of the 121a Return Form is governed by IRS regulations. Taxpayers must ensure that the information provided is truthful and complete, as inaccuracies can lead to penalties or audits. The form is legally binding once signed, and it is crucial to adhere to all applicable laws and guidelines when filing. Utilizing eSignature solutions can enhance the security and validity of the submission process.

Filing Deadlines / Important Dates

Filing deadlines for the 121a Return Form are critical to avoid penalties. Typically, the form must be submitted by April 15 of each year for individual taxpayers. However, extensions may be available under certain circumstances. It is essential to stay informed about any changes to deadlines, especially during tax season, as the IRS occasionally adjusts dates due to unforeseen events.

Form Submission Methods (Online / Mail / In-Person)

The 121a Return Form can be submitted through various methods, including online, by mail, or in person. For online submissions, taxpayers can use IRS-approved e-filing software, which often simplifies the process. If choosing to mail the form, ensure it is sent to the correct IRS address based on your location. In-person submissions may be possible at designated IRS offices, providing assistance for those who require it.

Quick guide on how to complete 121a return 2012 form

Your assistance manual on how to prepare your 121a Return Form

If you’re wondering how to fill out and submit your 121a Return Form, here are a few straightforward instructions to simplify tax declaration.

First, you need to create your airSlate SignNow account to revolutionize your document handling online. airSlate SignNow is a highly user-friendly and robust document solution that allows you to edit, generate, and finalize your tax forms with ease. With its editor, you can toggle between text, checkboxes, and eSignatures, and return to modify information as necessary. Enhance your tax management with state-of-the-art PDF editing, eSigning, and easy sharing options.

Follow the steps below to complete your 121a Return Form in just a few minutes:

- Create your account and start working on PDFs in no time.

- Utilize our library to obtain any IRS tax form; explore various versions and schedules.

- Click Get form to access your 121a Return Form in our editor.

- Input the necessary fillable fields with your information (text, numbers, checkmarks).

- Employ the Sign Tool to add your legally-binding eSignature (if required).

- Examine your document and rectify any errors.

- Save your changes, print your copy, submit it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Be aware that handwritten filing may lead to more errors and delays in refunds. Before e-filing your taxes, check the IRS website for the filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct 121a return 2012 form

FAQs

-

Can I fill out an income tax return for FY 2012-2013?

According to section 139 (1) of the Income Tax Act, 1961:Every person —

Create this form in 5 minutes!

How to create an eSignature for the 121a return 2012 form

How to make an eSignature for your 121a Return 2012 Form online

How to create an electronic signature for your 121a Return 2012 Form in Google Chrome

How to generate an eSignature for signing the 121a Return 2012 Form in Gmail

How to generate an electronic signature for the 121a Return 2012 Form right from your smart phone

How to make an electronic signature for the 121a Return 2012 Form on iOS

How to create an eSignature for the 121a Return 2012 Form on Android devices

People also ask

-

What is the 121a Return Form and why is it important?

The 121a Return Form is a crucial document for businesses to report their financial activities accurately. It helps ensure compliance with tax regulations and provides a clear record for both the business and tax authorities. Using the airSlate SignNow platform can simplify the process of preparing and submitting your 121a Return Form.

-

How does airSlate SignNow streamline the 121a Return Form process?

airSlate SignNow streamlines the 121a Return Form process by allowing users to easily send, sign, and manage documents digitally. Our user-friendly interface ensures that you can prepare your 121a Return Form quickly, reducing the time spent on paperwork and enhancing efficiency. With electronic signatures, you can finalize documents faster and securely.

-

What features does airSlate SignNow offer for the 121a Return Form?

airSlate SignNow offers a range of features tailored for the 121a Return Form, including customizable templates, automated workflows, and secure electronic signatures. These features ensure that your documents are completed accurately and efficiently, with built-in compliance checks. This makes managing your 121a Return Form straightforward and hassle-free.

-

Is airSlate SignNow cost-effective for managing the 121a Return Form?

Yes, airSlate SignNow is a cost-effective solution for managing the 121a Return Form. Our pricing plans are designed to fit various business sizes and needs, allowing you to choose the best option without breaking the bank. With the time saved on paperwork, the investment in airSlate SignNow pays off quickly.

-

Can I integrate airSlate SignNow with other software for the 121a Return Form?

Absolutely! airSlate SignNow seamlessly integrates with a variety of software tools, enhancing your ability to manage the 121a Return Form. Whether you use accounting software or document management systems, our integrations help streamline your workflow and ensure that all your documents are centralized and easily accessible.

-

What are the benefits of using airSlate SignNow for the 121a Return Form?

Using airSlate SignNow for your 121a Return Form provides numerous benefits, including increased efficiency, reduced errors, and enhanced security. Our platform ensures that your documents are signed and stored securely, protecting your sensitive information. Additionally, the ease of use means less time spent on administrative tasks, allowing you to focus more on your core business activities.

-

How secure is airSlate SignNow for handling the 121a Return Form?

Security is a top priority for airSlate SignNow, especially when handling sensitive documents like the 121a Return Form. We employ advanced encryption protocols and comply with industry standards to protect your data. You can trust that your information is secure while using our platform for all your document management needs.

Get more for 121a Return Form

Find out other 121a Return Form

- How Can I Sign Mississippi Real Estate Affidavit Of Heirship

- How To Sign Missouri Real Estate Warranty Deed

- Sign Nebraska Real Estate Letter Of Intent Online

- Sign Nebraska Real Estate Limited Power Of Attorney Mobile

- How Do I Sign New Mexico Sports Limited Power Of Attorney

- Sign Ohio Sports LLC Operating Agreement Easy

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter

- How Can I Sign New York Real Estate Memorandum Of Understanding

- Sign Texas Sports Promissory Note Template Online

- Sign Oregon Orthodontists Last Will And Testament Free

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later

- How Do I Sign Wisconsin Sports Forbearance Agreement

- How To Sign Oregon Real Estate Resignation Letter

- Can I Sign Oregon Real Estate Forbearance Agreement

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed